Digisign 1040EZ Form For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Digisign 1040EZ Form Feature

The Digisign 1040EZ Form feature simplifies your tax filing process. It provides a smooth, efficient way to prepare and sign your 1040EZ form. You can complete your taxes from the comfort of your home, making it easier to stay organized.

Key Features

Use Cases and Benefits

The Digisign 1040EZ Form feature addresses your tax filing challenges by providing a clear path to completion. It eliminates confusion and delays, ensuring you file on time without stress. You can trust this tool to manage your paperwork, allowing you to focus on what matters.

Digisign 1040EZ Form in minutes

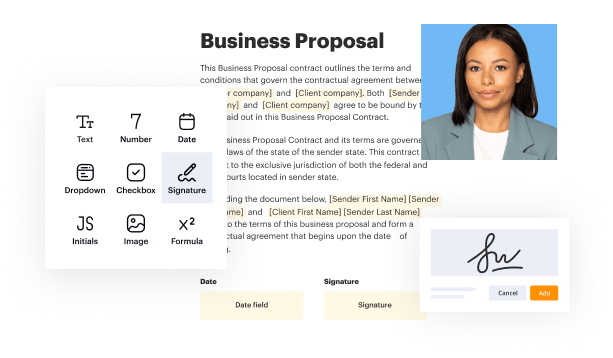

pdfFiller enables you to Digisign 1040EZ Form in no time. The editor's convenient drag and drop interface allows for quick and user-friendly document execution on any device.

Ceritfying PDFs electronically is a quick and safe way to validate paperwork at any time and anywhere, even while on the fly.

See the detailed guide on how to Digisign 1040EZ Form online with pdfFiller:

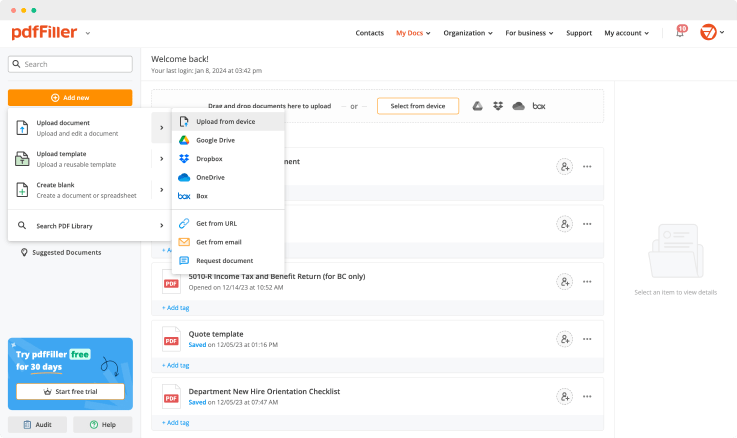

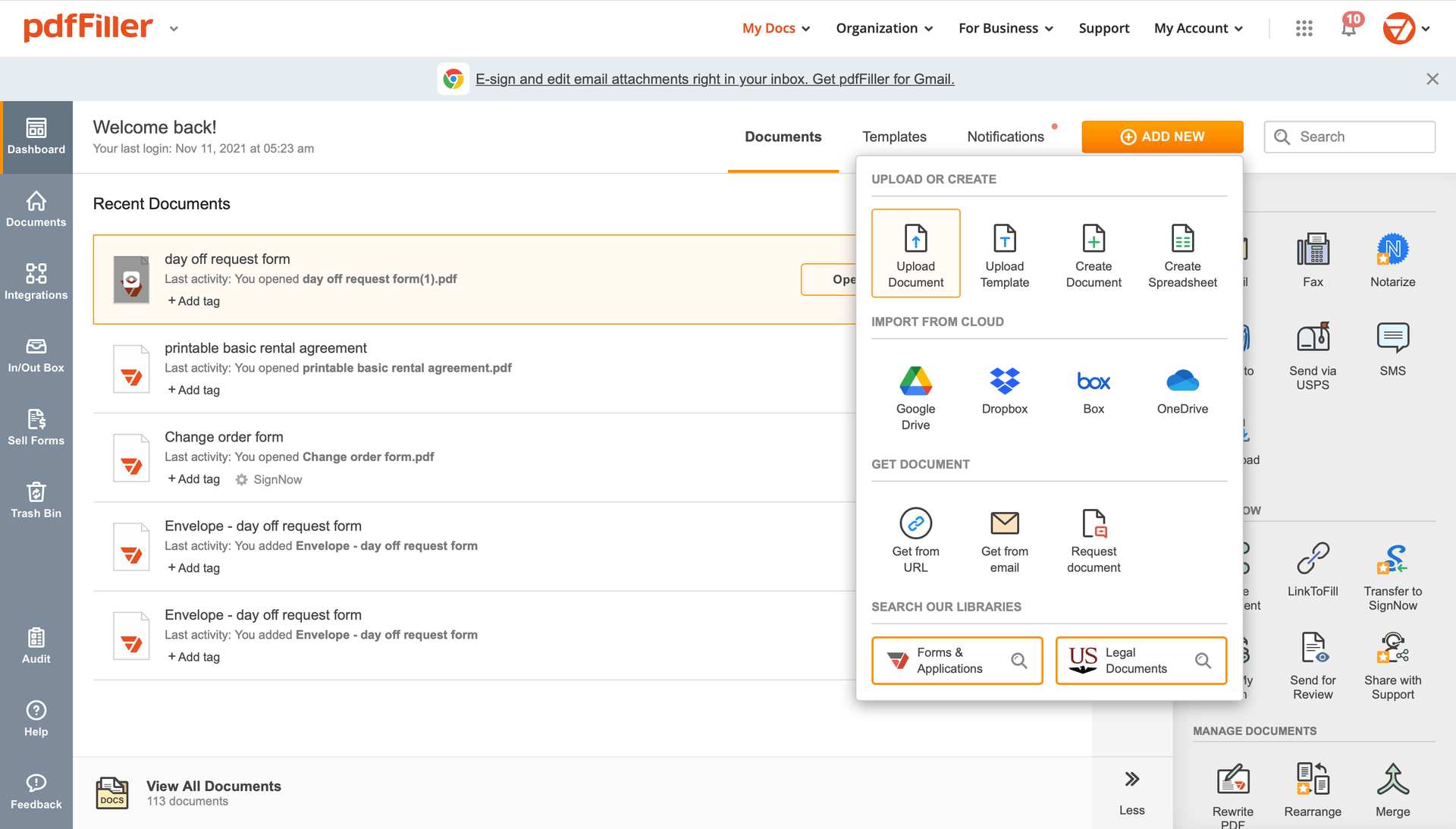

Upload the form for eSignature to pdfFiller from your device or cloud storage.

