Lay Payment Record For Free

Discover the simplicity of processing PDFs online

Every PDF tool you need to get documents done paper-free

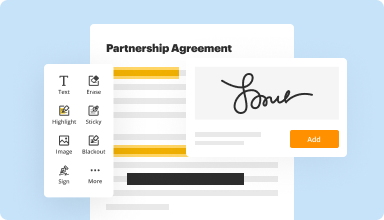

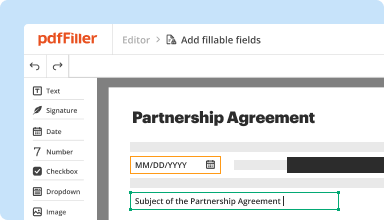

Create & edit PDFs

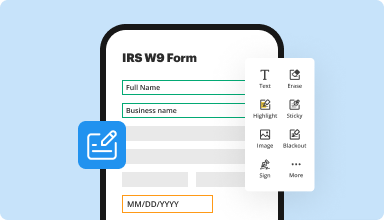

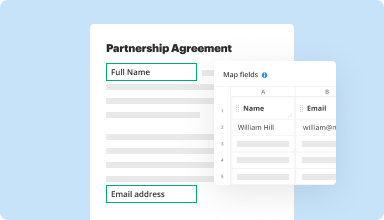

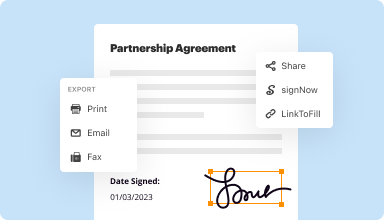

Fill out & sign PDF forms

Organize & convert PDFs

Collect data and approvals

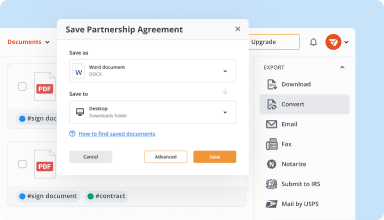

Export documents with ease

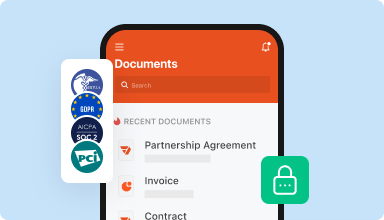

Store documents safely

Customer trust by the numbers

Why choose our PDF solution?

Cloud-native PDF editor

Top-rated for ease of use

Industry-leading customer service

What our customers say about pdfFiller

Lay Payment Record Feature Description

The Lay Payment Record feature simplifies how you manage and track your payments. This tool provides an organized way for you to document every transaction, ensuring that you always have a clear view of your financial commitments. Whether you're managing personal expenses or business transactions, this feature supports you in keeping everything in order.

Key Features

Potential Use Cases and Benefits

You might wonder how this feature can solve your problems. With the Lay Payment Record feature, you eliminate the hassle of lost receipts and forgotten payments. It offers a straightforward solution to keep your finances in check. As a result, you can save time, reduce stress, and make informed financial decisions. This tool empowers you to take control of your payment history, ensuring you never miss a deadline again.

For pdfFiller’s FAQs

#1 usability according to G2