Convert On Feature Settlement For Free

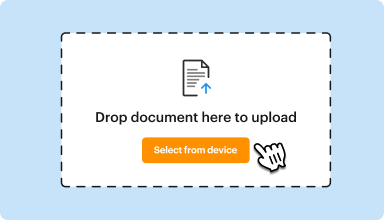

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

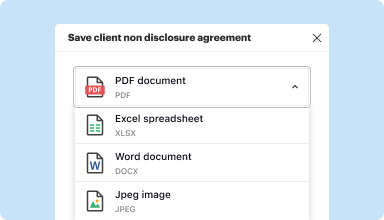

Edit, manage, and save documents in your preferred format

Convert documents with ease

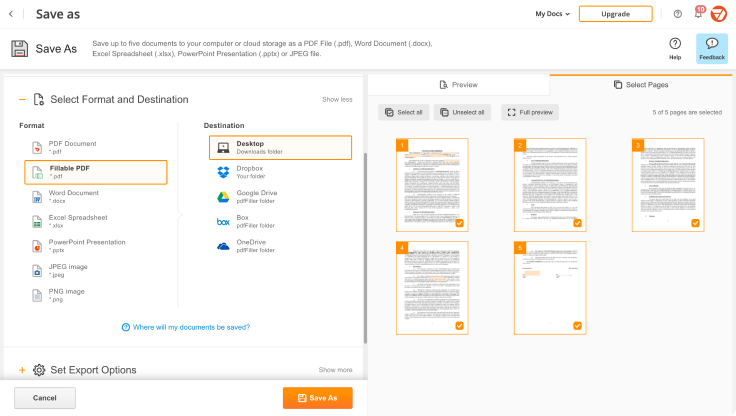

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

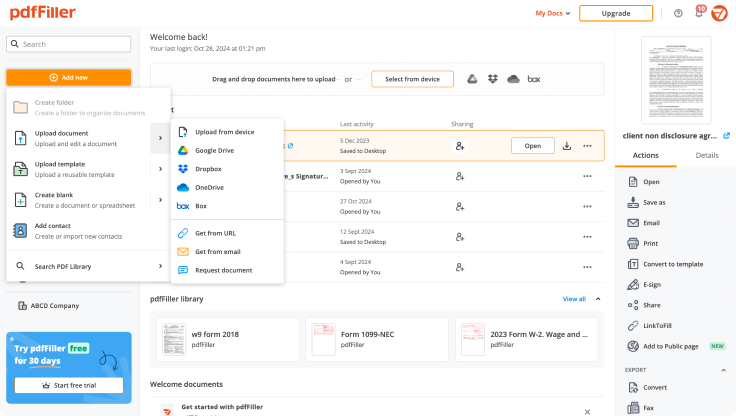

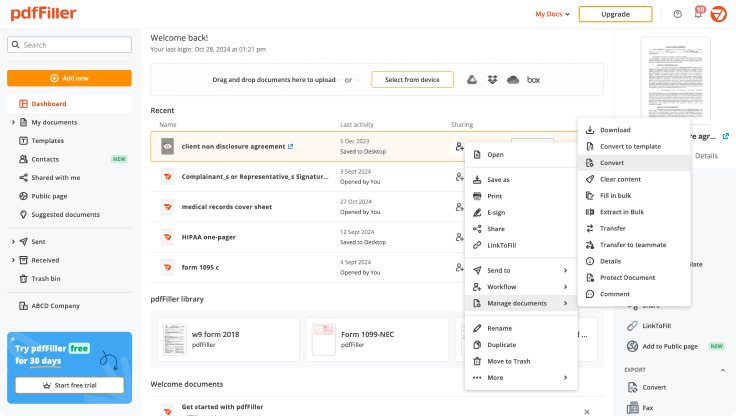

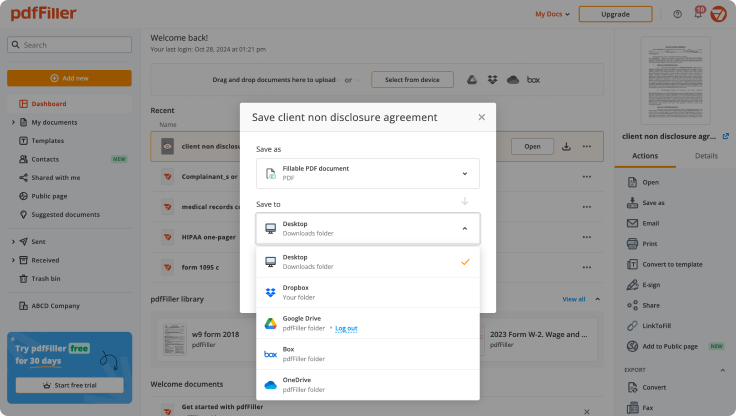

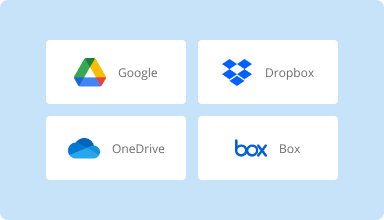

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

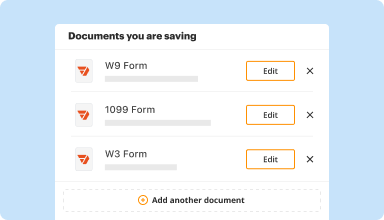

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

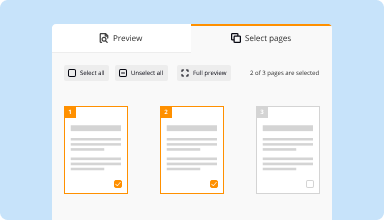

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

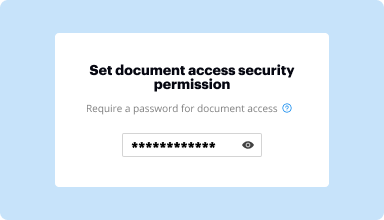

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The forms are easier to provide typed information into rather than trying to write it in and not having enough space. It's also easier to delete and correct mistakes rather than try using white-out with ink pen entry.

