Revise Day Settlement For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

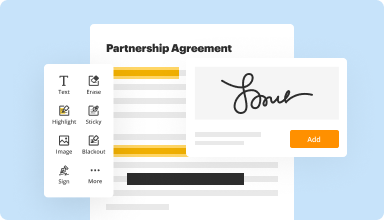

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

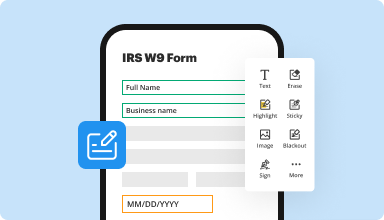

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

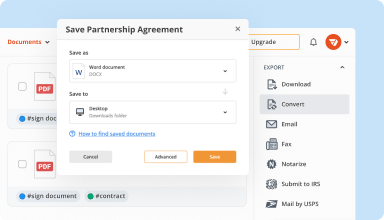

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

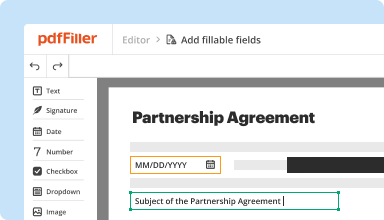

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

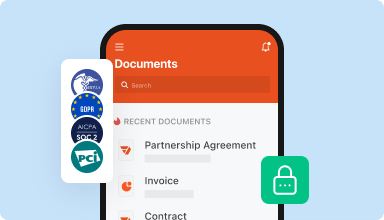

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I got confused a couple of times when using PDFfiller, but their customer support was outstanding; they immediately responded and were very helpful.

PDFfiller is a solid solution for filling out yearly tax paperwork on my Mac. I'll be using it every year now.

2015-01-20

I found PDFfiller through Goggle search after trying numerous other sites. I was pleased at how easy your site was to use, in addition to all the options and of course, the price.

2017-02-08

Easy to use, saves time

Time utilized more efficiently, forms completed with step by step guidance, simple for beginners or working late hours, most documents are available in the library, folder organization, can add signatures all in one spot.

PDF filler has a large library of documents, anyone can easily personalize templates, can prepare add signatures and finalize documents all in one step, saves time!

It does not have version history. It automatically saves all changes, however comparing to old versions has to be done through downloaded pdfs

2017-11-24

I had a surprisingly positive…

I had a surprisingly positive experience when I discovered that I had a subscription after several months of notifications being filtered into my spam folder. When I contacted the company, I received a prompt and thorough response. I wasn’t hassled or blamed; instead, I felt understood and supported. My account was canceled for me, and I was informed that I would receive a full refund. It was a great relief to be treated with such understanding. Thank you!

2024-11-11

I have very much so enjoyed this app…

I have very much so enjoyed this app much easier then any other one that i have worked with .they must have made this for dummies like me ,you cant beat it

2022-06-10

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

2022-04-05

I like the service and have been using for awhile!

I like the service and have been using for awhile. Their customer care team was really responsive through instant chat. Couldn't get a phone number for their customer service however I believe the chat service is all you need to get assistance! Kara was the representative I spoke with and she immediately understood my situation and helped me get the problems addressed with step by step processes and links. At the end she even saved me some money with the steps we took to save my old account! Definitely recommend their service and also contacting them with any question!

2021-08-05

Amazing Anna!

I was fighting with a document for two days! Anna from pdfFiller helped me via chat and she was FABULOUS!! I would have never been able to finish my document without her help! Thank you!

2021-01-22

I AM LEARNING THE PROGRAM BUT ENJOY…

I AM LEARNING THE PROGRAM BUT ENJOY THAT I CAN ADD MY SIGNATURE AND SEND OUT THE DOCUMENT VIA EMAIL OR FAX-

2020-07-16

Revise Day Settlement Feature

Introducing the Revise Day Settlement feature, a perfect solution for managing your day-to-day transactions with ease. This tool allows you to adjust your settlement dates quickly and efficiently, ensuring smooth operations and better financial planning.

Key Features

Easy date revisions for settlement transactions

User-friendly interface for quick adjustments

Automated notifications for updated settlement dates

Integration with existing financial systems

Comprehensive reporting for better oversight

Use Cases and Benefits

Adjusting settlement dates to align with cash flow needs

Streamlining transaction management for finance teams

Improving visibility into future settlements

Reducing manual errors and time spent on administration

Enhancing communication with stakeholders through automated alerts

If you face challenges with rigid settlement dates, the Revise Day Settlement feature provides a straightforward solution. By allowing you to adjust dates easily, it helps you maintain better control over your finances, reduce stress, and improve overall efficiency in your operations. With this tool in your arsenal, you can tackle shifting priorities without worry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What triggers a revised closing disclosure?

Once the Closing Disclosure is issued, the lender may issue a revised/updated Closing Disclosure in the event of a bona fide change. This event results in a change to the information provided the consumer on the initial form. A loan product change causing the disclosed information to become inaccurate. Or.

What is a revised closing disclosure?

A revised Closing Disclosure may be delivered at or before consummation reflecting any changed terms, unless: The disclosed APR becomes inaccurate. The three items are: 1) the APR becomes inaccurate (violates tolerances). 2) the addition of prepayment penalty. And, 3) a loan product change.

Can a closing disclosure be changed?

Changes After the Closing Disclosure Is Issued. Sometimes loan terms or fees change before closing, but after the lender has provided the Closing Disclosure (CD) to the borrower. If a CD has been provided then the borrower must receive a revised CD that reflects any such changes.

What happens if the closing disclosure is incorrect?

If an event occurs within 30 days after the consummation date, and that event causes the Closing Disclosure to become inaccurate in a way that results in a change to an amount actually paid by the consumer, the credit union can mail a corrected Closing Disclosure to the borrower.

What is Tried closing disclosure?

What Is TRIED? TRIED is a series of guidelines that attempt to close some of the loopholes that unscrupulous lenders have used in the past to trick consumers. TRIED rules dictate what information mortgage lenders need to provide to borrowers and when they must provide it.

What triggers a change of circumstance?

First off, a changed circumstance may involve an extraordinary event beyond anyone's control such as some type of natural disaster. A changed circumstance may also involve a situation where the lender relied on specific information to complete the loan estimate and that information later becomes inaccurate or changes.

What is a change of circumstance?

change in circumstances — Legal Definition n. A modification, usually substantial, unanticipated, and involuntary, in the emotional, financial, or physical condition of one or both parents, warranting a modification of a child custody or child support order.

Is adding a borrower a changed circumstance?

A borrower request is considered a valid changed circumstance. Besides, the loan amount went down, so that's most likely a CC too. You can issue an informational LE to a borrower at anytime. A changed circumstance only involves an increase in fees.

#1 usability according to G2

Try the PDF solution that respects your time.