Approve Electronically Signed Interest Rate Lock Agreement with pdfFiller

How to Approve Electronically Signed Interest Rate Lock Agreement

To approve an electronically signed Interest Rate Lock Agreement, log into pdfFiller, upload your document, and use the 'eSign' feature to quickly sign and manage your signing workflow electronically.

What is an electronically signed Interest Rate Lock Agreement?

An electronically signed Interest Rate Lock Agreement is a digital document confirming a borrower’s intent to secure a specific interest rate within a designated timeframe. This agreement is typically used in the mortgage and lending industries to lock in a favorable rate while the loan process is completed. With the rise of digital document solutions, these agreements can now be signed and approved electronically, facilitating faster decision-making and streamlined workflows.

Why approving electronically signed Interest Rate Lock Agreements matters for digital document workflows

The ability to approve electronically signed Interest Rate Lock Agreements is critical in today's fast-paced business environment. It enhances efficiency by eliminating the need for physical signatures, reduces turnaround times, and minimizes paper usage. Digitally managing these agreements also enables better tracking and management, ensuring that all parties are aligned and informed throughout the process.

Use-cases and industries that frequently use electronic signatures

Various industries utilize electronically signed Interest Rate Lock Agreements. These typically include:

-

Mortgage Lenders: To lock in interest rates for borrowers.

-

Real Estate: To facilitate agreements in purchasing or leasing property.

-

Financial Institutions: For approvals on loan agreements and related documents.

-

Title Companies: For securing the necessary agreements in real estate transactions.

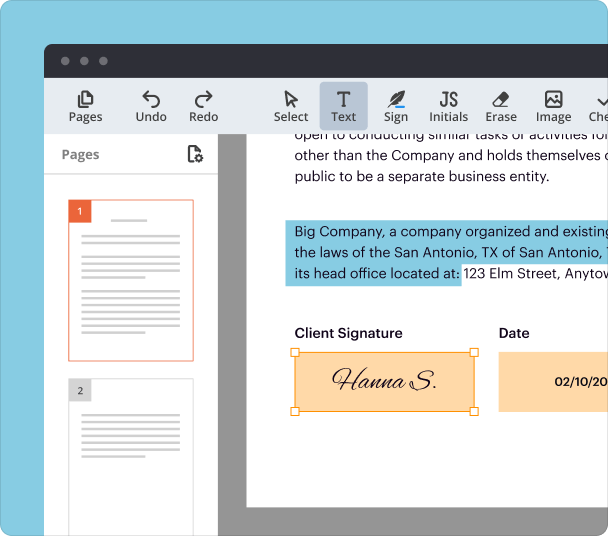

Step-by-step: how to approve electronically signed Interest Rate Lock Agreement in pdfFiller

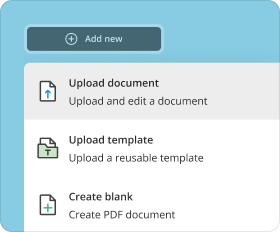

Follow these steps to approve your electronically signed agreement in pdfFiller:

-

Log into your pdfFiller account.

-

Click on ‘Upload Document’ and select your Interest Rate Lock Agreement file.

-

Open the document in the pdfFiller editor.

-

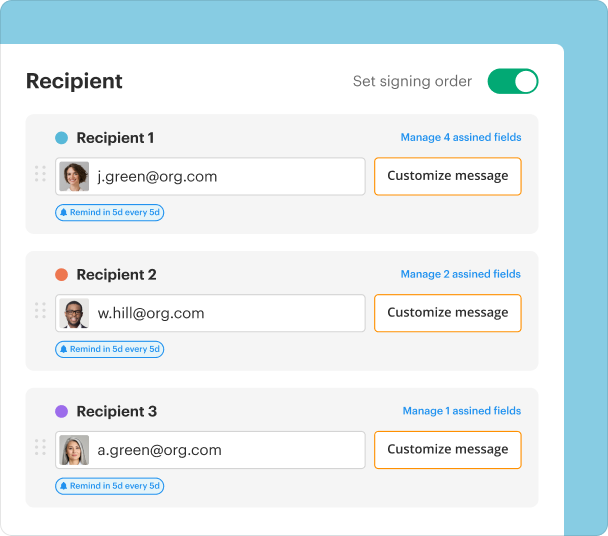

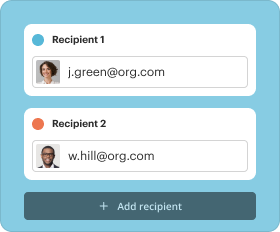

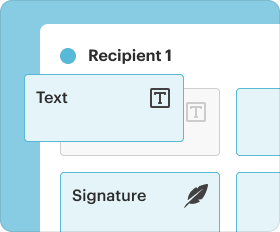

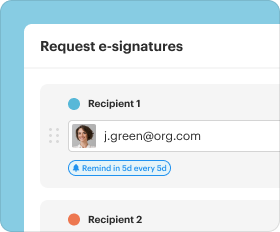

Select the ‘eSign’ option and follow the prompts to add your electronic signature.

-

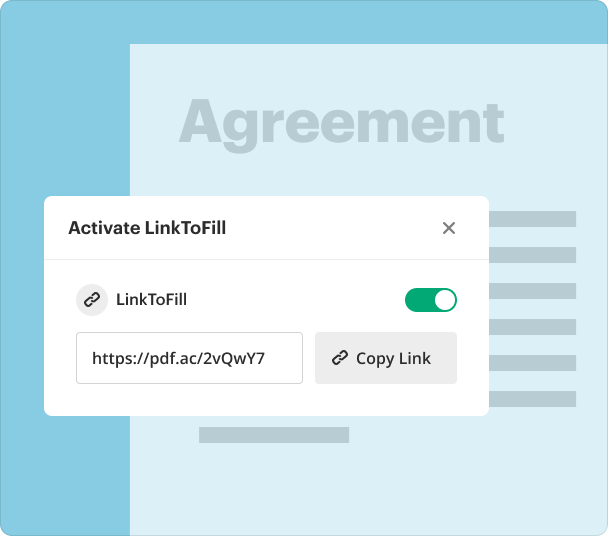

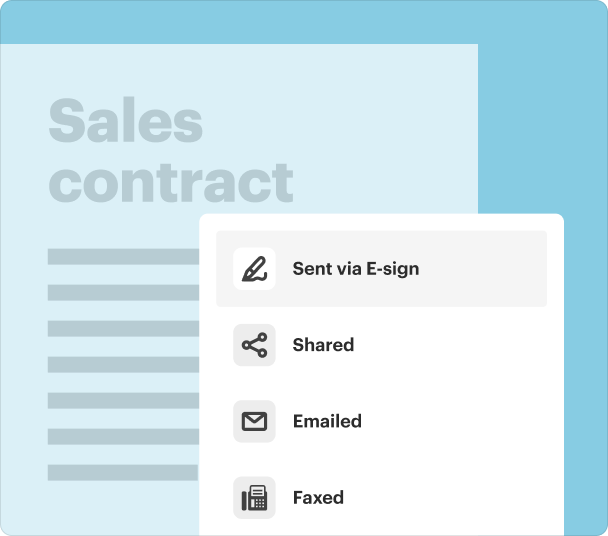

After signing, choose options to either send the document to other parties or save it directly.

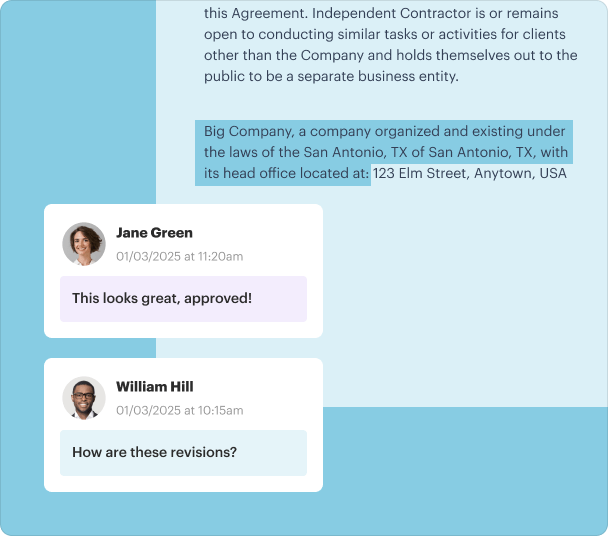

Options for customizing signatures, initials, and stamps when you approve an electronically signed agreement

pdfFiller offers a variety of options to customize your electronic signature to meet your preferences. Users can create a unique signature style, add initials, and even include date stamps. The customization process is straightforward, allowing you to choose different fonts, colors, and sizes for your elements.

Managing and storing documents after you approve the agreement

Once you have approved your Interest Rate Lock Agreement, pdfFiller simplifies document management and storage. Each signed document is automatically saved in your secure account, where you can easily access, share, or download it anytime. Additionally, users can organize documents using folders or tags for better organization.

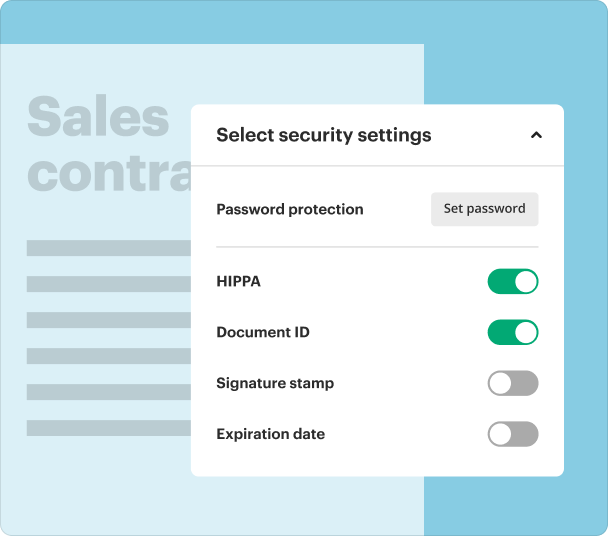

Security, compliance, and legal aspects when you approve electronically signed agreements

Using pdfFiller for electronic signatures ensures compliance with legal standards, such as the ESIGN Act and UETA, which authenticate electronic signatures. Additionally, pdfFiller employs top-notch security measures, including encryption and secure servers, to protect your information and documents throughout the signing process. This ensures that all approvals remain legally binding and secure.

Alternatives to pdfFiller for approving electronically signed agreements

While pdfFiller provides comprehensive features for electronic signatures, there are several alternatives available, including:

-

DocuSign: Known for its robust eSignature capabilities.

-

Adobe Sign: Offers integration with other Adobe workflows.

-

HelloSign: Provides a user-friendly experience and integrations.

Conclusion

Approving an electronically signed Interest Rate Lock Agreement with pdfFiller not only streamlines the process but also enhances the efficiency and security of document management. With convenient steps, customization options, and a focus on security compliance, pdfFiller stands out as a powerful tool for both individuals and teams. Experience how pdfFiller can transform your document handling and get started today.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms