Draft Electronically Sign Bank Loan Agreement with pdfFiller

What does it mean to draft electronically sign bank loan agreement?

Drafting an electronically signed bank loan agreement refers to the process of creating a legally binding document between a bank and a borrower, which can be signed electronically. This method not only enhances the efficiency of the loan process but also minimizes paper usage. Using a platform like pdfFiller allows users to create, modify, and sign loan agreements digitally, ensuring that all parties have a smoother experience.

-

Electronic signing of documents eliminates the need for physical signatures.

-

It allows for faster processing times for loan approvals.

-

The process is more environmentally friendly, reducing paper waste.

Why drafting electronically sign bank loan agreement is critical for modern document workflows?

The significance of drafting bank loan agreements electronically cannot be overstated. In today's fast-paced digital environment, the traditional method of using paper documents is no longer practical. Digital agreements streamline the lending process, reduce human error, and facilitate remote operations for businesses and individuals alike. Utilizing electronic signatures and cloud-based document management creates a more organized and efficient workflow.

-

Enhances efficiency: Digital documents reduce delays associated with mailing paperwork.

-

Improves accessibility: Stakeholders can access and sign agreements from anywhere.

-

Strengthens security: Electronic signatures are often backed by encryption and audit trails.

Use-cases and industries that frequently draft electronically sign bank loan agreement

Various professional sectors benefit from electronically signed bank loan agreements. Real estate, banking, financing, and small businesses frequently utilize this capability. These agreements are common in mortgage loans, personal loans, and even lines of credit. The convenience of electronic signing addresses the specific needs of these industries, enhancing overall productivity.

-

Real Estate: Quickly finalize mortgage agreements.

-

Banking: Facilitate personal loan approvals.

-

Small Businesses: Streamline business financing requests.

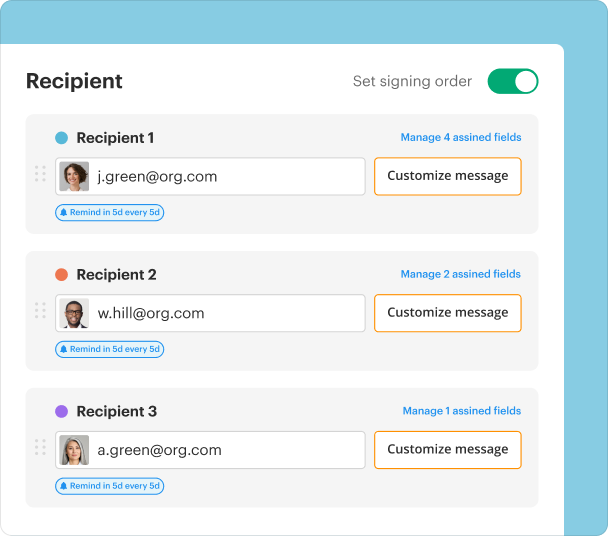

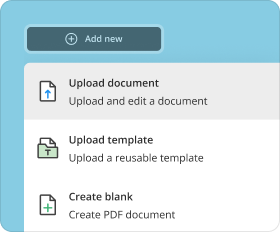

Step-by-step: how to draft electronically sign bank loan agreement in pdfFiller

Using pdfFiller to draft and sign a bank loan agreement is straightforward. Follow these steps to create your document:

-

Log into your pdfFiller account.

-

Select 'Create New Document' from the dashboard.

-

Choose a template for the bank loan agreement or upload your own.

-

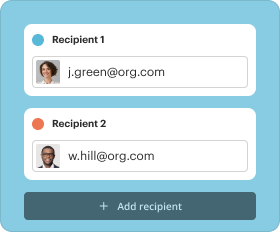

Fill in the necessary details, including borrower and lender information.

-

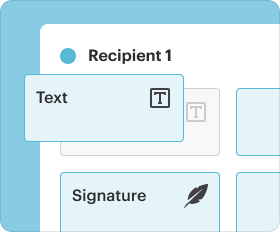

Add signature fields where necessary for both parties.

-

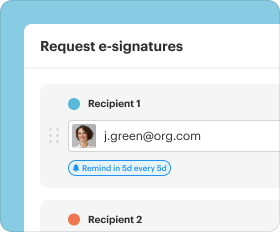

Once complete, apply your electronic signature and send it for signing.