2014-08-25

I am a brand new user and have no idea how to use the program or other documents. I downloaded it to accommodate a Security Clearance form and haven't ventured too fa

2016-04-06

An easy method of filling out and sending documents. Problem with sending document due to 'Bugs' in the system

It took three tries to send off a document and I still do not have a confirmation that it was send nor d I have a date in which the document would be received.

The concept is good as I can go to the website and complete a document and send it off. Still some bugs

2017-05-12

What do you like best?

I like the choice of fonts because one can add changes or complete empty fields to a pdf and by using a different font from the original text it is clear that the additions are different from the original.. Also I like that one can add circles, check marks, "X" to a doc. And can erase portions of text.

What do you dislike?

I dislike that you have to pay extra to add or subtract pages from a pdf.

What problems are you solving with the product? What benefits have you realized?

My hand writing is very poor. So I use PDFiller to compensate for this deficiency..

I like the choice of fonts because one can add changes or complete empty fields to a pdf and by using a different font from the original text it is clear that the additions are different from the original.. Also I like that one can add circles, check marks, "X" to a doc. And can erase portions of text.

What do you dislike?

I dislike that you have to pay extra to add or subtract pages from a pdf.

What problems are you solving with the product? What benefits have you realized?

My hand writing is very poor. So I use PDFiller to compensate for this deficiency..

2019-05-21

Great support from the team, especially Kara

Over two days I talked to several agents. Kara was able, with great patience and time commitment, to solve my problem. Anything I have paid for the program and year subscription was was worth the service I got. I hope she is recognized as the best! Thanks to the program but most of all to her. Great job!

2024-10-13

This was my first experience with completing a 1099-NEC. It took me a while to figure out what to do. I really enjoyed it. I hope I haven't duplicated

2024-05-23

PDFFiller: A Convenient and User-Friendly PDF Editing Solution

I have been using PDFFiller for several months now and I am impressed with its functionality and ease of use. The software allows me to easily edit and sign PDF documents, saving me a lot of time and hassle. The interface is user-friendly and the features are comprehensive, making it easy to use for people of all skill levels. The mobile app is also very convenient and allows me to access and update my PDFs on the go.

The software is very user-friendly and easy to navigate. It allows me to easily edit and sign PDF documents. The mobile app is also very convenient and allows me to access and update my PDFs on the go.

I did not encounter any major cons while using the software, however, I would like to see more customization options for the templates.

2023-01-16

Needed to edit doc urgently and was…

Needed to edit doc urgently and was able to do so with PDF FIller and the seamless interaction made for edited doc.

2021-12-03

We would like become a distributor and sale partner for PDFfiller.

We will design documents and forms to sell through PDFfiller.

Many thanks in advance foryour cooperation.

Best regards,

2020-10-21

Convert On Feature Settlement

The Convert On Feature Settlement allows users to seamlessly manage and convert settlement features in real-time. This tool is designed for both individual users and businesses looking to enhance their feature set.

Key Features

Instant conversion of feature settlements

User-friendly interface for easy navigation

Real-time analytics for informed decision-making

Customizable settings to fit your needs

Secure transactions to ensure data protection

Potential Use Cases and Benefits

Easily convert settlement terms to match evolving business needs

Reduce the time spent on feature management and settlement processing

Enhance customer satisfaction by providing timely updates and options

Streamline processes for accounting and finance departments

Adapt to market changes quickly and efficiently

This feature addresses common challenges faced by businesses. By allowing quick adjustments and conversions, it reduces delays in processes that could lead to customer dissatisfaction. It empowers you to manage your features effectively, ensuring you stay competitive and responsive in your market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you find the beneficial conversion feature?

Now take the amount allocated to the debt and divide by the number of shares into which the debt is convertible. That is you per share carrying value. If that number is less than the conversion price, then the ACTUAL effective conversion price for accounting purposes is the lower per share carrying value.

Where is convertible debt on the balance sheet?

Because convertible bonds have maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

How do you account for a convertible debt?

The equity & liability portion for the convertible bonds can be calculated using the Residual Approach. This approach assumes that the value of the equity portion is equal to the difference between the total amount received from the proceeds of the bonds and the present value of future cash flows from the bonds.

How do you show Convertible Notes on a balance sheet?

If it's in the form of debt it stays in the liability section of the balance sheet until converted to equity. A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Is a convertible bond debt or equity?

A convertible bond is a fixed-income debt security that yields interest payments, but can be converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock can be done at certain times during the bond's life and is usually at the discretion of the bondholder.

What is BCF in accounting?

Broadcast cash flow is a calculation used for accounting in the radio, television and cable industry. Broadcast cash flow is revenue minus operating expenses, focusing on the operating performance of a single station without consideration of corporate overhead and costs.

What is a BCF?

BCF — Investment & Finance Definition A Billion cubic feet. Typically, refers to an amount of natural gas that is in storage or that has been sold. Sometimes BCF/d is used, which is billions of cubic feet produced in a day.

What is a beneficial conversion feature?

A beneficial conversion feature arises when the conversion price of a convertible instrument is below the per-share fair value of the underlying stock into which it is convertible. The conversion price is 'in the money' and the holder realizes a benefit to the extent of the price difference.

#1 usability according to G2

Try the PDF solution that respects your time.