How to Confirm Electronically Sign 1040EZ Form with pdfFiller

What is confirming electronically signing a 1040EZ form?

Confirming electronically signing a 1040EZ form refers to the process of verifying your digital signature on a specific tax return form. The 1040EZ is a streamlined version of the 1040, designed for simple tax situations. E-signing this form electronically allows individuals to file their taxes without the need for paper submissions, significantly enhancing efficiency.

-

Electronics signature: A digital representation of your handwritten signature.

-

Form 1040EZ: A simplified federal income tax return form for certain taxpayers.

-

E-filing: The electronic submission of tax returns to the IRS.

Why confirming an electronically signed 1040EZ form matters for digital document workflows?

The importance of confirming an electronically signed 1040EZ cannot be overstated in today's digital landscape. As organizations move toward paperless environments, the ability to e-sign documents securely and confirm those signatures is paramount for compliance and efficiency. Confirming your signature helps ensure the legitimacy of your tax return and protects against fraud.

-

Legitimacy: Confirms that the signed document is legally valid.

-

Compliance: Helps you comply with IRS regulations regarding digital signatures.

-

Efficiency: Streamlines the filing process, saving time and resources.

What are the typical use-cases and industry applications for electronically signing a 1040EZ?

Electronically signing tax forms like the 1040EZ is widely used across different industries, especially in finance and accounting. Small business owners, freelancers, and individuals with simple tax situations often prefer this method for its convenience and legal recognition. Additionally, tax preparers and accountants frequently utilize e-signature tools to expedite client processes.

-

Freelancers: Utilize e-signatures to simplify personal tax filings.

-

Accountants: Expedite client tax preparation and filing.

-

Small businesses: Facilitate tax compliance through electronic submissions.

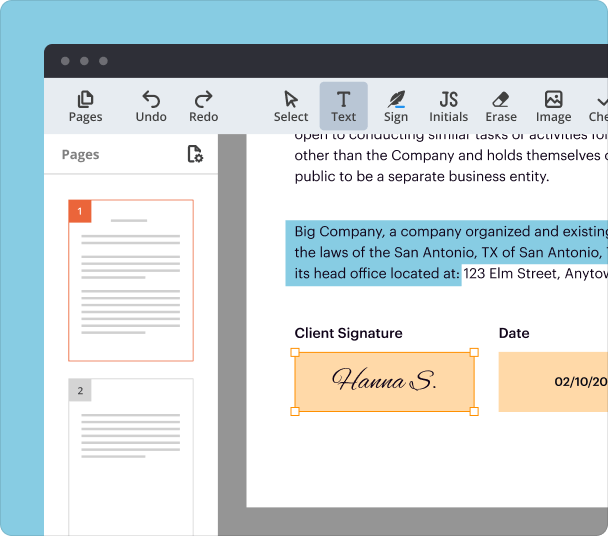

How to confirm electronically signing a 1040EZ form in pdfFiller: step-by-step

Using pdfFiller to confirm your electronically signed 1040EZ form is a straightforward process. Follow these steps:

-

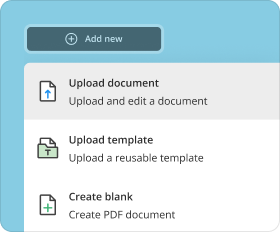

Login to pdfFiller account.

-

Upload your completed 1040EZ form to the platform.

-

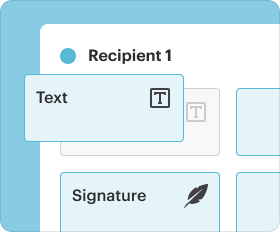

Click on the 'eSign' option to add your signature.

-

Follow the prompts to create or select your electronic signature.

-

Confirm your signature and submit the document.

-

Download or save the completed form for your records.

What are the customization options in electronically signing a 1040EZ form?

PdfFiller provides users with various customization options for their electronic signatures. You can create unique signatures, initials, and even include date stamps to personalize your forms.

