Integrate ESign Mortgage Deed with pdfFiller

How to integrate ESign Mortgage Deed

Integrating eSign in the creation and management of mortgage deeds using pdfFiller allows for quick, secure, and legally compliant signing of documents electronically. To get started, simply upload your PDF mortgage deed to pdfFiller, add your signature fields, and send it for e-signing.

What is integrating ESign Mortgage Deed?

Integrating ESign Mortgage Deed refers to the process of adding electronic signature capabilities to mortgage deed documents, allowing parties to sign and manage these documents digitally. This improves efficiency, reduces paper waste, and speeds up the entire mortgage process.

Why integrating ESign Mortgage Deed is critical for modern document workflows

The modern landscape of document management requires a shift toward digital solutions, and integrating eSignatures in mortgage deeds is essential. Not only does it facilitate faster turnaround times for document approvals, but it also enhances security by ensuring that signed documents remain tamper-proof and easily verifiable.

Use-cases and industries that frequently integrate ESign Mortgage Deed

Several industries benefit from digitally signing mortgage deeds. Primarily, the real estate sector recognizes the need for speed and efficiency. Finance and banking industries also leverage this technology to expedite client onboarding and loan approvals, leading to improved customer satisfaction.

-

Real Estate Transactions: Streamlining buyer-seller interactions.

-

Banking: Facilitating loan processing and approvals.

-

Legal Services: Ensuring compliance with e-signature laws.

Step-by-step: how to integrate ESign Mortgage Deed in pdfFiller

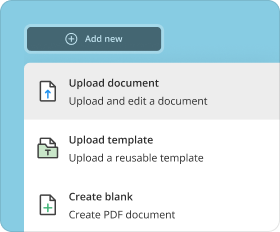

To integrate eSign functionality into your mortgage deed using pdfFiller, follow these steps:

-

Log into your pdfFiller account and upload your mortgage deed PDF file.

-

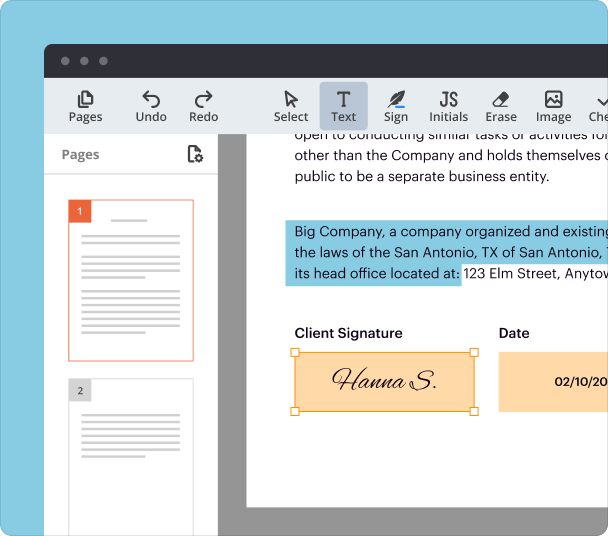

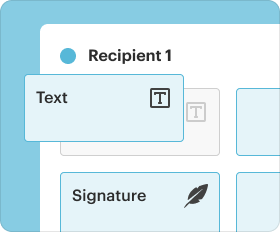

Select the 'eSign' option to add signature fields to your document.

-

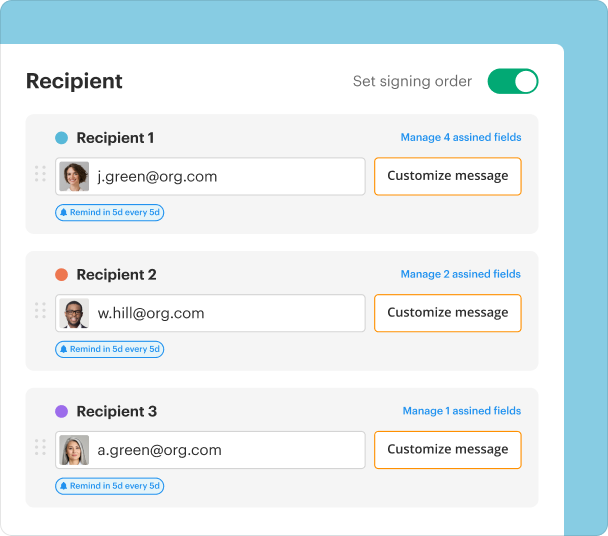

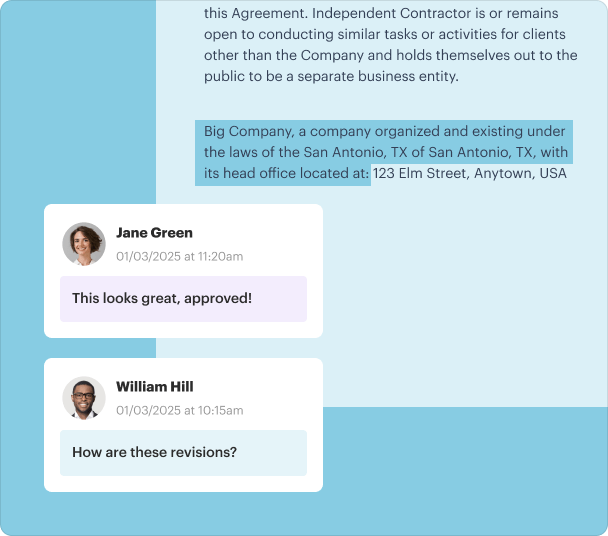

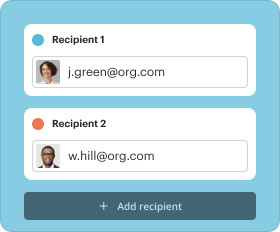

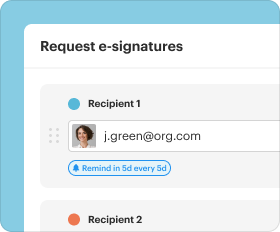

Add the recipients' email addresses and define their signing roles.

-

Customize the email notification and send the document for e-signing.

-

Once all parties have signed, download the completed document and store it securely.

Options for customizing signatures, initials, and stamps when you integrate ESign Mortgage Deed

pdfFiller allows users to personalize their signatures and initials when integrating eSignatures into mortgage deeds. Users can upload their own signatures, choose from various pre-designed styles, and incorporate date stamps for added authenticity.

Managing and storing documents after you integrate ESign Mortgage Deed

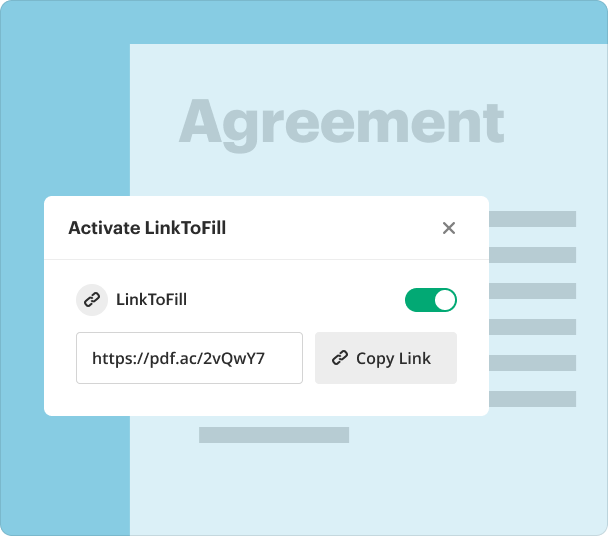

Following the successful integration and signing of your mortgage deed, pdfFiller offers robust document management tools. Users can organize, retrieve, and share signed documents with ease, ensuring that all important paperwork is stored securely in the cloud.

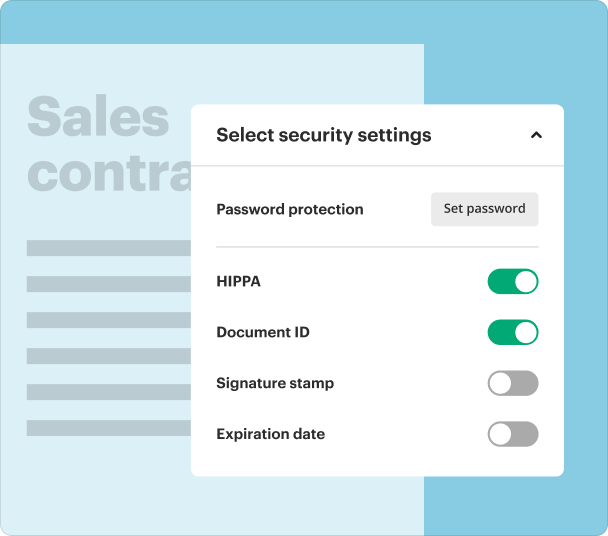

Security, compliance, and legal aspects when you integrate ESign Mortgage Deed

Security is a top priority when integrating eSignatures into mortgage documents. pdfFiller adheres to stringent compliance standards, ensuring that all signed documents are legally binding and secure. With features like encryption and authentication measures, users can trust that their important documents are protected.

Alternatives to pdfFiller for integrating ESign Mortgage Deed workflows

While pdfFiller provides a comprehensive eSigning solution, other platforms may offer varying features. Alternatives such as DocuSign and Adobe Sign are popular choices, although they may not always match pdfFiller's user-friendly interface and integrated document management.

-

DocuSign: Well-known, expansive feature set but may be pricier.

-

Adobe Sign: Industry standard with robust verification, less focused on document creation.

-

HelloSign: User-friendly but lacks some advanced features.

Conclusion

Integrating ESign Mortgage Deed with pdfFiller transforms how individuals and organizations manage their document workflows. With streamlined processes, enhanced security, and user-friendly features, pdfFiller positions itself as a leader in e-signature solutions. Embrace this digital shift and simplify your mortgage documentation today.

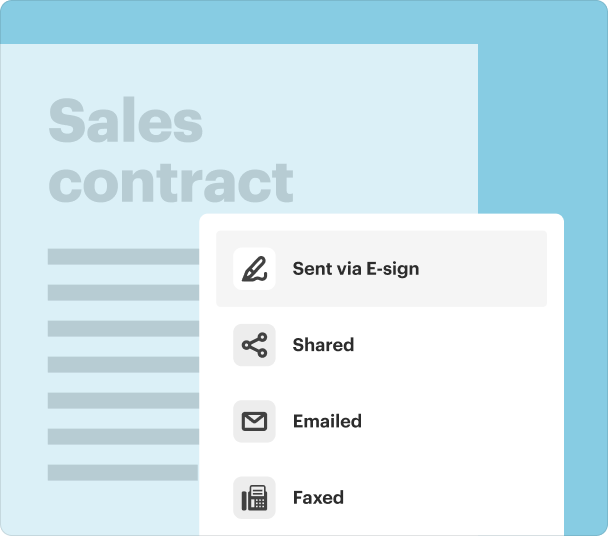

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms