Convert On Sum Warranty For Free

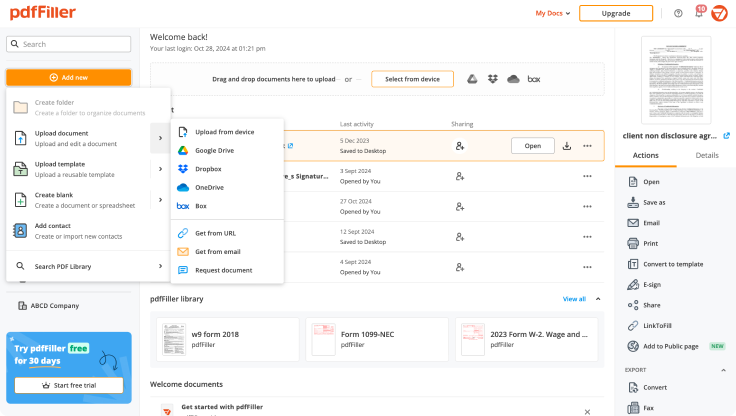

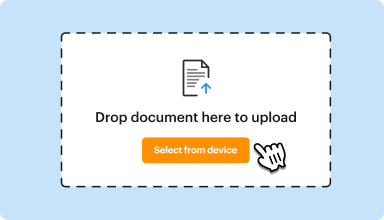

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

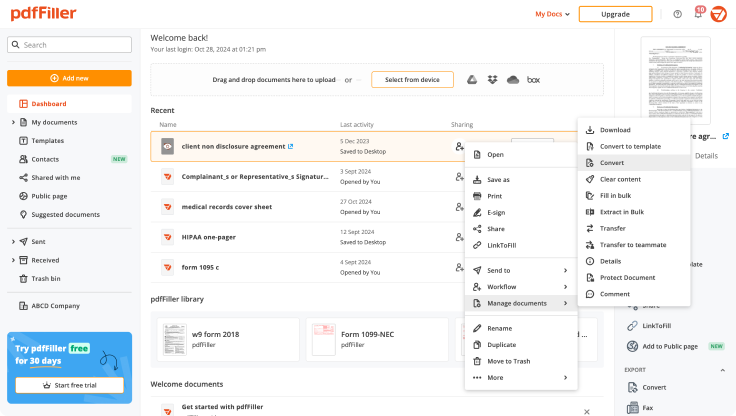

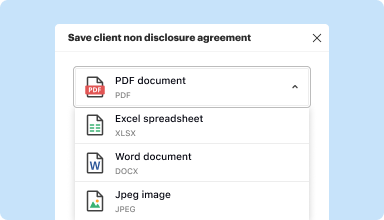

Edit, manage, and save documents in your preferred format

Convert documents with ease

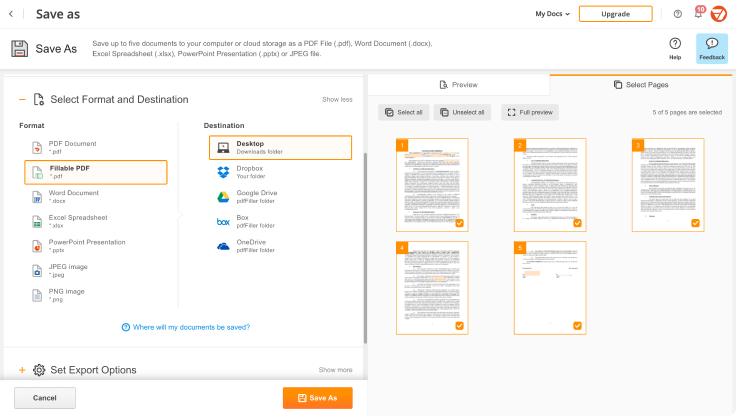

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

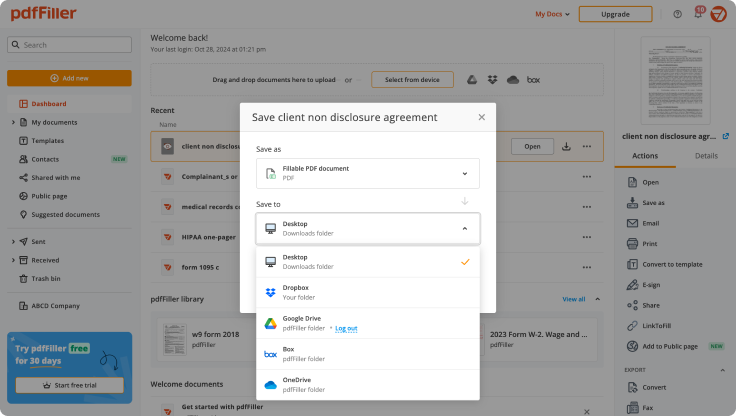

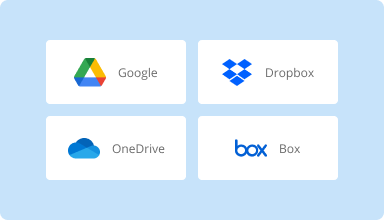

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

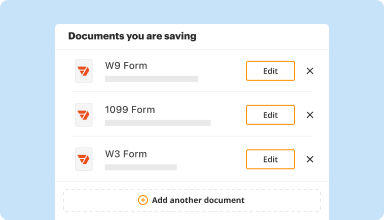

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

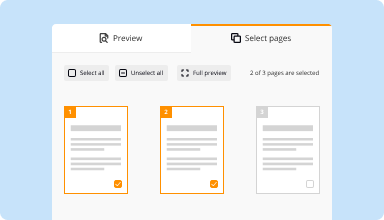

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

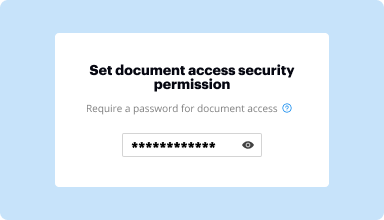

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Limited capabilities on iPad. Would be nice to have drawing tools on iPad. Also can't copy and paste between two forms, so if you need to have the same info on two forms, it's somewhat cumbersome. That said, not bad for the price.

2014-11-07

Program is a time saver for me.

Plus my reports have a more professional appearance.

I would not want to go back to doing it the old way.

Thank you PDFfiller!

2017-01-19

To Whom It May Concern,

I need to let you know that I jumped the gun on submitting my prior severely bad review. Knoll G ended up figuring out the issue and assisted greatly in resolving it. She had much more patience than I had as I had been trying to figure out where everything had been changed to from when I used your site the year before. After 4 hours of much frustration, Knoll G saved the day. I would like to ask for you to somewhat disregard my initial review. I only say somewhat because I feel that the site had such a huge change from last year's "easy to use" formatting. I never needed to use support help. That said, I would like to praise Knoll G. She never gave up even when I did. Huge THANK YOU for not giving up Knoll! You're great and I hope you get some sort of reward for going above and beyond.

I would also like to add a technical note...I don't know how everything is viewed on the companies side, but it was very difficult to work with support in terms of the chat box. Every time Knoll G gave me a direction to go and I went (which means the screen changed), I would lose the chat box and had to wait for Knoll G to type and send me something before the box would reappear and then I could respond. It only added to my then current frustration so your site coders might want to look into that.

2017-05-22

Awesome!! if i could erase letters without distorting the background that would be awesome. i would give 5 stars for that. Otherwise if i could 4.75 I WOULD!!!

2018-05-04

Forms are fairly easy to fill out…

Forms are fairly easy to fill out however it would be better if there was a tab function to go between blocks.

2020-11-06

Excellent application but not sure if…

Excellent application but not sure if its worth $9 a month for an individual user working on domestic household forms. Definitely worth it if using for a small business.

