Move Electronically Signed Annual Report Template – Foreign For Profit with pdfFiller

What does it mean to Move Electronically Signed Annual Report Template – Foreign For Profit?

Moving an Electronically Signed Annual Report Template – Foreign For Profit refers to the process of managing, distributing, and storing legal documents that have been electronically signed. This involves ensuring compliance with various regulatory standards while keeping track of modifications and preserving document integrity. In today’s digital landscape, using a structured template for such reports not only improves efficiency but also enhances collaboration among stakeholders.

Why Moving Electronically Signed Annual Reports is critical for modern document workflows

The importance of moving electronically signed documents such as annual reports cannot be overstated. It streamlines the documentation process, ensures timely compliance with regulatory requirements, and significantly reduces the likelihood of errors. Additionally, transitioning to a digital workflow enhances security, reduces storage needs, and facilitates easier access to important information whenever required.

Use-cases and industries that frequently Move Electronically Signed Annual Reports

Various industries benefit from utilizing electronically signed annual report templates. Key fields include:

-

Corporate sector for compliance reporting.

-

Financial institutions to ensure regulatory compliance.

-

Non-profit organizations for transparent reporting.

-

Consulting firms to streamline client reporting processes.

Step-by-step: how to Move Electronically Signed Annual Report Template – Foreign For Profit in pdfFiller

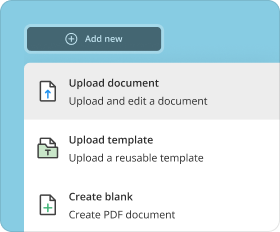

To effectively move your electronically signed annual report template in pdfFiller, follow these simple steps:

-

Log in to your pdfFiller account.

-

Upload the annual report template you wish to work with.

-

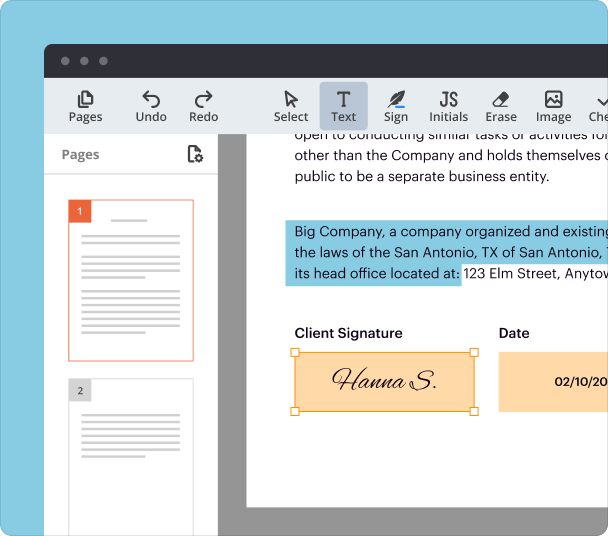

Use the editing tools to make necessary modifications.

-

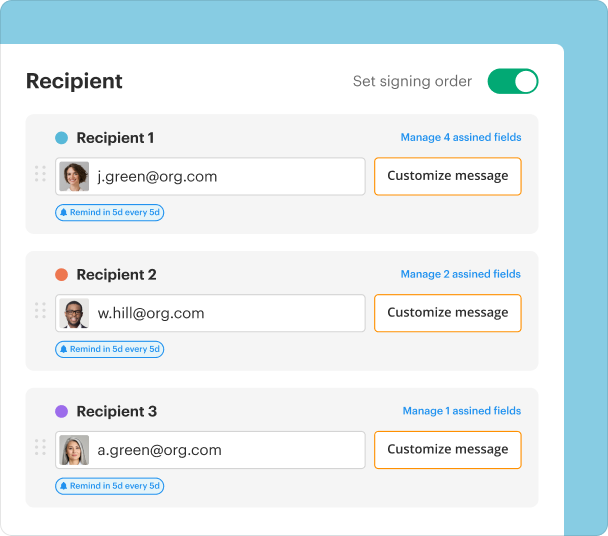

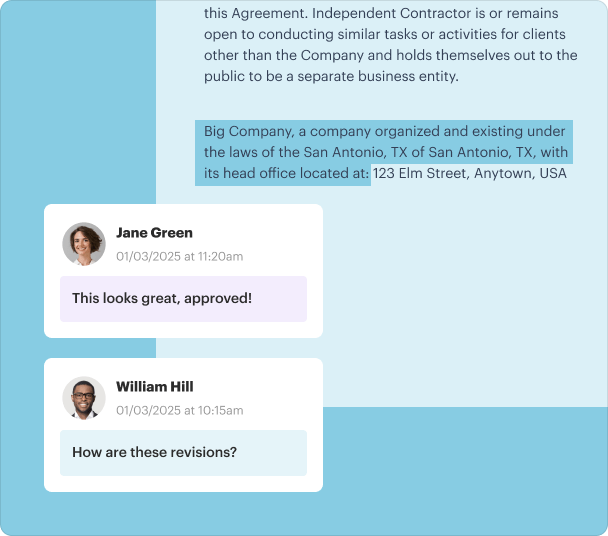

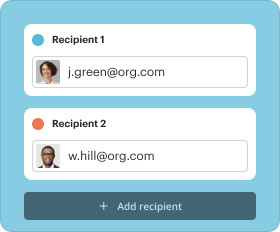

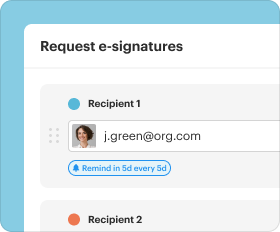

Send the document for electronic signing by entering the email of the recipient.

-

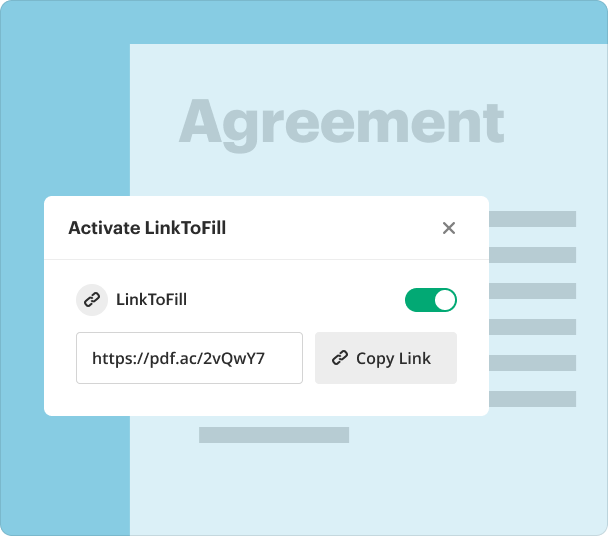

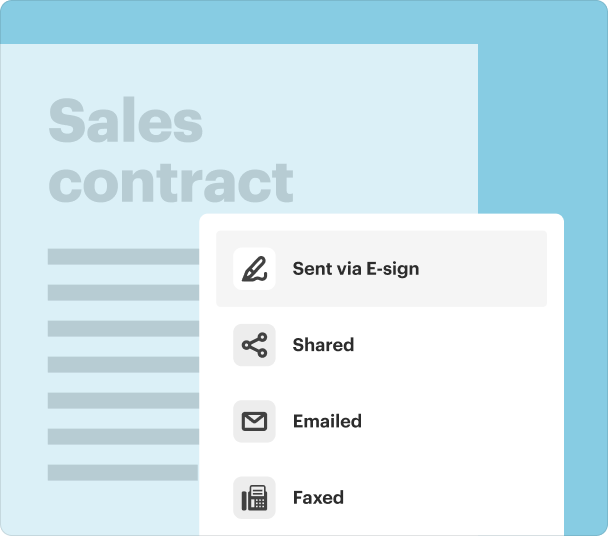

Once all signatures are collected, download or share the final document.

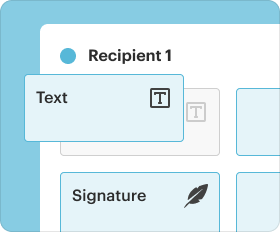

Options for customizing signatures, initials, and stamps when you Move Electronically Signed Annual Report Template

pdfFiller provides various options to customize the signing process, including, but not limited to:

-

Customizable e-signatures allowing for unique styles.

-

Initials that can be inserted quickly without hassle.

-

Stamp options including logos and official seals.

Managing and storing documents after you move Electronically Signed Annual Reports

After successfully moving and storing your annual report template, managing the document is crucial for future access and legal compliance. Options to consider include:

-

Organizing documents into folders based on projects or years.

-

Utilizing tags for quick retrieval and search functionality.

-

Setting access permissions for team members.

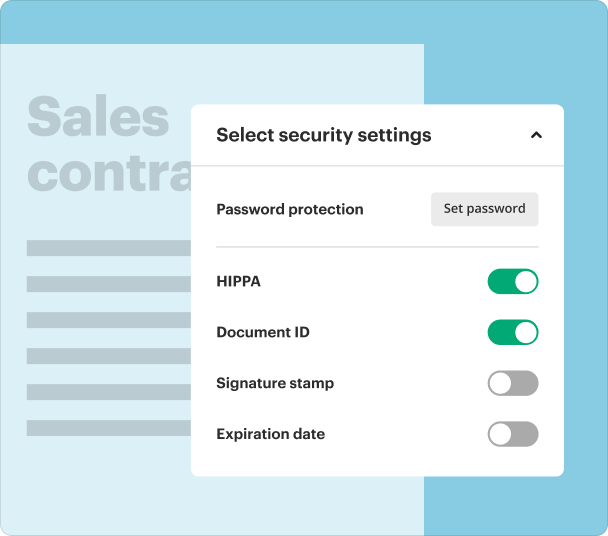

Security, compliance, and legal aspects when you Move Electronically Signed Annual Reports

When dealing with electronically signed documents, security and compliance are paramount. pdfFiller ensures:

-

Encryption of documents in transit and at rest.

-

Compliance with e-signature regulations such as ESIGN and UETA.

-

Audit trails for tracking document changes and signers.

Alternatives to pdfFiller for Moving Electronically Signed Annual Reports

While pdfFiller offers comprehensive features, there are alternatives available that cater to different needs, including:

-

DocuSign: Focused primarily on e-signature services.

-

Adobe Sign: Integrated with Adobe products for editing.

-

HelloSign: User-friendly interface for simple document signing.

Conclusion

Moving Electronically Signed Annual Report Template – Foreign For Profit is essential for maintaining streamlined, compliant, and efficient document workflows in today’s digital environment. pdfFiller not only fosters easy document customization and e-signing but also ensures secure storage and management of your important files. By leveraging its full array of features, users can enhance productivity while navigating the complexities of corporate reporting.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms