Export PDF to TAX2008 with pdfFiller

How to Export PDF to TAX2008

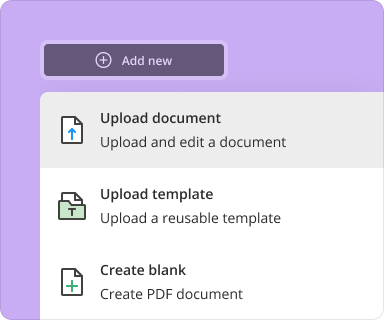

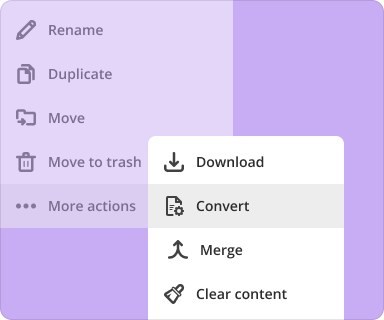

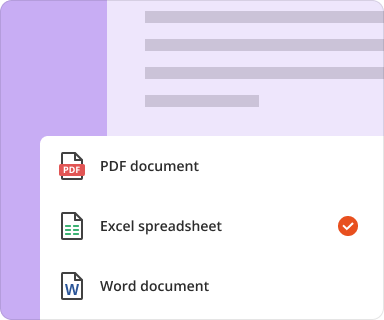

To export PDF to TAX2008, simply upload your PDF document to pdfFiller, select the TAX2008 format, and click 'Convert'. This process will convert your document directly, ensuring data integrity and ease of use.

-

Upload your PDF document.

-

Choose the TAX2008 format for conversion.

-

Click 'Convert' to initiate the process.

-

Download your converted TAX2008 file.

What are PDF files?

PDF (Portable Document Format) is a file format developed by Adobe that presents documents in a manner independent of application software, hardware, and operating systems. PDF files are widely used for documents that need to be shared and printed, preserving their formatting regardless of the platform.

What is TAX2008?

TAX2008 is accounting software designed for managing personal and corporate tax returns effectively. It includes functionalities for calculations, filing, and tracking, making it easier for users to handle tax-related issues. The software often requires data input from various formats, including PDFs.

Why might you need to export PDF to TAX2008?

Exporting PDF to TAX2008 is essential for users looking to streamline their tax filing process. It reduces the need for manual data entry, ensuring that sensitive financial information is accurately transferred without errors. This feature is particularly beneficial during peak tax season for both individuals and businesses.

What are typical use cases for exporting PDF to TAX2008?

Various industries and individuals benefit from this feature, including accountants, tax preparers, and small business owners. By converting PDF tax documents directly into a format compatible with TAX2008, users save significant time and streamline their workflows. Common use cases include:

-

Preparing annual tax returns with uploaded PDFs.

-

Importing tax documents from clients directly into TAX2008.

-

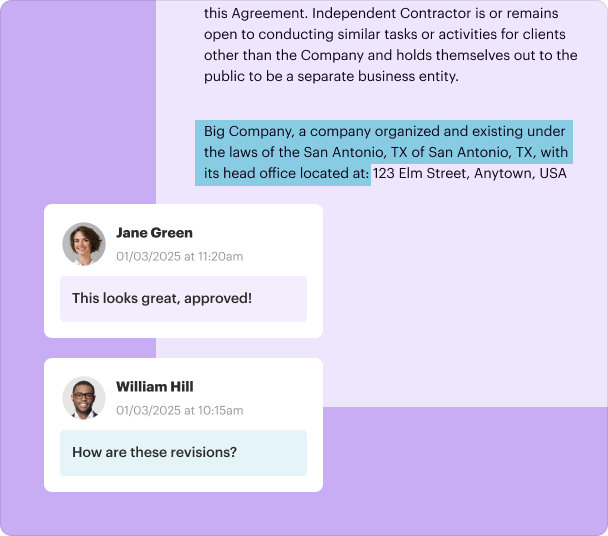

Collaborating with teams by sharing correctly formatted tax documents.

-

Maintaining accurate financial records by converting invoices and receipts.