-

After all parties have signed, save or export the document.

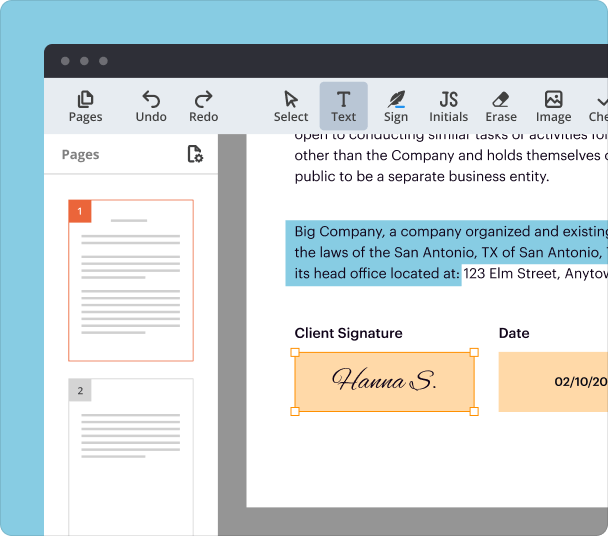

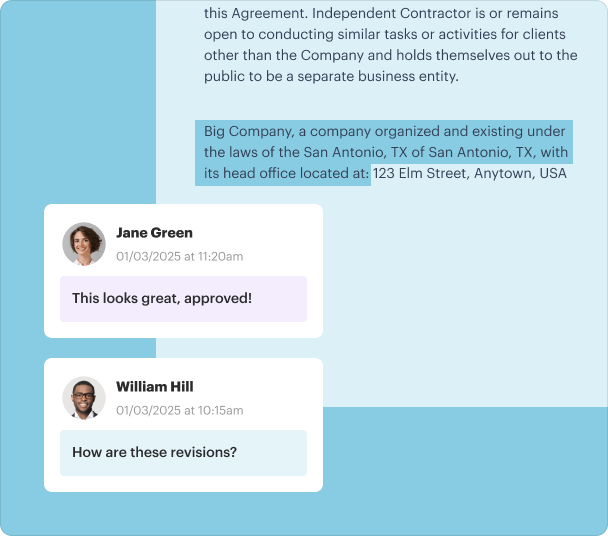

Options for customizing signatures, initials, and stamps when you draft electronically sign bank loan agreement

pdfFiller provides users with several options for customizing signatures and initials when creating bank loan agreements. You can select from various signature styles or upload a scanned image of your handwritten signature. Additionally, initials and stamps can be added easily to highlight approval points within the document.

-

Select a font style or upload your personal signature image.

-

Position your signature exactly where required in the document.

-

Add a date stamp automatically when signing.

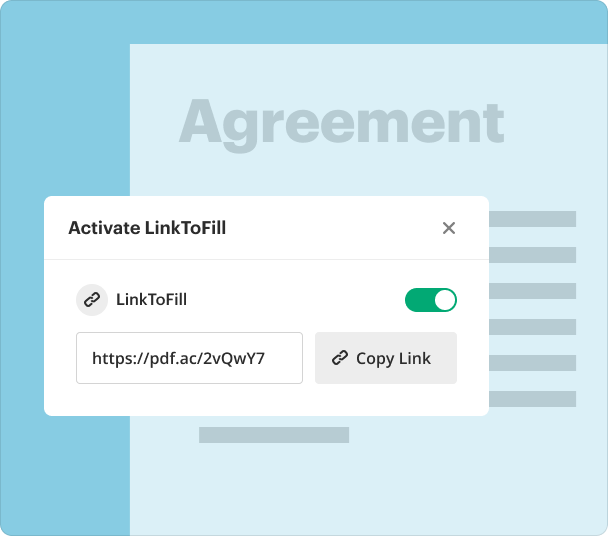

Managing and storing documents after you draft electronically sign bank loan agreement

Once you've drafted and signed a bank loan agreement, managing and storing these documents efficiently is vital. pdfFiller offers cloud storage solutions that keep your documents secure and accessible anytime. Organizing files and folders can help you find agreements quickly when needed.