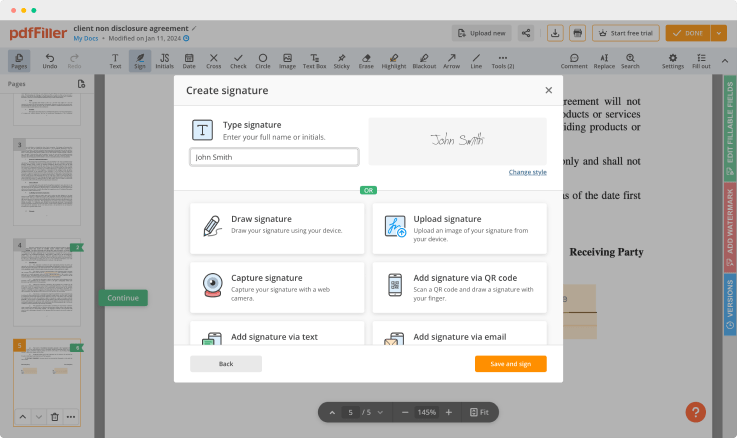

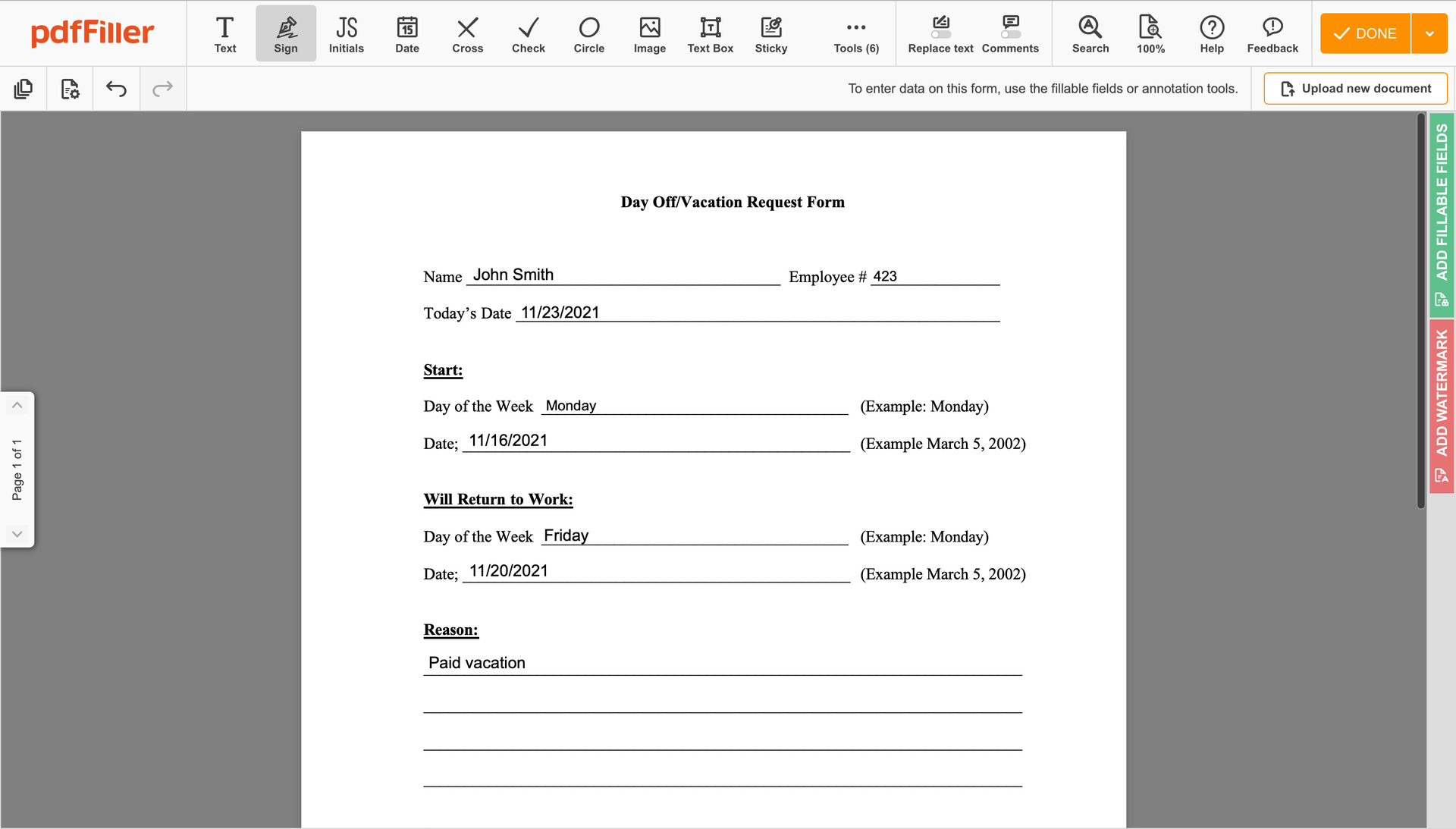

Once the document opens in the editor, click Sign in the top toolbar.