-

Custom signatures: Choose from a variety of fonts or draw your own signature.

-

Initials: Add your initials for additional verification of changes.

-

Date stamps: Include the date of signature for accurate record-keeping.

How to manage and store documents after confirming electronically signing a 1040EZ form?

Once you've confirmed your electronically signed 1040EZ form, managing and storing your documents is crucial. With pdfFiller, you can securely save your forms in the cloud, making them accessible from anywhere.

-

Cloud storage: Keep all your documents in a secure online location.

-

Document organization: Utilize folders to categorize and find documents easily.

-

Search functionality: Use keywords to quickly locate forms.

What are the security, compliance, and legal considerations when confirming electronically signing a 1040EZ form?

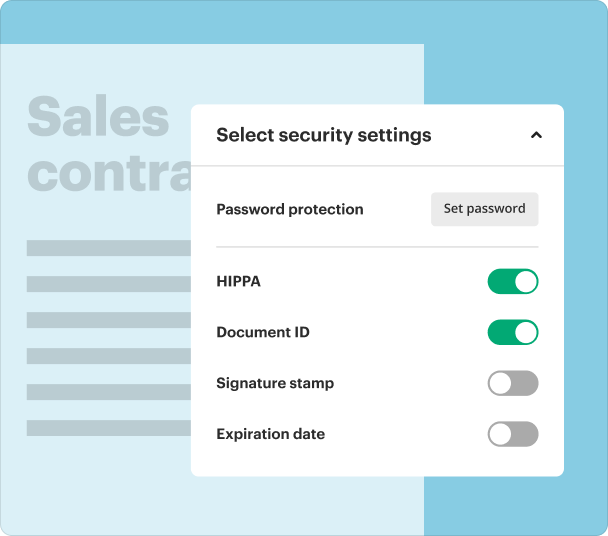

When it comes to electronically signing tax forms, security is paramount. PdfFiller ensures compliance with industry standards for digital signatures, making your signed documents legally binding.

-

Encryption: Documents are encrypted to protect sensitive data.

-

Audit trails: Track changes and view signature histories.

-

Compliance: Meets IRS standards for e-signatures.

How does pdfFiller compare to alternatives for confirming electronically signing a 1040EZ form?

While there are other platforms available for electronically signing documents, pdfFiller offers unique features that set it apart from the competition. It combines user-friendly editing capabilities, robust cloud storage, and strong security measures.

-

User experience: Intuitive interface that simplifies the signing process.

-

Integration: Compatible with various tax preparation software.

-

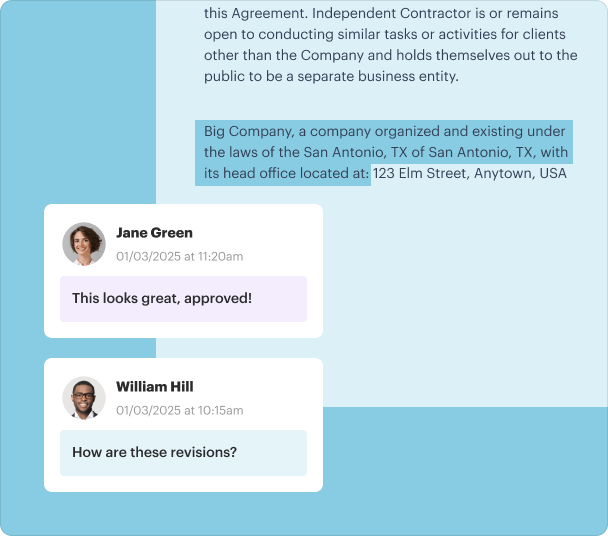

Robust features: Offers extensive document management and collaboration tools.

Conclusion

In summary, confirming electronically signing a 1040EZ form using pdfFiller significantly streamlines the tax filing process. By utilizing this tool, users can enjoy a more efficient, secure, and compliant approach to handling their tax documents. With its robust features and ease of use, pdfFiller positions itself as a leading solution for digital document management.

