Excise Spreadsheet Charter For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

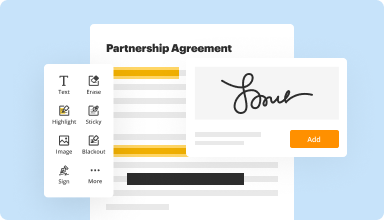

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

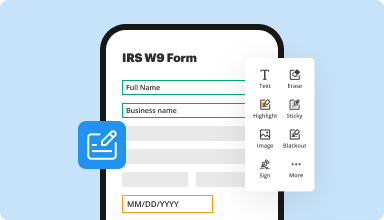

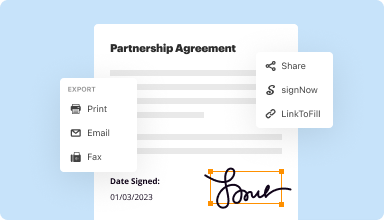

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

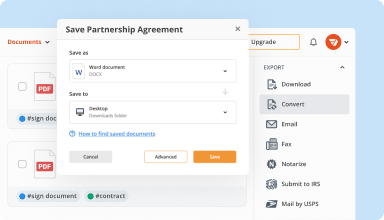

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

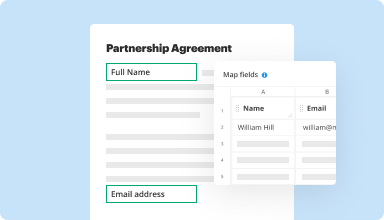

Collect data and approvals

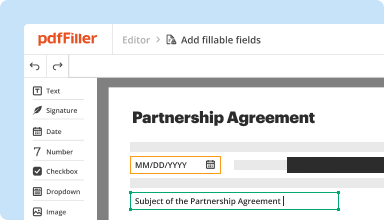

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

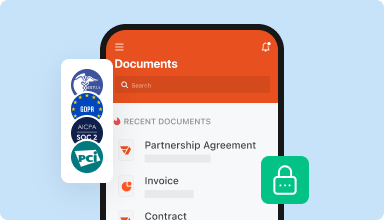

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I completed a passport application. The document was easy to fill & very professional in quality which made it very easy to be understood during processing.

2015-11-25

I like the send to sign feature but customers have had difficulty printing copies. Asking for a review so often delays the processing I need to do on business.

2017-07-27

Works well, but not sure why you create a page that cannot be scanned and sent to the IRS on the first part of the form. If this is not legal or usable why have it?

2018-01-31

What do you like best?

PDFiller is ultra-convenient and super-easy to use. It's in the cloud, so it's easy to access. And it has a vast array of features. Storage is a cinch, whether on your hard drive or in the cloud.

What do you dislike?

I can't think of much that I don't like about the program. There might be a more direct or seamless way to save documents to Google Drive, in terms of getting them straight into a particular folder instead of just onto the Drive, but that's a minor issue.

Recommendations to others considering the product:

Try it. You'll like it.

What problems are you solving with the product? What benefits have you realized?

PDFiller is a lifesaver when I'm editing contracts and related forms. The clarity of the input and the ability to maneuver the text around the document is a huge plus. Line-outs and erasures are a breeze, making for "cleaner," more legible documents.

PDFiller is ultra-convenient and super-easy to use. It's in the cloud, so it's easy to access. And it has a vast array of features. Storage is a cinch, whether on your hard drive or in the cloud.

What do you dislike?

I can't think of much that I don't like about the program. There might be a more direct or seamless way to save documents to Google Drive, in terms of getting them straight into a particular folder instead of just onto the Drive, but that's a minor issue.

Recommendations to others considering the product:

Try it. You'll like it.

What problems are you solving with the product? What benefits have you realized?

PDFiller is a lifesaver when I'm editing contracts and related forms. The clarity of the input and the ability to maneuver the text around the document is a huge plus. Line-outs and erasures are a breeze, making for "cleaner," more legible documents.

2019-05-21

Took some getting used to the different…

Took some getting used to the different text box features, but overall good. Worth the annual cost to be able to edit and print PDFs

2024-01-17

Excellent Customer Service

I contacted the customer service team of pdfFiller when I had a problem and it was dealt with straight away. I spoke to someone called Harmhon and they were really kind and understanding. They replied to me very quickly and the problem was resolved in less than a few minutes. Overall, I am very happy with the service and would definitely recommend to a friend.

2021-07-24

I would like more New York templates available in the non-upgraded version. I would also appreciate different pricing options, I am disabled on a fixed income. Other than these two issues, I find pdfFiller useful.

2021-03-02

Great PDF Filler!

We needed and easy way to for patients to sign there name for Covid testing. Before we came across this they were signing with pen and paper and now they sign digitally on and case protected iPad that can be wiped down and sterilized. The iOS pdffiller app then digitally sends the completed PDF to a nurse. The whole process is seamless.

PDFfiller is very easy to use. Some features that we love are:

-Being able to convert a file into a PDF

-Converting a PDF into a Fillable PDF

-Creating PDF online.

There is also a mobile application for Android and iOS that works great.

Initially it was tough finding out where things were and where the files ended up when saved or converted over to be fillable. I think the menu could be simplified and reorganized.

2020-09-29

I looked at some pdf that were not…

I looked at some pdf that were not editable until I found PDFiller. Great experience and so useful in my tax business.

2025-03-11

Excise Spreadsheet Charter Feature

The Excise Spreadsheet Charter feature simplifies the management of excise tax records. It offers an efficient way to organize, track, and analyze your excise data. This tool can help you stay compliant and make informed decisions.

Key Features

User-friendly interface for easy navigation

Customizable templates for different excise categories

Automated calculations to reduce errors

Export options for various formats

Real-time collaboration for team input

Potential Use Cases and Benefits

Tax professionals managing client excise filings

Businesses tracking excise products for compliance

Organizations analyzing excise trends over time

Teams collaborating on excise reports and assessments

Individuals preparing for audits or reviews

Using the Excise Spreadsheet Charter feature addresses common challenges faced in excise tax management. It streamlines your processes, enhances data accuracy, and fosters collaboration among team members. With this tool, you can confidently manage excise records and focus on achieving your business goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How is Tennessee excise tax calculated?

The franchise tax is based on the greatest of Tennessee apportioned net worth (assets less liabilities) or real and tangible property owned or used in Tennessee. The tax rate is $0.25 per $100 (0.25%) of the tax base. There is a $100 minimum tax.

How is Tennessee franchise and excise tax calculated?

How is franchise tax computed? The franchise tax is based on the greatest of Tennessee apportioned net worth (assets less liabilities) or real and tangible property owned or used in Tennessee. The tax rate is $0.25 per $100 (0.25%) of the tax base. There is a $100 minimum tax.

How much is franchise and excise tax in TN?

The franchise tax has a minimum payment of $100. Franchise tax is figured at. 25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

How do I file franchise and excise tax in Tennessee?

File a franchise and excise tax return (Form FAE170).

File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax.

Make quarterly estimated payments.

Make an extension payment.

File the annual exemption renewal (Form FAE183).

Make a payment for an e-filed annual return.

What is Tennessee excise tax?

Tennessee's excise tax, which effectively is an income tax, is a flat 6.5% tax on net earnings from doing business in the state. All capital losses are claimed in the year incurred. Generally speaking, only general partnerships and sole proprietorship are exempt from the excise tax.

Who Must File Tennessee franchise tax return?

Entities with limited liability protection that are doing business and have substantial nexus in the state must file a franchise tax return on form FAE170. If the computed franchise tax is less than $100, the minimum $100 franchise tax is due.

Does Tennessee have excise tax?

Tennessee has both an excise tax, which is a tax on net earnings, and a franchise tax, which is a tax on net worth. Both of these taxes apply to most Tennessee businesses other than general partnerships and sole proprietorship.

Does Tennessee have a corporate income tax?

Tennessee Corporate Income Tax Brackets. Tennessee has a flat corporate income tax rate of 6.500% of gross income. The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax. There are a total of twenty-nine states with higher marginal corporate income tax rates then Tennessee.

What is TN franchise and excise tax?

All Corporations, LCS, and Partnerships, regardless of their tax status with the IRS, are subject to the Tennessee Franchise tax and Tennessee Excise tax. ... Franchise tax is figured at .25% of the net worth of corporation or the tangible property. The excise tax is 6.5% of the net taxable income made in TN.

What do excise taxes pay for?

Excise taxes are taxes required on specific goods or services like fuel, tobacco, and alcohol. Excise taxes are primarily taxes that must be paid by businesses, usually increasing prices for consumers indirectly. Excise taxes can be ad valor em (paid by percentage) or specific (cost charged by unit).

#1 usability according to G2

Try the PDF solution that respects your time.