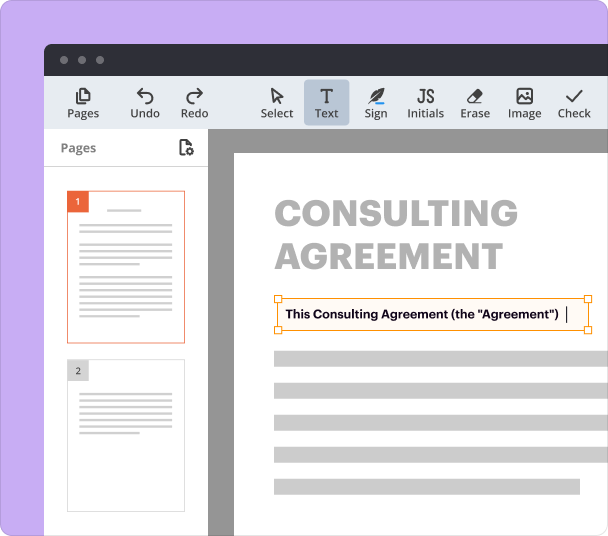

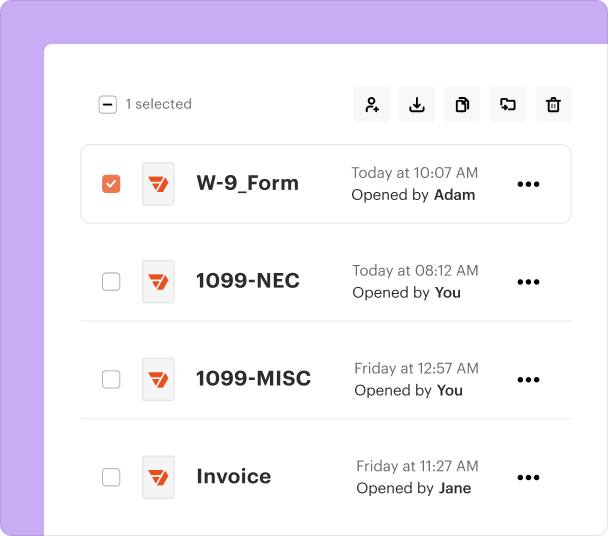

How to export PDF to TAX2008 with pdfFiller: step-by-step guide

Utilizing pdfFiller to convert PDFs to TAX2008 format is straightforward. Follow these steps for efficient conversion:

-

Visit the pdfFiller website and log in to your account.

-

Select the 'Convert’ tab from the menu.

-

Upload your desired PDF documents.

-

Choose “TAX2008” as your output format.

-

Click 'Start Conversion' and wait for the process to finish.

-

Download the output file and review your document.

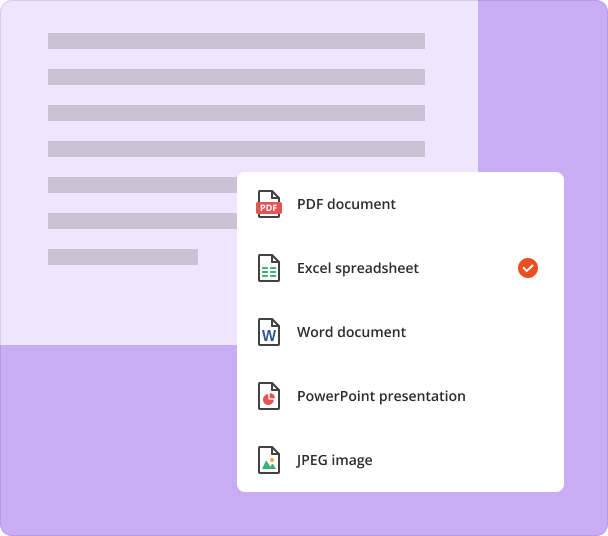

Which file formats does pdfFiller support for conversion?

pdfFiller supports various file formats for conversion, including but not limited to DOCX, XLSX, and CSV. This versatility allows users to convert a wide array of documents into a format compatible with TAX2008.

How does batch processing work for export to TAX2008?

Batch processing in pdfFiller allows users to convert multiple PDF documents into TAX2008 format simultaneously. This functionality is especially useful for accountants handling numerous client documents at once.

-

Select multiple PDF files to upload.

-

Choose the TAX2008 format for all selected files.

-

Initiate the batch conversion.

-

Download all files at once post-conversion.

How to maintain quality and formatting during export?

Maintaining data quality and formatting during conversion is paramount for accurate tax documentation. pdfFiller’s advanced technology ensures that formatting remains consistent across documents, helping users avoid discrepancies in their financial reports.

How does pdfFiller compare with other PDF conversion tools?

pdfFiller stands out among PDF conversion tools due to its user-friendly interface, speed, and ability to maintain formatting integrity. While many tools offer basic conversion features, pdfFiller’s comprehensive solution includes additional functionalities such as editing, e-signing, and collaborative tools for document management.

What are the advantages and limitations of using pdfFiller?

Utilizing pdfFiller for PDF to TAX2008 conversion presents several advantages:

-

User-friendly interface and seamless navigation.

-

Maintains formatting and data integrity.

-

Supports batch processing for efficiency.

-

Cloud-based access from anywhere.

However, potential limitations may include required subscriptions for premium features and the need for reliable internet access for cloud-based tasks.

Conclusion

The Export PDF to TAX2008 feature available through pdfFiller effectively simplifies the tax preparation process for individuals and teams. By leveraging this tool, users can minimize manual entry errors, save time, and improve the organization of their documents, allowing for a smoother tax season. This feature is indispensable for anyone looking to streamline their financial documentation handled within the TAX2008 software. Start using pdfFiller today to optimize your tax paperwork and manage your financial documents efficiently.

How to convert your PDF?

Why convert documents with pdfFiller?

More than a PDF converter

Convert documents in batches

Preview and manage pages

pdfFiller scores top ratings on review platforms