Consolidate Approve Work For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

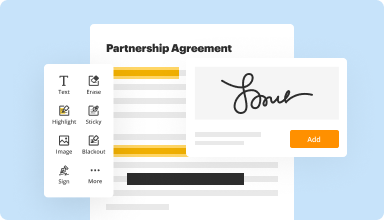

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

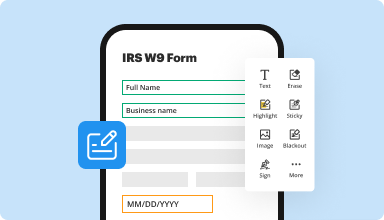

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

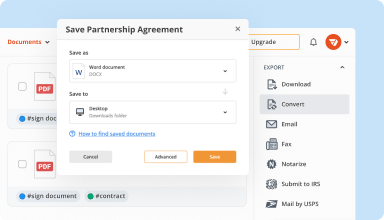

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

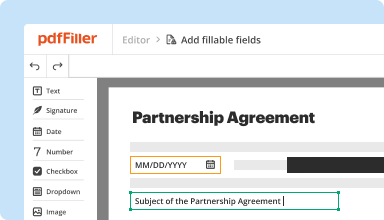

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

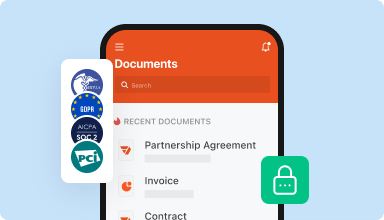

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I had some frustrations with PDFfiller.com, but they went beyond my expectations to make it right. Nice to see that level of customer service. Thank you!

2015-07-20

Pretty easy to use...so far.

The only thing that concerns me was I didn't realize I had to pay for this until I had finished filling out a complex form. How did i miss that information at the beginning?

2016-05-18

Affordable, reliable, and flexible with changes. Could use a little more explaining to become more user friendly without having to get technical assistance all the time.

2017-08-14

Best PDF Editor

Up until a few years ago, all PDF software seemed the same to me. 'What could they do that much better to make a difference' was a question I asked. PDFfiller answered the question the first time I got to use it.

PDFfiller is the perfect PDF editing and managing software that I have tried by a mile. Modifying documents and making last minute changes has never been easier. Smart signature protection, revision history, and commenting are just a few of the great features that make PDFfiller my favorite.

Loved it since the first time I got to use it. Well worth the price.

2018-11-05

Great Customer Service

We thought this was a bit scammy when we were charged for a plan no one recalled signing up for but once we found the email address associated with the account they cancelled the subscription and refunded the charge, no questions asked. Very pleased!

2023-03-27

I choose pdf filler for it's fill & print ability, plus it's option to look up Texas forms! I've been very satisfied with everything on your website up to this point & would recommend it to others to give it a whirl!!

2022-08-05

All trials have been very satisfactory. It has been easy to learn the use of the various features. Especially the relatively small size of the ready documents is appreciated.

2022-02-01

Ive only completed 3 documents on this…

Ive only completed 3 documents on this program so far but I love it. Font matches, text replacement is flawless, resizing is super easy, this is the first time out of all pdf editor programs that Ive ever used that I really enjoy and would recommend all day

2021-06-10

Great resource

This looks like a great source. My situation become more complicated than anticipated and I had the need for an attorney. Otherwise, this would have worked great.

2021-06-09

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do consolidation loan hurt your credit score?

Debt consolidation may hurt your credit score if you: Continue to make charges on your credit cards after you pay off your balances. (Any gain from reducing your credit utilization will go away quickly when your balances go up again) You're 30 days (or more) late on making your payments on the debt consolidation loan.

What does debt consolidation do to your credit score?

Debt consolidation combining multiple debt balances into one new loan is likely to raise your credit scores over the long term if you use it to pay off debt. But it's possible you'll see a decline in your credit scores at first. That can be OK, as long as you make payments on time and don't rack up more debt.]

Does debt consolidation hurt your credit score?

Debt consolidation may hurt your credit score if you: Continue to make charges on your credit cards after you pay off your balances. (Any gain from reducing your credit utilization will go away quickly when your balances go up again) You're 30 days (or more) late on making your payments on the debt consolidation loan.

Is it a good idea to consolidate your debt?

Consolidating debt with a personal loan can be a good idea if you can get a new loan with favorable terms and a lower interest rate than current debt. Whether you can qualify for a consolidation loan depends on your credit scores, income and other financial factors.

How does debt consolidation work pros and cons?

The pros for debt consolidation are obvious: You are simplifying the process of paying your bills. The one new loan should have a lower interest rate and monthly payment than the combined cost of the bills you consolidated. The cons to debt consolidation are just as obvious: The debt is not forgiven or even reduced.

What are the disadvantages of consolidation?

There is a huge downside to consolidating unsecured loans into one secured loan: When you pledge assets as collateral, you are putting the pledged property at risk. If you can't pay the loan back, you could lose your house, car, life insurance, retirement fund, or whatever else you might have used to secure the loan.

Is a debt consolidation loan a good idea?

Remember that a debt consolidation loan won't solve all your debt problems. It'll only make it easier for you to pay it back. You still owe the same amount of money if not more because of the fees you have to pay for the loan approval. If you have all three of these, then a debt consolidation loan is a good idea.

How does debt consolidation affect my credit score?

Debt consolidation combining multiple debt balances into one new loan is likely to raise your credit scores over the long term if you use it to pay off debt. But it's possible you'll see a decline in your credit scores at first. That can be OK, as long as you make payments on time and don't rack up more debt.]

#1 usability according to G2

Try the PDF solution that respects your time.