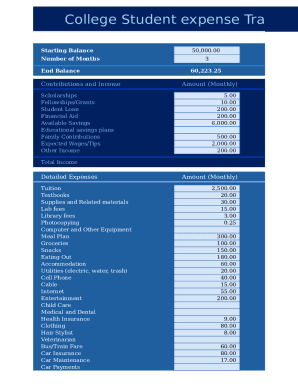

What is College Student Expense Tracker?

College Student Expense Tracker is a tool that helps students keep track of their expenses while attending college. It allows users to input their expenditures and income to help them budget and manage their finances effectively.

What are the types of College Student Expense Tracker?

There are several types of College Student Expense Trackers available to help students manage their finances efficiently. Some popular types include:

How to complete College Student Expense Tracker

Completing a College Student Expense Tracker is a simple process that can greatly benefit your financial management. Here are some steps to help you effectively complete your tracker:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.