How To Modify Currency Contract Online For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Last updated on

Nov 13, 2024

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

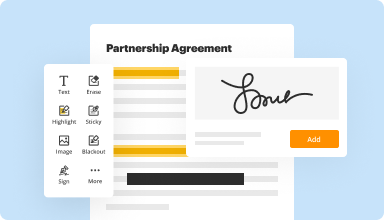

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

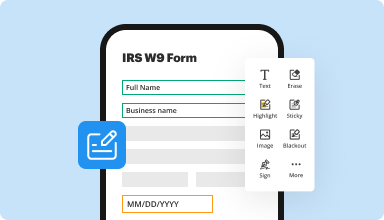

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

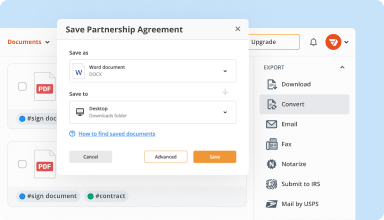

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

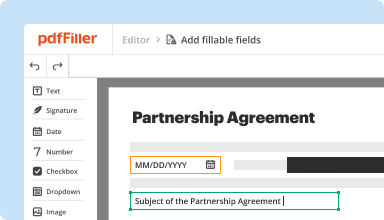

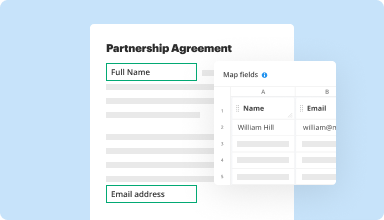

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

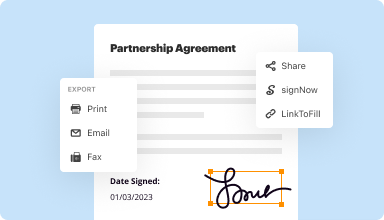

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

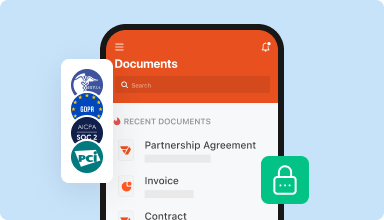

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

This application is users friendly and easy to use. Great product. The only thing missing for my agency's purpose is the attachment part. If the attachment features is add to it, this would be awsome.

2015-11-06

Need to have more option to edit a document, like Microsoft Word.

When editing a document, there needs to be page breaks added. it appears as one long document until you go to turn it into a PDF where it is then broken into pages. It is impossible to get the spacing right since you have to go back and forth with the document.

2017-07-26

I would prefer that the fill in templates be free of charge. The one used is great and I would hope to find another one as such. Easy to use formatting and site.

2018-03-23

I loved using the program. It helped on saving paper while allowing to update documents without having to print, use white out, and scan the updated document. It was really the only feature I used, but i know there was so much more to the program. I would love if they created a pay option that was cheaper than basic or reduced the price of basic for those of us who just need it for one or two functions. It was very easy to use and i wish i needed it for other things. Overall still a great program and i would recommend it to anyone. I am only giving it 4 stars due to me just not needing it for a whole lot.

2020-03-31

He tenido una buena experiencia, pero lo único a mejorar que al realizar cualquier modificación queden alineados al texto, ya que al guardar el documento se pierde.

2024-05-05

Spelling assistance

The spelling check assistance is not very effective. It is difficult to predict where the cursor must be placed for the correction suggestions to pop up.

2021-07-26

I had to fill an application and I really loved being able to type my thoughts. The other features seem great too, like the circle for multiple choice questions was cool too.

2021-07-04

Useful and handy website

Useful and handy website! Excellent customer service, very kind and helpful. Would highly recommend for all your PDF needs.

2021-01-12

What do you like best?

I love the fact that we can collect uploads AND money through filled PDFS

What do you dislike?

The entire site is very confusing and we have a hard time understanding where our active sheets are located within the site. We see things like "documents" and then we make a new template ... then lose which template is live and which one isn't. I also don't care for the fact that we cannot choose to have ZERO color in the field that the customer sees for filling in and I would love to be able to disable the "lock to grid" feature that is clearly on at all times.

Recommendations to others considering the product:

I recommend reading through the site, reading through all the tutorials you can and getting very organized about what you are going to do before getting started.

What problems are you solving with the product? What benefits have you realized?

We no longer have to deal with faxing our documents to customers to fill out, sign and fax back. We just tell them to go to our website . They are also so much more likely to complete the entire process including sending us pictures that we require and we no longer lose the pictures or get confused as to where everything is.

2020-08-07

How-to Guide

How to Modify Currency Contract:

01

Upload your document to pdfFiller

02

Select the Modify Currency Contract feature in the editor`s menu

03

Make the necessary edits to the document

04

Click the “Done” orange button in the top right corner

05

Rename the document if necessary

06

Print, download or email the document to your computer

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is currency option contract?

A currency option (also known as a forex option) is a contract that gives the buyer the right, but not the obligation, to buy or sell a certain currency at a specified exchange rate on or before a specified date.

How does a currency futures contract work?

An FX futures or currency futures contract is a type of foreign exchange derivative, where a buyer agrees to buy one currency in exchange for another currency, at a future date and at a current agreed upon price by both buyer and seller at the moment of creating the contract.

What is a currency futures contract?

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price (exchange rate) that is fixed on the purchase date; see Foreign exchange derivative.

What is a currency contract?

A currency forward contract is an agreement between two parties to exchange a certain amount of a currency for another currency at a fixed exchange rate on a fixed future date. By using a currency forward contract, the parties are able to effectively lock-in the exchange rate for a future transaction.

What are currency futures and options?

Currency futures and options are derivative contracts. These contracts derive their own values from utilization of the underlying assets, which, in this case, are currency pairs. Currencies are always traded in pairs. For example, the Euro and U.S. Dollar pair is expressed as EUR/USD.

Is futures the same as forex?

Futures. Forex is considered to be an individual class of assets that can be bought and sold directly, like equities, commodities and bonds. However, futures are a derivative trading instrument, meaning their value is based on the value of another asset known as the “underlying” asset.

How are currency futures settled?

Currency futures are standardized contracts that trade on centralized exchanges. These futures are either cash settled or physically delivered. Cash-settled futures are settled daily on a mark-to-market basis. As the daily price changes, the differences are settled in cash until the expiration date.

How do you trade currency futures?

To open a currency futures trade, the trader must have a set minimum amount of capital in their account, called the margin. There are many currency futures contracts to trade, and specifications for each one should be checked on the exchange website before trading it.

Video Review on How to How To Modify Currency Contract Online

#1 usability according to G2

Try the PDF solution that respects your time.