Ratify Signed Electronically Insurance Plan with pdfFiller

How do you ratify a signed electronically insurance plan?

To ratify a signed electronically insurance plan, use pdfFiller to easily e-sign documents. Start by uploading your insurance plan PDF, then utilize the e-signature feature to input your electronic signature. Finally, save and share the ratified document as needed, ensuring compliance with all legal requirements.

What is a ratified signed electronically insurance plan?

A ratified signed electronically insurance plan refers to an insurance document that has been electronically signed and approved by the relevant parties, establishing its validity without the need for physical signatures. This process properly fulfills the legal requirement for consent and approval while ensuring efficiency and ease of access.

Why is ratifying an electronically signed insurance plan critical for modern document workflows?

Ratifying electronically signed insurance plans significantly streamlines workflows, reduces processing time, and minimizes manual handling. This digitization helps eliminate errors and boosts overall productivity, which is especially vital in fast-paced industries where time is crucial.

What are typical use-cases and industry applications for electronically ratified insurance plans?

Ratified electronically signed insurance plans are prevalent in various industries, including healthcare, real estate, and automotive sectors. Use cases may include the signing of policy documentation, claims processing agreements, and loan applications where insurance verification is needed.

-

Healthcare: Signing agreements for patient insurance coverage.

-

Real Estate: Confirming property insurance during transactions.

-

Automotive: Handling insurance documents for vehicle financing.

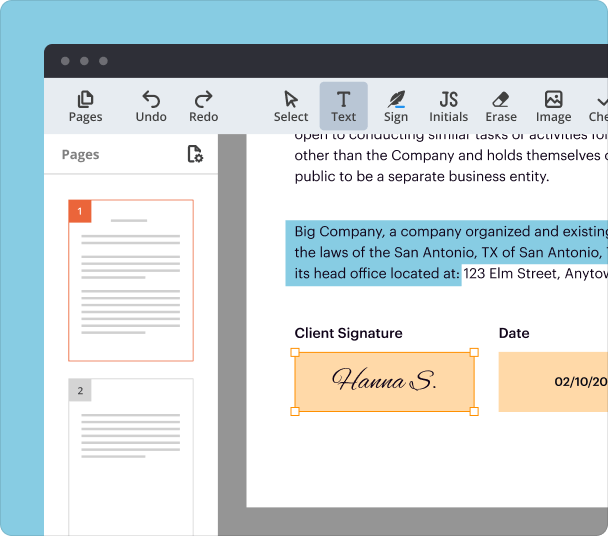

How do you work with an electronically ratified insurance plan in pdfFiller: step-by-step?

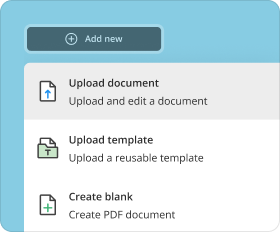

To ratify a signed electronically insurance plan in pdfFiller, follow these detailed steps:

-

Upload the insurance plan document in PDF format.

-

Navigate to the 'eSign' feature.

-

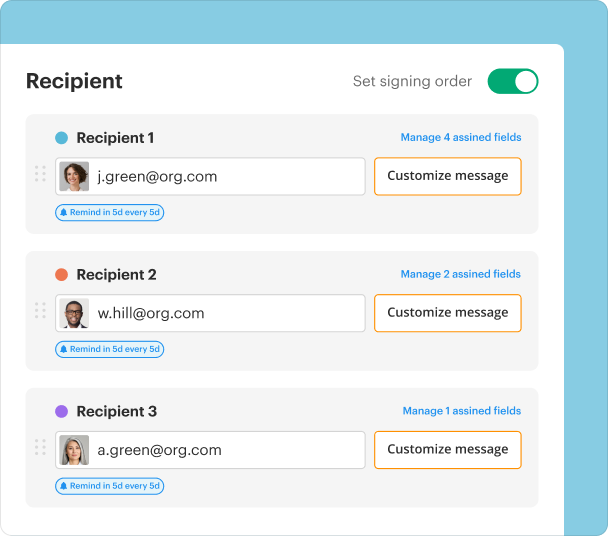

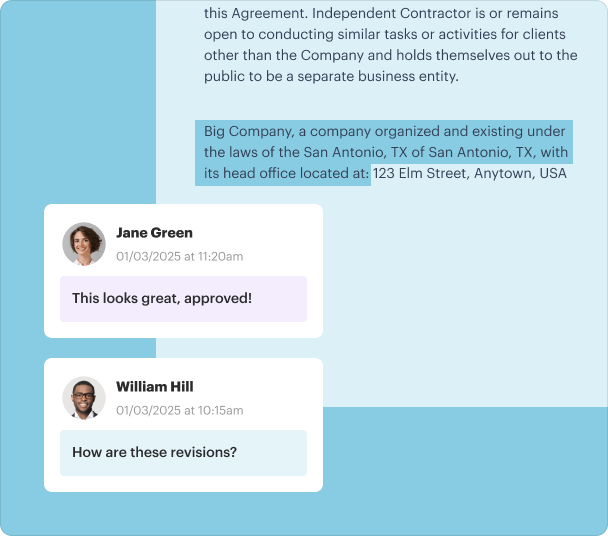

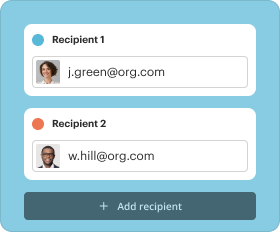

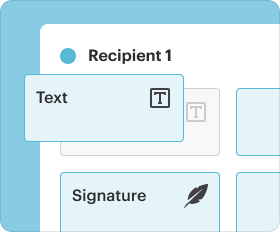

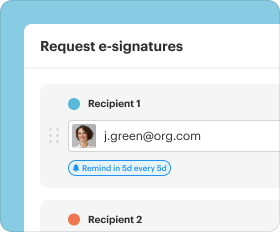

Select the recipient(s) who need to sign the document.

