ez Tax Return PDF Converter shortcut alternative For Free

Use pdfFiller instead of ez Tax Return to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

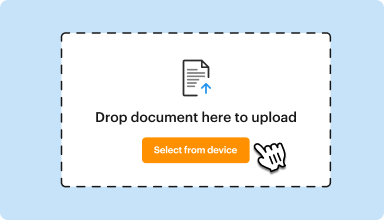

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

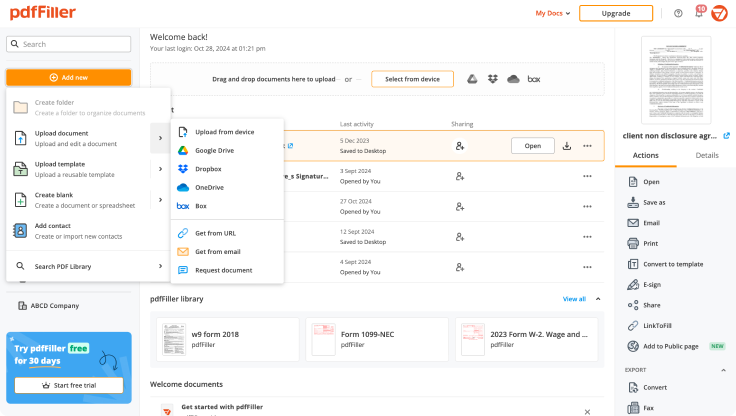

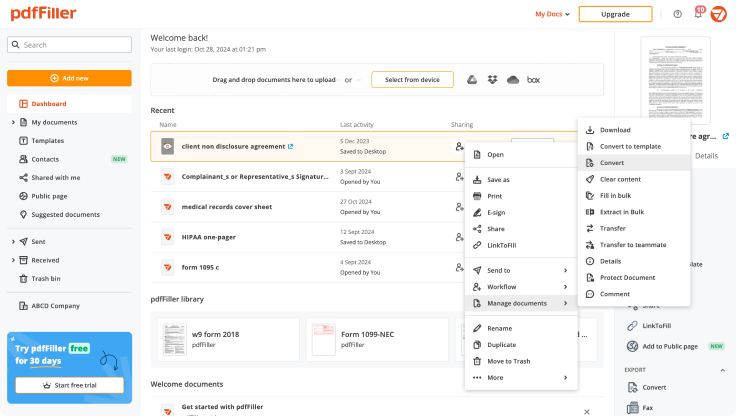

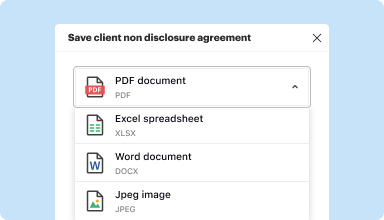

Edit, manage, and save documents in your preferred format

Convert documents with ease

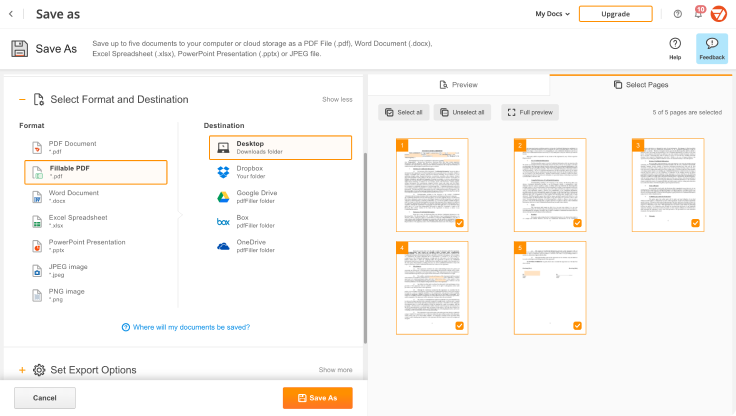

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

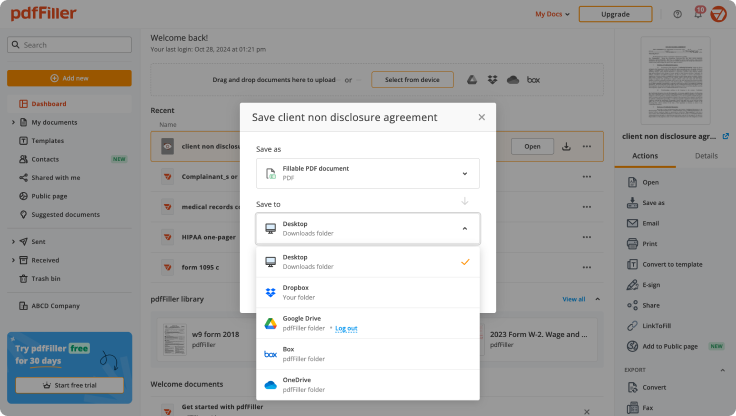

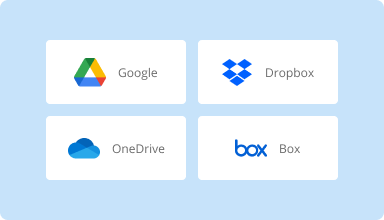

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

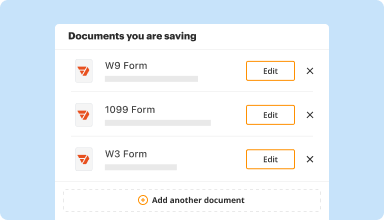

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

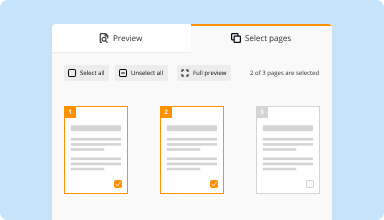

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

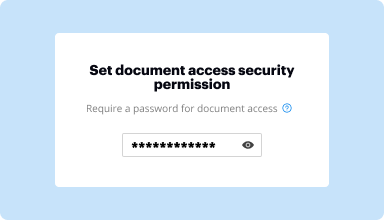

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It worked like a charm, but although I figured it would be a paid service, but it would have been nice to know it was and how much before I got started.

2014-12-31

I'm going with the default you had.

"Works exactly as expected. Smooth, responsive, and intuitive interface."

That about sums it up. It was so obvious on how to edit text, increase it's size, move it around (great feature!), add checkmarks and Xs.

All around just very good.

2016-02-18

Absolutely fantastic program with all…

Absolutely fantastic program with all the tools you need to edit PDFs. Really impressed with the customer service too! Very helpful and efficient!! 10/10!!

2020-04-15

Good

The accessibility is great and the look of the forms ones the user completes it is superb.

Accessibility is great and the convenience is amazing. I would recommend this to anyone in a business setting.

The monthly cost, but I like the fact that you can renew at any time. This program is cheaper when you pay for multiple months.

2017-11-20

Very effective tool that enables me to upload and mark students PDF assessments. I would love to learn more to speed up the process further and have some questions re adding colour to symbols i.e. tick symbol

2024-05-04

The reason it is a four instead of a five...

The reason it is a four instead of a five is I feel like there is a strong learning curve... at least for me.

So I am still learning.

Check back with me in a month and let's see if we can delete this 4 rating and move it up to a 5!!

2023-02-20

I was having issues with billing as I don't remember when & which account I used for registration.

I was having issues with billing as I don't remember when I registered this account. CSE Dee was very helpful and managed to assist me accordingly. Keep up your good service. My issue is resolved now and really appreciate it. Thank you :)

2021-11-29

PdfFiller helped me to edit and fill in…

PdfFiller helped me to edit and fill in my work documents quite easily! It has made my day! Thanks.

2021-01-11

Handy service. Swift support. I am amazed

Let me share with you my experience frankly. I needed to edit a one single pdf document. Found this service. Registered for a free trial. Edited the document swiftly and smoothly. And forgot about it. Till the moment I received a charge for the yearly subscription. Which, admittedly, is not low at all (though may be reasonable to those who use this service).Anyway, I contacted pdfFiller support team, and I was surprised by both: 1) the fact that they immediately agreed to issue a refund, as it met their policy (I canceled in less than 24 hours, actually, immediately) 2) that even though they told that I will receive the money back within 1-5 business days - I got it within a few minutes. I am perplexed. The only pity really is that I can't afford it

2020-12-23

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can I do a 1040EZ online?

Although you will have to calculate your taxes yourself, the IRS allows you to e-file the forms at no charge but you must create an online account with the IRS in order to do so. For more information about this and other tax topics, visit TurboTax.com.

How can I get my tax return from a PDF?

You can also order tax return and account transcripts by calling 800-908-9946 and following the prompts in the recorded message, or by completing Form 4506-T, Request for Transcript of Tax Return or Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript and mailing it to the address listed in the

Is EZ tax return legit?

ezTaxReturn has been an Authorized IRS e-file Provider for 21 years and has successfully e-filed millions and millions of federal and state tax returns.

How do I download my tax documents?

Order online. Use the 'Get Transcript tool available on IRS.gov. There is a link to it under the red TOOLS bar on the front page.

Order by phone. The number to call is 800-908-9946.

Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

Is there a 2019 1040 EZ form?

The simplest of the three tax forms you can use to file your federal income taxes is the IRS 1040EZ form. For tax years beginning 2018 (the tax return you submit in 2019), the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms.

Can I download my tax returns?

An official from the United States Department of the Treasury announced today that Americans can now download their tax returns directly from the IRS from the new service Get Transcript.

Can you print a 1040EZ form online?

To access online forms, select “Individuals” at the top of the IRS website and then the “Forms and Publications” link located on the left-hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

#1 usability according to G2

Try the PDF solution that respects your time.