-

Organize documents in folders based on categories (e.g., mortgage, personal loans).

-

Utilize pdfFiller's search functionality to find documents easily.

-

Download or share documents directly from the platform.

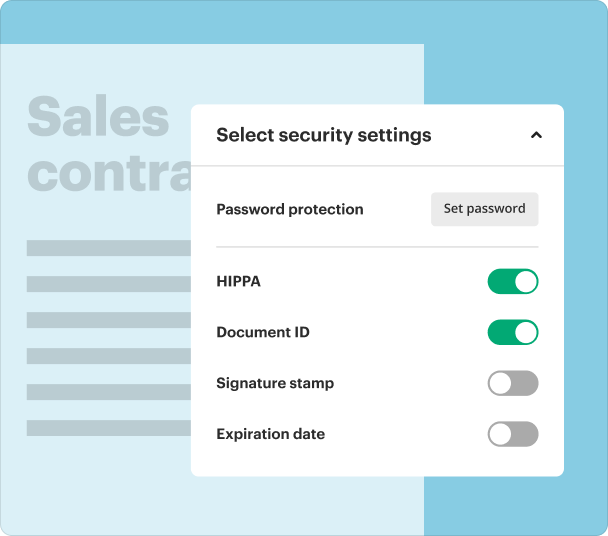

Security, compliance, and legal aspects when you draft electronically sign bank loan agreement

When dealing with bank loan agreements, maintaining security and compliance with legal standards is critical. Electronic signature laws vary by region, but electronic signatures are legally accepted in most jurisdictions when done correctly. Using pdfFiller ensures compliance with standards such as ESIGN and UETA, providing robust security features.

-

pdfFiller complies with federal and state laws governing electronic signatures.

-

Use encryption to protect document integrity.

-

Audit trails allow tracking of who signed the document and when.

Alternatives to pdfFiller for workflows related to drafting electronically sign bank loan agreement

While pdfFiller offers many unique benefits, there are alternatives for drafting electronically signed bank loan agreements. Popular options include DocuSign, Adobe Sign, and SignNow, each with their own features and pricing structures. Evaluating the pros and cons of each platform can help users decide which tool best fits their needs.

-

DocuSign: Known for its ease of use and robust integrations.

-

Adobe Sign: Offers seamless connections with other Adobe products.

-

SignNow: Provides a more cost-effective signing solution for small businesses.

Conclusion

In conclusion, drafting an electronically signed bank loan agreement with pdfFiller is an efficient way to streamline financial transactions. By embracing digital solutions, individuals and businesses can reduce their reliance on paper, ensure security, and facilitate faster loan processing. Whether you're in real estate, banking, or any industry that requires loan agreements, pdfFiller offers the tools you need for seamless document management. Start using pdfFiller today to experience the convenience of digital agreements.

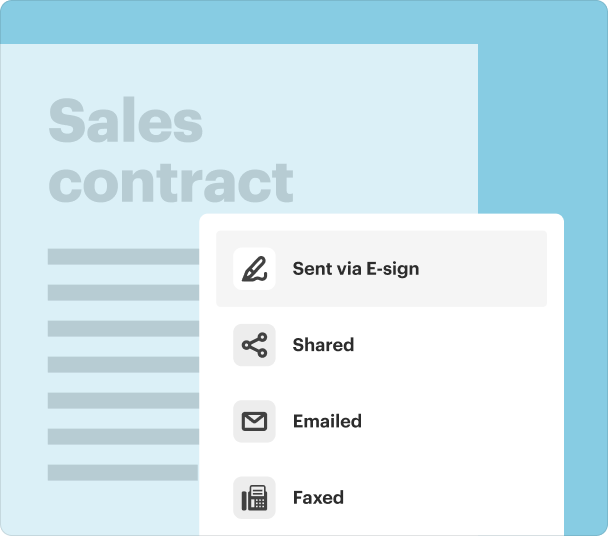

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms

I like the fact that you can upload any document and make the necessary changes.

What do you dislike?

I dislike that you sometimes it freezes and doesn't allow you to upload quickly.

What problems are you solving with the product? What benefits have you realized?

I have not had many problems . I enjoy I can easily stamp a signature on forms and send them out quickly.