2020-10-01

What do you like best?

Ability to quickly and easily edit PDF's

What do you dislike?

Sometimes it's difficult to undo changes made.

What problems are you solving with the product? What benefits have you realized?

I work in real estate and I often need to fill in PDF's with information for my clients. Being able to do in a web based platform makes it easy to do on any computer.

2020-08-30

PDFfiller was an easy and convenient service to use. I filled out my PDF no problem and saved my documents. The customer support team was extremely helpful and accommodating when I needed to change my plan. Highly recommend!

2020-06-10

I needed a HIPAA compliant PDF editor and found this one. Lost the document I was working on but was helped by chat and got it back. Very relieving!

2025-07-09

Convert On Sum Warranty Feature

The Convert On Sum Warranty feature provides a seamless and efficient way to manage warranties for your products. With this feature, you can ensure peace of mind for both you and your customers, as well as simplify the warranty process. This tool is designed to enhance customer satisfaction while reducing administrative burdens.

Key Features of Convert On Sum Warranty

Automatic conversion of warranties based on predefined conditions

Easy management of warranty terms and conditions

Real-time tracking of warranty status

User-friendly interface for straightforward navigation

Comprehensive reporting tools for informed decision-making

Potential Use Cases and Benefits

Streamlining warranty processes for manufacturers and retailers

Enhancing customer support by providing clear warranty guidelines

Reducing disputes related to warranty claims

Improving customer loyalty through reliable warranty offerings

Facilitating data analysis to forecast warranty trends and issues

The Convert On Sum Warranty feature addresses common warranty management challenges. By automating the conversion process and providing clear tracking mechanisms, you can minimize errors and save time. Customers gain confidence in your brand when they know their products are covered under a reliable warranty. Ultimately, this feature helps create a smoother experience for everyone involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a conversion option on term life insurance?

Simply put, the term life conversion option gives you the ability to convert your term policy to a whole life policy at specified dates during the length of your term. This will enable you to turn your term policy which is temporary coverage into permanent coverage.

What is a life insurance conversion option?

Term life insurance policies usually offer the conversion privilege option. This provision allows a policyholder to convert a term policy to a permanent policy that will provide insurance for the rest of someone's life. If health or life insurance needs have changed, it is best to review their conversion options.

What is a life insurance conversion period?

Most term life insurance is convertible. That means you can make the coverage last entire life by converting some or all of it to a permanent policy. That means you can make the coverage last entire life by converting some or all of it to a permanent policy, such as universal or whole life insurance.

Should you convert term life insurance to permanent?

However, as you age, you'll likely make more money and improve your financial situation. That's a good time to convert to a permanent life policy. Permanent life will cost you more than term life, but it will also provide you with savings for your survivors or to use as an emergency fund or retirement fund.

What is a term conversion credit?

Conversion Credits: Sometimes insurance companies will offer conversion credits to offset the costs of increased premiums on a permanent life policy. Ask about your options: Some companies will limit the kinds of permanent policies you can convert a term policy into.

Should I convert my term life insurance to permanent?

However, as you age, you'll likely make more money and improve your financial situation. That's a good time to convert to a permanent life policy. Permanent life will cost you more than term life, but it will also provide you with savings for your survivors or to use as an emergency fund or retirement fund.

Is it worth converting term to whole life?

Most term life insurance is convertible. That means you can make the coverage last entire life by converting some or all of it to a permanent policy, such as universal or whole life insurance. The deadline for converting and the type of permanent policies available depend on the life insurance company.

How long should I keep my term life insurance?

Most term life insurance policies last 10, 20 or 30 years, but many companies offer additional five- or 10-year increments, some up to 35 or 40 year terms. For example, a 20-year term policy covers you for 20 years from date of purchase, as long as you keep paying the premiums.

#1 usability according to G2

Try the PDF solution that respects your time.