Import TAX12 to PDF with pdfFiller

How to Import TAX12 to PDF

To effortlessly convert TAX12 files into PDF format, upload your TAX12 document to pdfFiller, select the 'Convert to PDF' option, and download the resulting PDF. This process streamlines managing your tax documents while maintaining security and accessibility.

What is TAX12?

TAX12 is a specific file format used primarily for tax-related document submissions and records, particularly in contexts where detailed financial documentation is required. It often contains structured data, such as income information, deductions, and credits, which need to be accurately maintained in any conversions.

What is a PDF?

PDF (Portable Document Format) is a versatile file format developed by Adobe that allows users to present documents, including text and images, in a manner independent of application software, hardware, and operating systems. This ensures that the document appears the same on every device and is widely used for sharing and archiving important documents.

Why might you need to import TAX12 to PDF?

Converting TAX12 files to PDF provides numerous benefits, such as improved compatibility with various software, enhanced security features for sensitive data, and ease of sharing with clients or auditors. PDF files maintain necessary formatting and are a common requirement for official document submissions.

-

Standardized format ensures consistency across various devices.

-

PDFs can be secured with passwords and encryption.

-

Easy to share and print without altering the content.

-

Widely accepted format for official documentation and audits.

-

Large data files can be compressed without losing quality.

Typical use-cases and industries relying on importing TAX12 to PDF

Various individuals and organizations benefit from the ability to convert TAX12 files to PDF. Tax professionals, accountants, and businesses frequently require such functionality to comply with regulations and improve documentation efficiency.

-

Tax professionals create documents for client communication.

-

Businesses prepare tax documents for audits.

-

Individuals maintain organized personal tax records.

-

Educational institutions standardize tax forms for students.

-

Accountants utilize PDFs to streamline paperwork and reduce clutter.

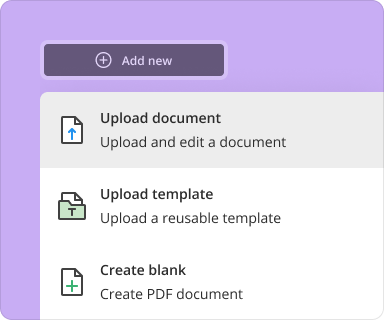

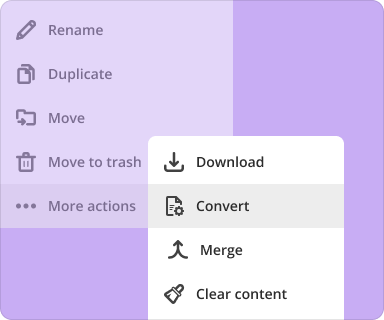

How to import TAX12 to PDF with pdfFiller: step-by-step guide

Importing TAX12 to PDF with pdfFiller is a straightforward process that ensures high-quality conversions. Follow these steps to successfully convert your files:

-

Access pdfFiller from any browser with an internet connection.

-

Upload your TAX12 file using the upload button.

-

Select the 'Convert to PDF' option from the dropdown menu.

-

Review the converted file for accuracy and formatting.

-

Download the PDF version of your TAX12 file.

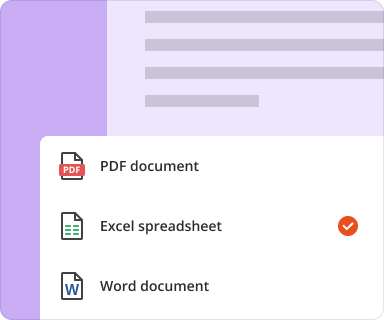

What file formats are supported for conversion on pdfFiller?

pdfFiller supports a range of file formats for conversion, ensuring versatility in managing your documents. When it comes to importing TAX12 files, users can rely on the following formats:

-

CSV—ideal for structured data.

-

Excel files—commonly used for financial records.

-

Word documents—useful for creating text-heavy forms.

-

Plain text files—basic text formatting.

-

Images—allowing scans of tax documents to be converted.

How to manage batch and large-volume imports of TAX12 to PDF

pdfFiller is designed to handle batch processing effectively, enabling users to convert multiple TAX12 files in one go. This is essential for businesses that deal with a high volume of documents regularly.

-

Select multiple TAX12 files using the upload interface.

-

Initiate the batch conversion process with a single command.

-

Monitor progress through the pdfFiller dashboard.

-

Download all converted PDFs at once.

How to maintain quality and formatting during import of TAX12 to PDF

To ensure your TAX12 files retain their quality and formatting during conversion, follow these best practices:

-

Avoid excessive use of complex formatting in your TAX12 files.

-

Review the PDF output for any discrepancies post-conversion.

-

Utilize pdfFiller’s preview functionality before finalizing downloads.

-

Consider using high-resolution documents for better quality.

-

Edit and correct any formatting issues within pdfFiller after conversion.

How does pdfFiller compare with other conversion tools?

When considering PDF conversion tools, pdfFiller stands out for its user-focused design and robust features. Below is a comparison with other common tools:

-

User experience—pdfFiller offers a more intuitive interface.

-

Security—pdfFiller ensures secure data handling with encryption.

-

Versatility—supports more file formats beyond TAX12, including images and text files.

-

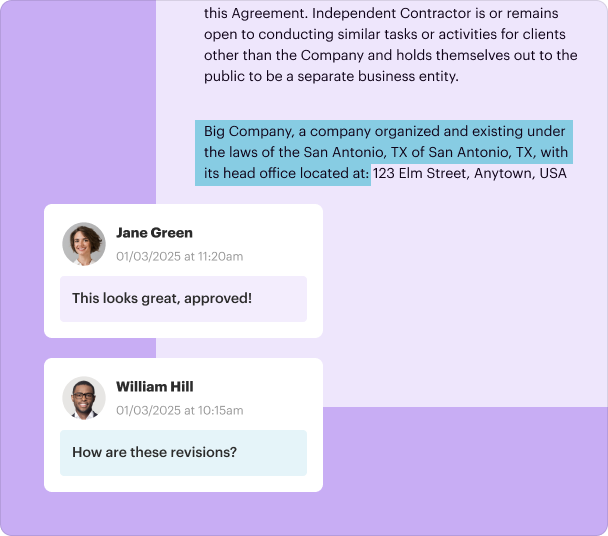

Collaboration features are built-in, making it great for team environments.

-

Customer support—pdfFiller provides extensive resources and support for users.

Conclusion

The capability to Import TAX12 to PDF with pdfFiller empowers users to manage their tax documents with efficiency and professionalism. With a streamlined conversion process, excellent support for various file formats, and features that prioritize security and organization, pdfFiller stands out as a leading platform for anyone looking to simplify document management. Experience the benefits of converting your TAX12 files to PDF today and enhance your tax documentation process.

How to convert your PDF?

Why convert documents with pdfFiller?

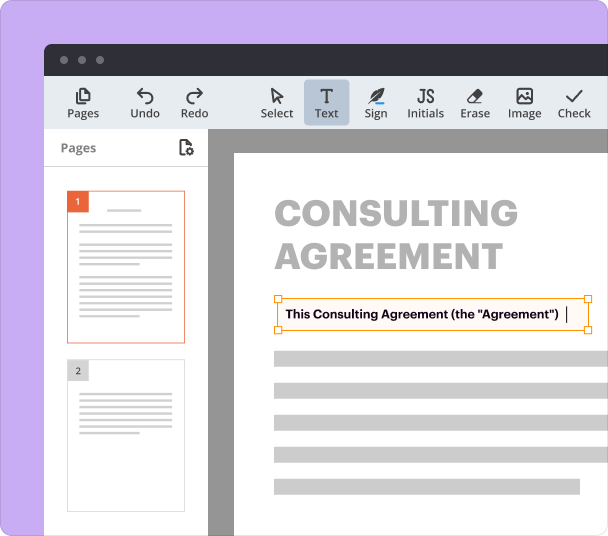

More than a PDF converter

Convert documents in batches

Preview and manage pages

pdfFiller scores top ratings on review platforms