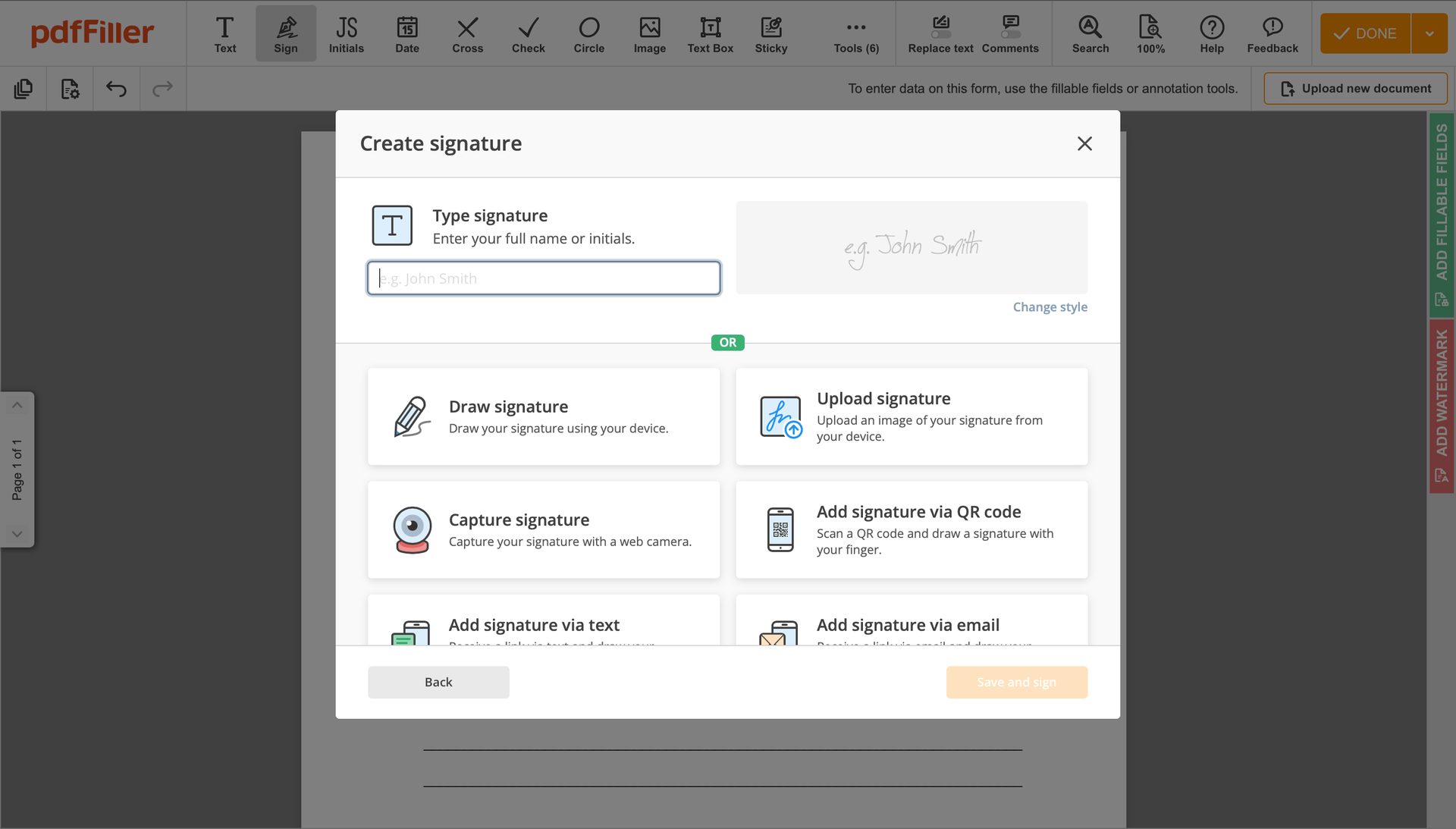

Create your electronic signature by typing, drawing, or uploading your handwritten signature's image from your laptop. Then, click Save and sign.