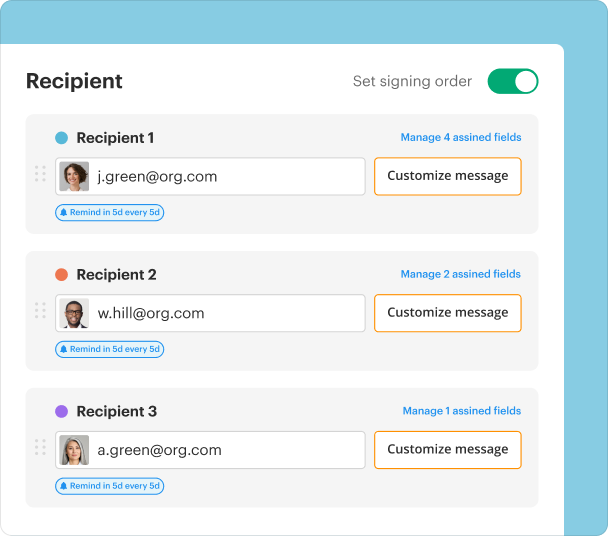

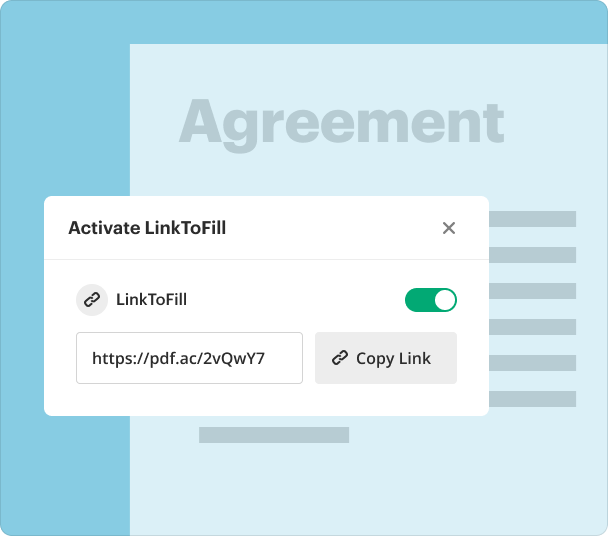

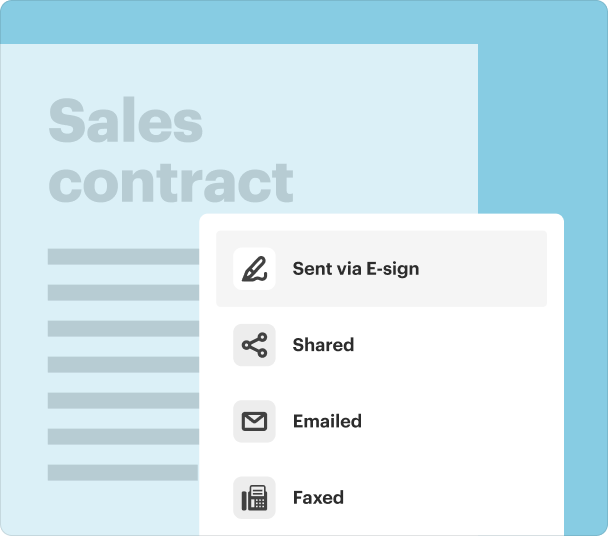

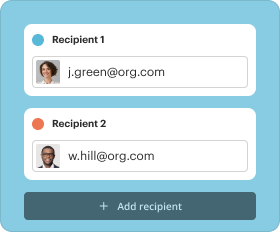

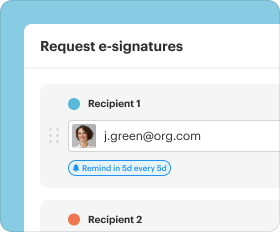

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms