Personal Ira – Taking Charge Of Your Retirement Income

What is Personal Ira – Taking Charge Of Your Retirement Income?

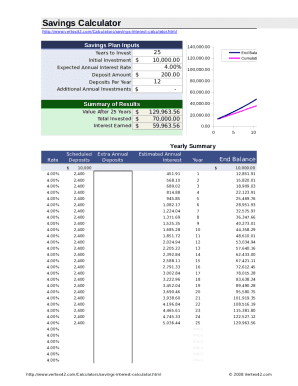

Personal IRA, or Individual Retirement Account, is a powerful tool for securing your financial future. By setting up a Personal IRA, you take control of your retirement income and ensure that you have a nest egg to rely on when you stop working.

What are the types of Personal Ira – Taking Charge Of Your Retirement Income?

There are several types of Personal IRAs to choose from, each with its unique features and benefits. The most common types include Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs.

How to complete Personal Ira – Taking Charge Of Your Retirement Income

Completing your Personal IRA involves several steps to ensure that you maximize its benefits and grow your retirement savings over time. Here is a simple guide to help you complete your Personal IRA:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.