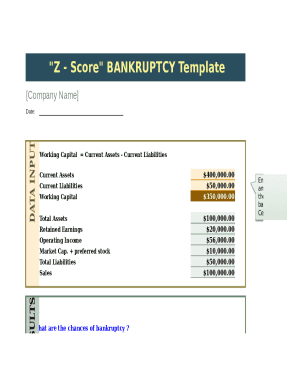

What is Z-score Bankruptcy Template?

The Z-score Bankruptcy Template is a financial tool used to predict the likelihood of a firm going bankrupt within two years. It takes into account different financial ratios to provide an overall assessment of a company's financial health and stability.

What are the types of Z-score Bankruptcy Template?

There are two main types of Z-score Bankruptcy Templates:

Altman Z-score model

Z''-score model

How to complete Z-score Bankruptcy Template

Completing a Z-score Bankruptcy Template involves the following steps:

01

Gather the necessary financial data of the company.

02

Calculate the different financial ratios required by the chosen Z-score model.

03

Input the calculated ratios into the Z-score formula to obtain the final score.

04

Interpret the final score to determine the potential risk of bankruptcy for the company.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Z-score Bankruptcy Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the z-score for financial stability?

In the financial sector, a z-score of 1.8 or lower indicates that a company may be headed for bankruptcy and, as such, potentially represents an unwise investment. A score of 3 or higher indicates financial stability, and that the company has the potential to be a solid investment choice.

What is Z score for financials?

The Z-score is a metric that reveals how likely a company is going to be bankrupt or insolvent. This formula requires seven variables: Working Capital, Total Assets, Retained Earnings, Earnings Before Interest and Tax, Market Value of Equity, Total Liabilities, and Sales. The Z-score is expressed as a numerical value.

What's the bankruptcy risk categorization of a firm with a 1.8 Z score?

A z-score lower than 1.8 indicates that bankruptcy is likely, while scores greater than 3.0 indicate bankruptcy is unlikely to occur in the next two years. Companies that have a z-score between 1.8 and 3.0 are in the gray area, and bankruptcy is as likely as not.

What does a z-score greater than 2.99 meant bankruptcy within one year in actual use?

If the Z value is between 2.99 and 1.81, then the firm is in the “gray zone” and has a moderate probability of bankruptcy. And finally, if the Z value is below 1.81, then it is said to be in the “distress zone” and has a very high probability of reaching the stage of bankruptcy.

How do you calculate z-score for bankruptcy?

The formula for Altman Z-Score is 1.2*(working capital / total assets) + 1.4*(retained earnings / total assets) + 3.3*(earnings before interest and tax / total assets) + 0.6*(market value of equity / total liabilities) + 1.0*(sales / total assets).

What's the bankruptcy risk categorization of a firm with a 1.8 z-score?

A z-score lower than 1.8 indicates that bankruptcy is likely, while scores greater than 3.0 indicate bankruptcy is unlikely to occur in the next two years. Companies that have a z-score between 1.8 and 3.0 are in the gray area, and bankruptcy is as likely as not.