Ratify Electronically Signed VAT Invoice Template with pdfFiller

What does it mean to ratify electronically signed VAT invoice template?

Ratifying electronically signed VAT invoice templates refers to the process of affirming and finalizing a document that has been digitally signed, ensuring its authenticity and compliance with relevant tax regulations. This process is crucial in modern business environments, particularly for transactions that require formal acknowledgment of services or goods rendered.

Why ratifying is critical for modern document workflows?

Ratifying VAT invoices electronically enhances efficiency, reduces paperwork, and minimizes delays in tax processing. With digital signatures recognized legally, businesses can streamline approvals and maintain compliance more easily than traditional paper-based methods.

Use cases and industries that frequently ratify electronically signed VAT invoices

Several industries benefit from electronically ratified VAT invoices, including finance, consulting, and e-commerce. For instance, freelance consultants sending out invoices need quick validations for their records, while retail companies must ensure customer transactions comply with VAT regulations.

-

Freelancers: Quick processing of client invoices.

-

E-commerce businesses: Efficient transaction management.

-

Consulting firms: Streamlined billing processes.

Step-by-step: how to ratify electronically signed VAT invoice template in pdfFiller

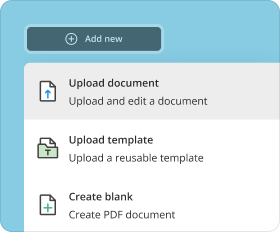

To ratify an electronically signed VAT invoice template using pdfFiller, follow these steps:

-

Log in to your pdfFiller account.

-

Upload your VAT invoice template.

-

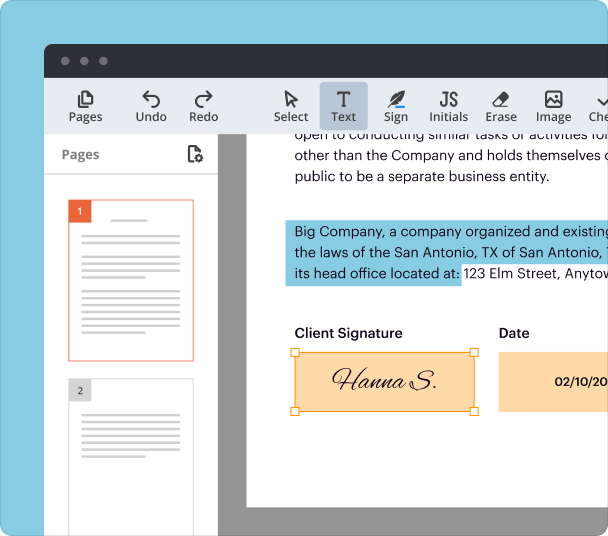

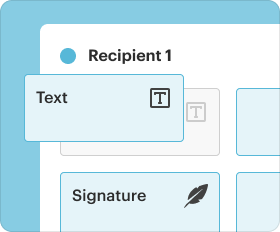

Add the electronic signature using the eSignature tool.

-

Review the invoice to confirm accuracy.

-

Click 'Ratify' to finalize the document.

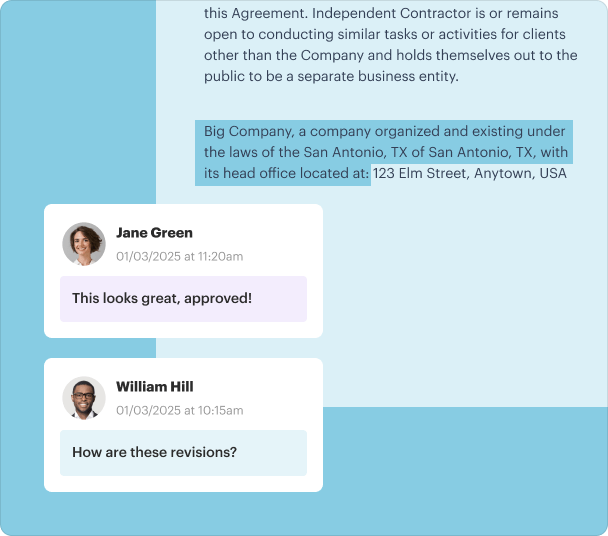

Options for customizing signatures, initials, and stamps when you ratify

pdfFiller offers various customization options for signatures and stamps, allowing you to maintain branding and ensure authenticity. You can create and save personalized signatures, initials, and stamps to represent your business clearly.

Managing and storing documents after you ratify

Upon ratification, managing and storing invoices is essential for future reference and compliance audits. pdfFiller's cloud storage enables you to organize documents in folders, tag them with relevant keywords, and easily retrieve them when needed.