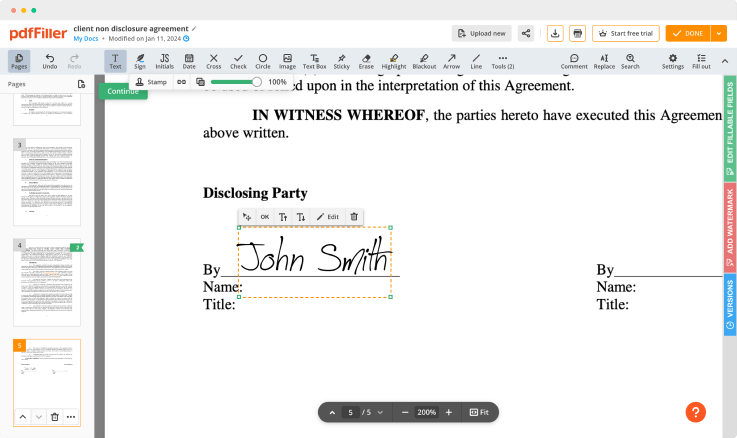

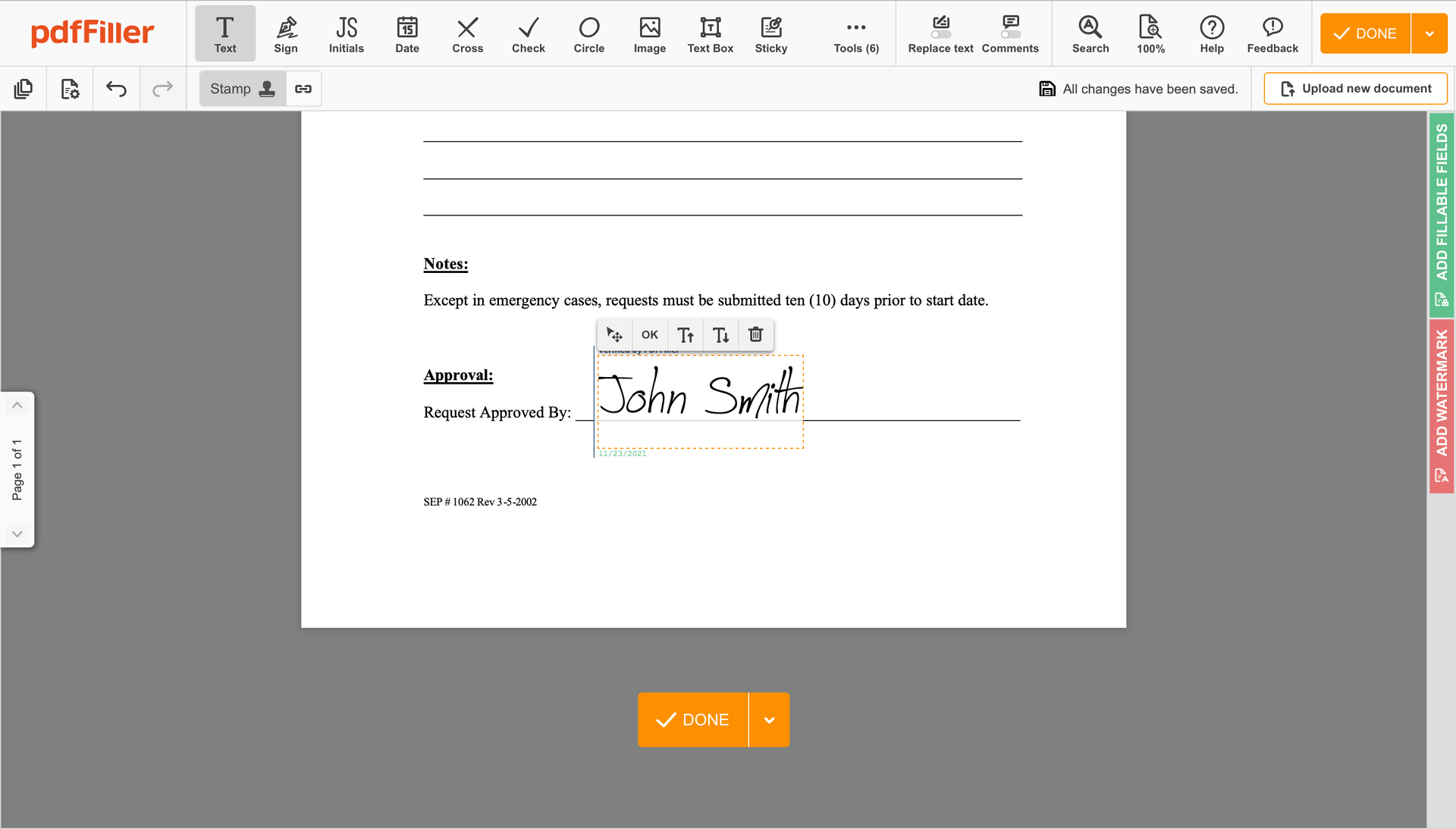

Click anywhere on a document to Digisign 1040EZ Form. You can move it around or resize it using the controls in the hovering panel. To use your signature, hit OK.

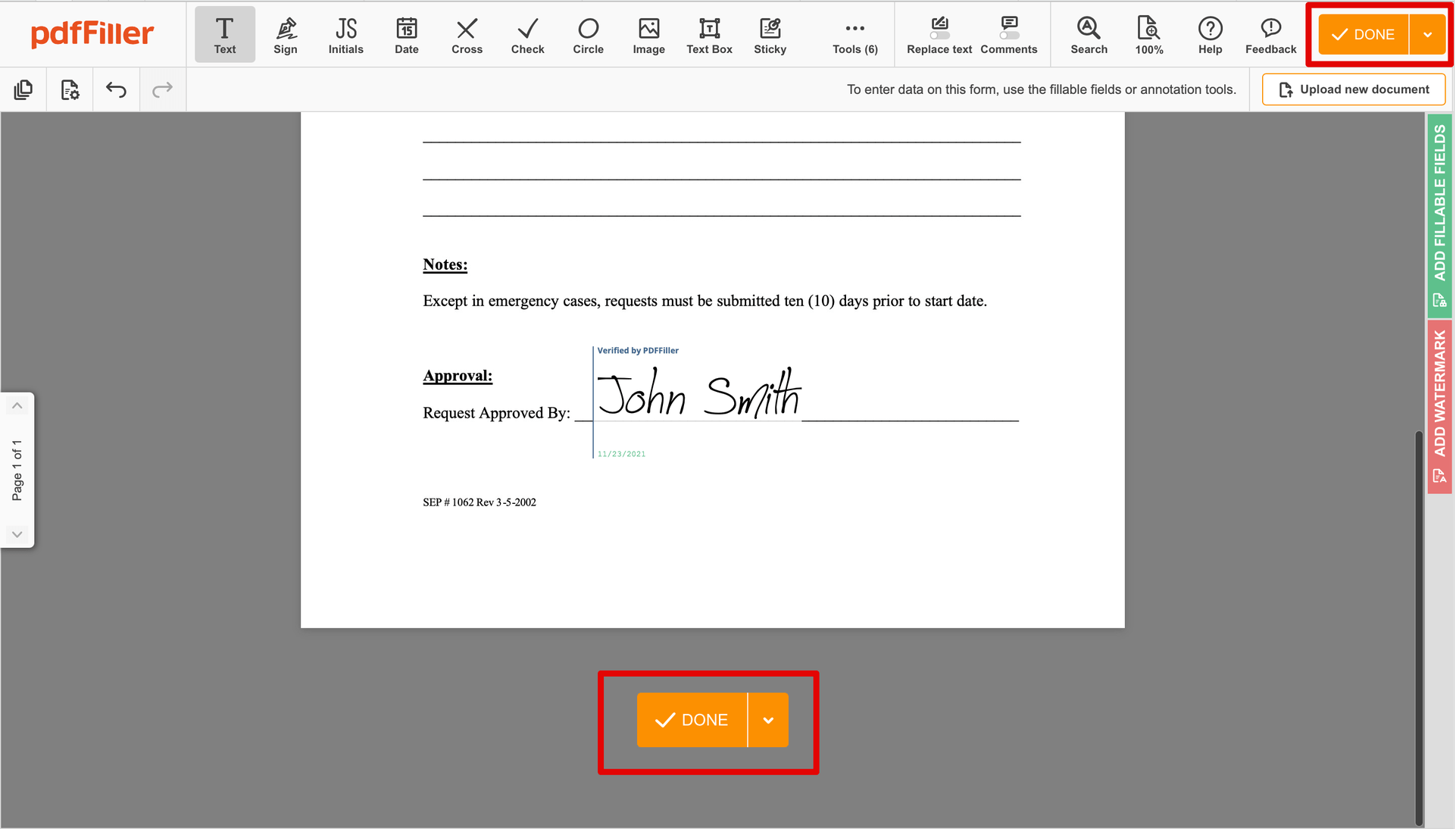

Complete the signing process by hitting DONE below your form or in the top right corner.

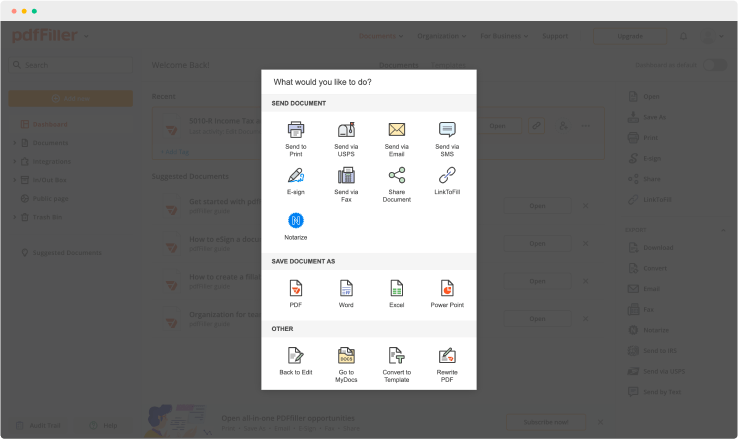

Next, you'll return to the pdfFiller dashboard. From there, you can get a signed copy, print the document, or send it to other people for review or approval.

Still using multiple applications to edit and manage your documents? We have an all-in-one solution for you. Use our document management tool for the fast and efficient work flow. Create forms, contracts, make template sand other features, without leaving your browser. You can use Division 1040EZ Form with ease; all of our features, like signing orders, reminders, requests , are available to all users. Have the value of full featured platform, for the cost of a lightweight basic app.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Digisign 1040EZ Form