Last updated on

Nov 13, 2024

Add Option Choice Contract For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

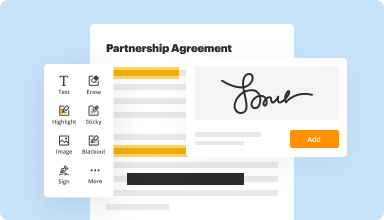

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

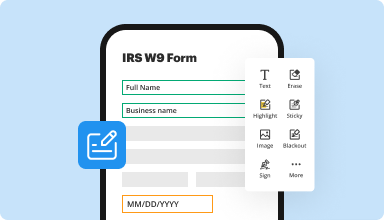

Fill out & sign PDF forms

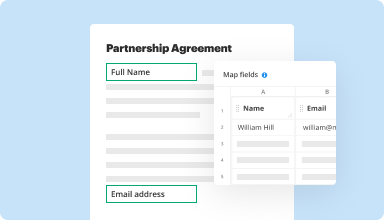

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

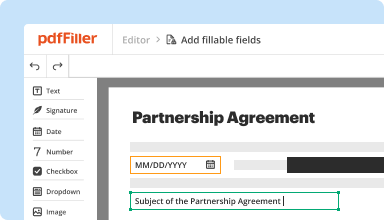

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

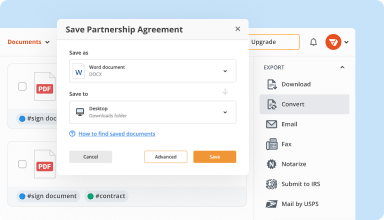

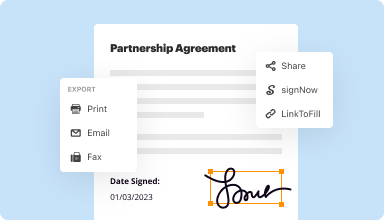

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

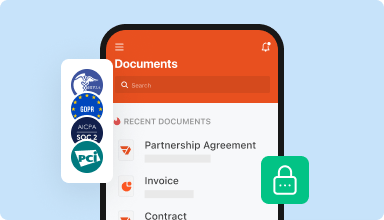

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Love it. It's the BEST thing that has happened for my business! PDF Filler has allowed my company to go almost completely paperless. Thanks PDF Filler.

2014-12-05

It was hard to figure out how to get started, and I made some mistakes in the beginning. I saved two files too soon and now I don't know how to erase them because when I try it says if I delete it it will no longer be shared. Is it okay to delete it anyway?

2015-09-25

I thought it was great & easy to use. Only reason I didn't give it 5 stars was I would have liked to have known I had to buy a subscription before I could print my document. I probably won't need to use it again in the foreseeable future.

2016-03-30

Fill Your Boots !!!

Brilliant piece of kit... does what it says on the tin

Great multi functional PDF editing software. Handy to unlock and edit PDF files and convert, rearrange, reformat etc etc

Graphical interface is lacking, but the software works so effortlessly that this does not impact on the functionality

2020-04-10

PDFFiller

I like PDFFiller because it's easy to work between my Android phone and my computer. It's also extremely easy to email myself documents, reports, pay stubs whatever so that I can update them, edit them or have others sign off on them.

At times the program lags behind but overall well worth the wait.

2019-01-16

interesting...I am a sponsor for a nonprofit addiction recovery program and this would help me lead my sponsees through their step work and writing assignments.

2023-02-09

It is an excellent experience with…

It is an excellent experience with pdFiller. I was attended to by an experienced customer advisor. The service I received is beyond my expectation. Please I will recommend pdFiller for your needs

2021-07-27

Bruce immediately responded to my…

Bruce immediately responded to my concerns, advised me what I needed to do to resolve the issue and followed up to make sure the issue was resolved. I was very pleased with his professionalism, customer service and follow through.

2021-05-01

This site made dealing with PDF files…

This site made dealing with PDF files so much easier. Thank you for allowing a free trial during such a trying time in teaching.

2020-04-22

How to Add Option Choice Contract making use of pdfFiller

Follow the steps to use the Add Option Choice Contract feature in pdfFiller.

01

Set up your pdfFiller account or log in if you already have one.

02

Click the Add New button to upload your file or drag-and-drop one.

03

If you don’t have a document ready, go to the forms' library to locate and pick one that you want to use.

04

If you do not have the needed document or form at hand, you can find one in the forms' library.

05

Select the Add Option Choice Contract feature from the toolbar and apply it to your document.

06

Explore the advanced tools for editing and annotating text.

07

When done editing the document, hit the downward icon next to the DONE button and select Save As.

08

Select the delivery option you need.

09

Save your file in any format you prefer.

10

Share it with others or the IRS using multiple delivery options.

Introducing Add Option Choice Contract Feature

Upgrade your contract management experience with our new Add Option Choice Contract feature

Key Features:

Easily add customizable options to your contracts

Select from a variety of predefined choices or create your own

Effortlessly track and manage different contract versions with added options

Potential Use Cases and Benefits:

Tailor contracts to individual needs and preferences

Streamline the negotiation process by offering multiple choices upfront

Increase customer satisfaction by providing flexibility and customization

With our Add Option Choice Contract feature, you can solve the customer's problem of rigid, one-size-fits-all contracts by offering personalized options that meet their unique requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is an example of an addendum?

For example, the seller of a house may agree – after the original sales contract has been written – to include certain pieces of furniture for an additional specified sum. Mortgage terms or the closing date for the sale are often amended in real estate transactions, with the change noted in an addendum.

What is the difference between an option and an option contract?

The term option refers to a financial instrument that is based on the value of underlying securities, such as stocks, indexes, and exchange-traded funds (ETFs). An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset.

What is an addition to a legal document called?

An addendum is an attachment to a contract that modifies the terms and conditions of the original contract. Addendums are used to efficiently update the terms or conditions of many types of contracts.

What is an add on to a contract?

A contract addendum is a post-contract attachment that modifies, alters, or changes some of the terms of a previously established contract. Typically, this adds something new to a preexisting document. Once all parties in a contract agree to an addendum, it becomes a part of the new contract.

What are the rules for option contracts?

The terms of option contracts specify the underlying security, the price at which that security can be bought or sold (the strike price), and the expiration date of the contract. For stocks, a standard contract covers 100 shares, but this number can be adjusted for stock splits, special dividends, or mergers.

What does add on mean in construction?

to include or build something extra: We've added on a couple of rooms to the house. You will need a different kind of building permit if you are adding on to the existing structure.

What is the reason for addendum in a contract?

But, instead of outlining the whole agreement again, it focuses on the new information or changes you and the other party agree to. The purpose of an addendum is to modify, clarify, or introduce new terms and conditions to the original document.

How to create a new option contract?

Understanding Writing an Option Traders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific date (expiration date). In other words, the writer of the option can be forced to buy or sell a stock at the strike price.

#1 usability according to G2

Try the PDF solution that respects your time.