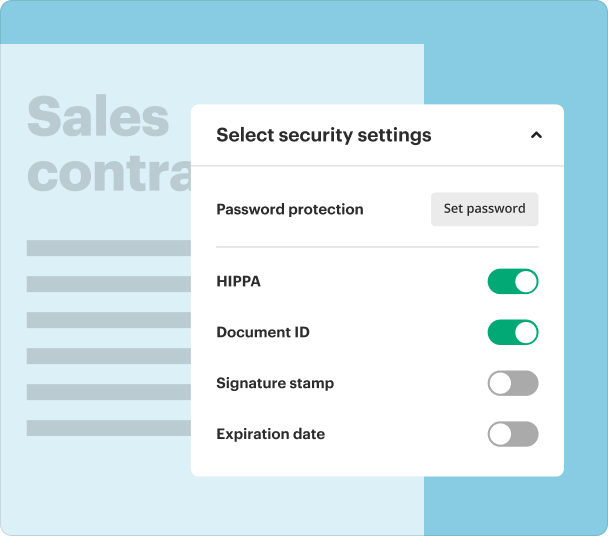

Security, compliance, and legal aspects when you ratify

When ratifying VAT invoices electronically, security and compliance with data protection regulations are vital. pdfFiller implements industry-standard security protocols to safeguard your documents and ensure that electronic signatures meet legal requirements.

Alternatives to pdfFiller for ratifying workflows

While pdfFiller is designed for ease of use, various alternatives exist that also support electronically signed VAT invoices. Popular options include DocuSign and Adobe Sign, which offer similar functionalities but have different pricing structures and user experiences.

Conclusion

Ratifying electronically signed VAT invoices is an essential part of modern business practices. Implementing a tool like pdfFiller not only streamlines this process but also increases efficiency and compliance with tax laws. Explore pdfFiller today to enhance your document management capabilities.

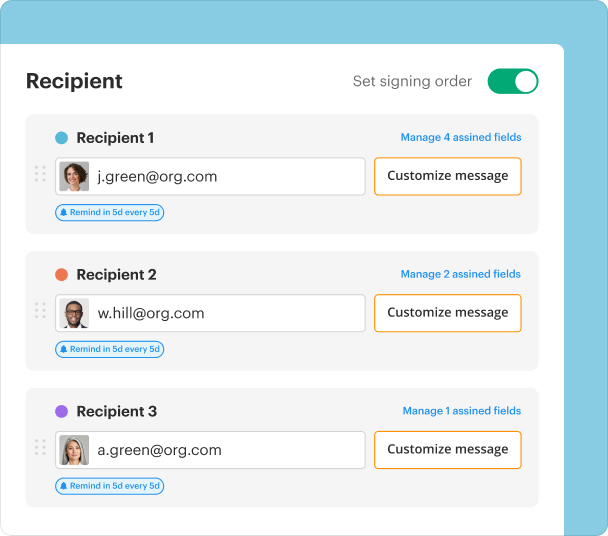

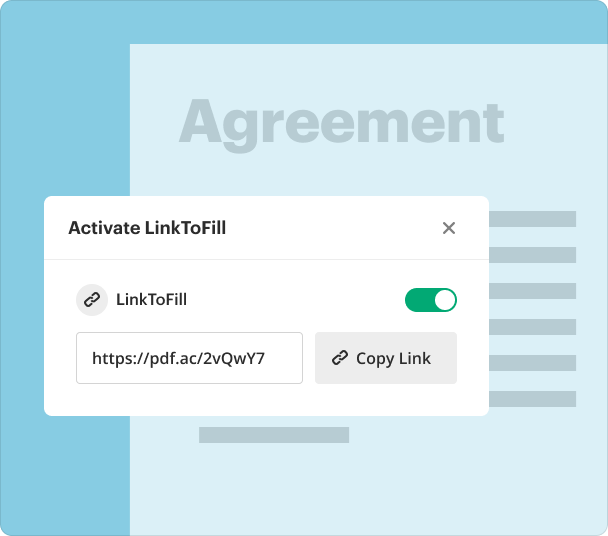

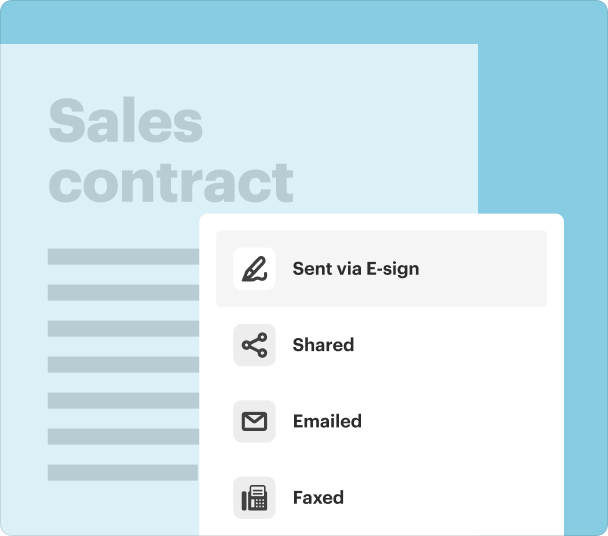

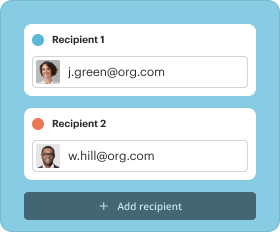

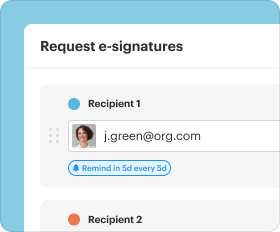

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms