Choose Line Transcript For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

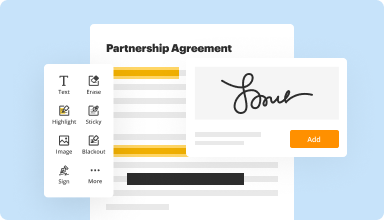

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

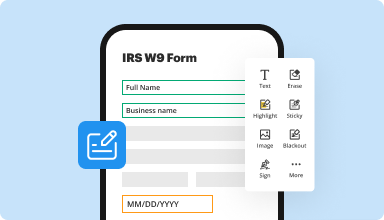

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

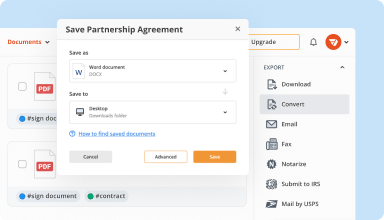

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

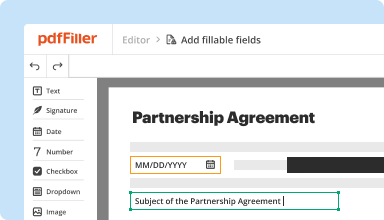

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

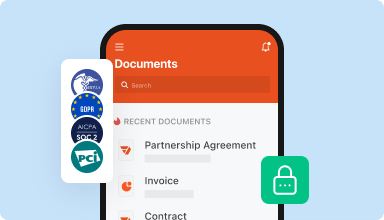

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Thanks I have been using you and your service for years and if you ever want to run a marketing campaign to my 950,000 website members that are all real estate investors and agents please reach out to me.

2014-06-11

I had to use pdf Filler to fill out some online divorce documents, and after being initially upset at having to pay for a monthly subscription for a year to print it (very upset), I sucked it up, signed up, and have never stopped using it. Just discovered the eraser...very cool.

2015-07-02

What do you like best?

Easy to use and very flexible. Upload and go. Very user friendly.

What do you dislike?

Haven't noticed any downside. Have been even able to access from my smart phone as well.

Recommendations to others considering the product:

Offer tutorials on instructions and examples of usage of the features. Currently going thru trial and error which so far has worked well

What problems are you solving with the product? What benefits have you realized?

Uploading and Filling out documents and signing them then forwarding to whomever...with ease.

Easy to use and very flexible. Upload and go. Very user friendly.

What do you dislike?

Haven't noticed any downside. Have been even able to access from my smart phone as well.

Recommendations to others considering the product:

Offer tutorials on instructions and examples of usage of the features. Currently going thru trial and error which so far has worked well

What problems are you solving with the product? What benefits have you realized?

Uploading and Filling out documents and signing them then forwarding to whomever...with ease.

2019-05-28

A tool to get by, but far from perfect

If you can't find any other tools to fill in PDF, or if you don't want to research into other advanced tools, this is OK. It can get your work done, but you will sometimes be frustrated.

With this tool, I can fill in PDF which are not fillable by default. It saves me the trouble printing it out, filling it by hand and scanning it. It's easy to use and very straightforward.

It's costly, taking into account of what it can offer. Sometimes it's difficult to save the file, and I have to save as another file even if I write only a few words.

2019-11-26

All PDF tools in one app

My overall satisfaction about that app is a lot, it's just great tool for everyone, for students and also employees as well, at any time people can make change in their document and send it wherever it's needed.

That's basically great app, because you can solve all document issues in one app, scanning, adding image to the document putting dates, even signature, saving as pdf, or word or excel, sending to email, printing and etc. which help users to save more time.

I remember I faced problem while logging in, actually I think to login for that kind of program is something extra.

2019-10-09

If you are an insurance biller....this is the software you need!

The ease of finding, and using different types of preformatted pdf documents vastly cuts down on the amount of time I have to spend on filling these forms out by hand.

2018-03-07

At last a brilliant document converter

At last a brilliant document converter

Easy to follow instructions. Good variety of tools available at an affordable price.

2023-09-27

Pdf filler review

So far so good

The software works great. Have little to no complaints overall

I would like it to have more templates for documents to choose from

2022-06-30

I would like to become more familiar…

I would like to become more familiar with the PDF-filler tools before I provide a final Review but up to now I am happy with the program

Thanks

Chuck

2022-03-14

Choose Line Transcript Feature

The Choose Line Transcript feature provides an easy way to manage and navigate your audio and video transcriptions. With this tool, you can select specific lines to focus on, making it simpler to communicate important points and retrieve crucial information.

Key Features

Select specific lines of interest for quick reference

Streamlined interface for effortless navigation

Integration with various media formats

Ability to highlight and annotate selected segments

Export options for sharing or further editing

Potential Use Cases and Benefits

Perfect for educators looking to emphasize key lecture points

Helpful for journalists when collecting quotes from interviews

Useful for researchers needing to pinpoint relevant data

Beneficial for legal professionals reviewing court transcripts

Ideal for students summarizing essential themes in their studies

The Choose Line Transcript feature can solve your problem of information overload. Instead of sifting through long transcripts, you can hone in on the relevant sections that matter most. This focused approach not only saves you time but also enhances your ability to understand and communicate critical information effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get a wage and income transcript?

You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Transcript page. ...

You can also use Form 4506-T, Request for Transcript of Tax Return.

What is the wage and income transcript?

IRS Definition A wage and income transcript shows data from information returns the IRS receives, such as Forms W-2, 1099, 1098 and Form 5498.

What is the difference between a tax return transcript and a tax account transcript?

A tax transcript is a summary of your tax return provided by the IRS. There are a few types of transcripts available. The most basic is the tax return transcript, which contains most line items from the tax return, including the adjusted gross income along with associated forms and schedules.

What is IRS transcript?

An IRS transcript is a record of your past tax returns. You can choose to receive them online or by mail. Request a transcript from the IRS website.

How can I get my tax transcript online immediately?

You can get your free transcripts immediately online. You can also get them by phone, by mail or by fax within five to 10 days from the time IRS receives your request. To view and print your transcripts online, go to IRS.gov and use the Get Transcript tool. To order by phone, call 800-908-9946 and follow the prompts.

How do I get my corporation tax transcript?

Please visit us at IRS.gov and click on Get a Tax Transcript... under Tools or call 1-800-908-9946. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return. There is a fee to get a copy of your return.

Can you file taxes with a wage and income transcript?

The Wage & Income transcript reports only “data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498, IRA Contribution Information.” ... That is, the Wage and Income Transcript does not show your tax return, but the income forms that were copied to the IRS.

How do I get my wage and income transcript?

You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Transcript page. ...

You can also use Form 4506-T, Request for Transcript of Tax Return.

What is a wage and income transcript?

The IRS Wage & Income Transcript is a listing of all the information reports that the IRS has received for you. ... If you're wondering what the IRS does with this information, they build an annual file about you, and then they compare what they have received with your tax return.

Can I get a tax transcript if I didn't file?

This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T. Verification of Non-filing Letter — provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the year you requested. It doesn't indicate whether you were required to file a return for that year.

#1 usability according to G2

Try the PDF solution that respects your time.