-

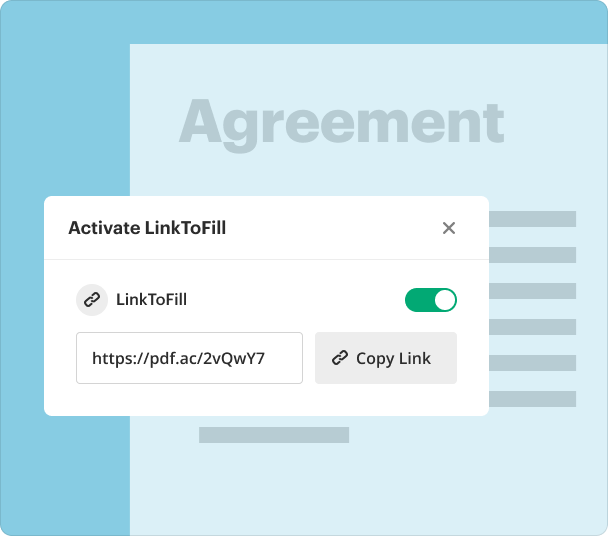

Insert your electronic signature or allow others to do so.

-

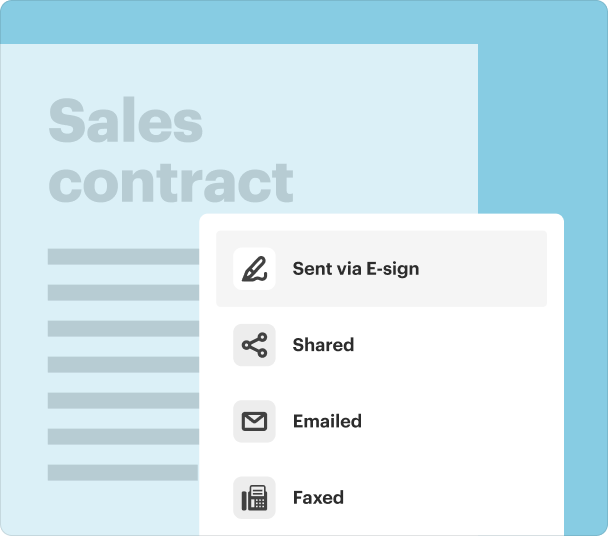

Save the ratified document and share it as necessary.

What are the customization options for signatures, initials, and stamps when ratifying?

When ratifying an electronically signed insurance plan with pdfFiller, you have various options for customizing signatures and stamps. Users can choose from different fonts, colors, and styles for their electronic signatures, as well as add initials and stamps that align with their branding.

How to manage and store documents handled by electronically signed insurance plans?

pdfFiller simplifies document management by offering cloud storage solutions. Every ratified electronic insurance plan can be easily stored and organized, allowing users to quickly locate and retrieve documents whenever needed.

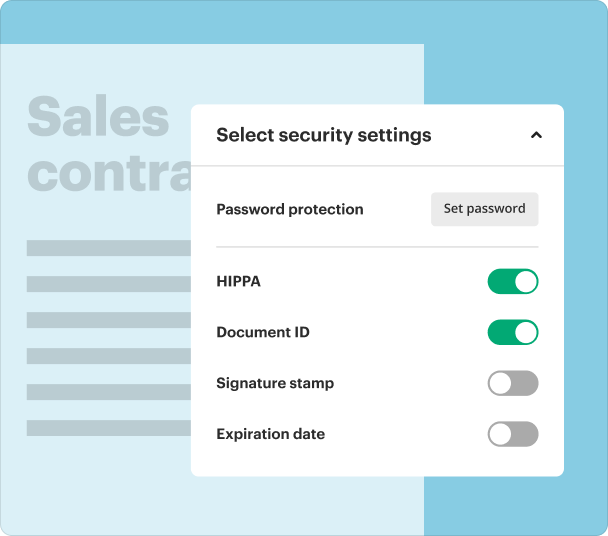

What are the security, compliance, and legal considerations for electronically ratified insurance plans?

When dealing with electronically ratified insurance plans, it is imperative to ensure that documents comply with regulations such as the ESIGN Act and UETA. pdfFiller employs robust encryption and authentication processes, thus ensuring that your documents remain secure and legally binding.

How do alternatives compare to pdfFiller for electronically ratifying insurance plans?

While there are various alternatives to pdfFiller for electronically ratifying insurance plans, pdfFiller is recognized for its user-friendly interface, advanced features, and exceptional customer support. Competitors may lack comprehensive functionalities or robust integrations that pdfFiller provides.

What is the conclusion on ratifying signed electronically insurance plans?

Ratifying signed electronically insurance plans with pdfFiller not only streamlines the document management process but also enhances efficiency, compliance, and security for users. By leveraging pdfFiller’s features, individuals and teams can ensure they meet legal requirements while enjoying the flexibility of a cloud-based platform.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms