Save Age Form For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

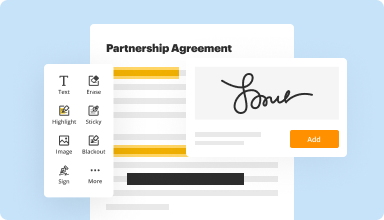

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

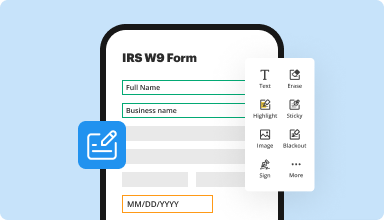

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

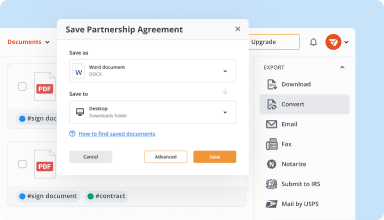

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

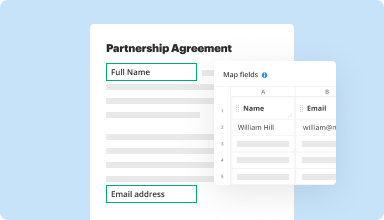

Collect data and approvals

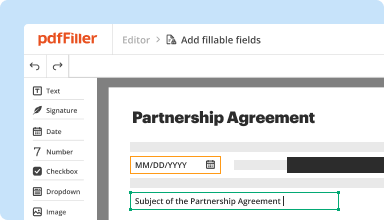

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

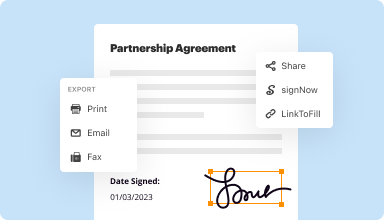

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

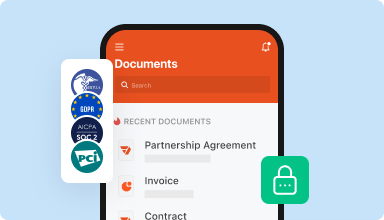

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

PDFFiller is a great tool! I have been very happy being able to fill in documents without having to print the document, then handwrite the answers on the document, so I could then scan it back in to my computer to send it off via email.

2017-05-19

I was looking for a free, easy to use program to complete documents because I have trouble with arthritis in both hands making it difficult and painful to hand/write. PDFfiller fit the bill to a T! I have already recommended it to my best friend who has job applications to complete. I highly recommend this online website for all your application/document needs.

2017-10-14

I needed a program that would allow me to auto-fill information on export documents that I am responsible for completing, and PDF fillers has given me the ability to do that. I know that PDFfiller will do a lot more than what I am aware of. I would highly recommend this site to anyone who needs almost any commercial-type document, or you can load your own document and create a pdf file and for your personal needs. I am happy that I found this site. It is just what I was looking for! 5-stars in my book!

2017-12-26

What do you like best?

PDFFILLER has been one of the best platforms I’ve used in client document transmission. The price is unmatched for the services available and the HIPAA compliance seals the deal.

What do you dislike?

The only downside is how long some forms such as registration can take to complete when adding in the initial fillable fields.

What problems are you solving with the product? What benefits have you realized?

Many of my clients are throughout the country, so the ease of securely transmitting documents while maintaining HIPAA compliance is the best problem solved. I recently discovered the ability to have documents faxed digitally through the services and it’s cut down on my physical paperwork.

PDFFILLER has been one of the best platforms I’ve used in client document transmission. The price is unmatched for the services available and the HIPAA compliance seals the deal.

What do you dislike?

The only downside is how long some forms such as registration can take to complete when adding in the initial fillable fields.

What problems are you solving with the product? What benefits have you realized?

Many of my clients are throughout the country, so the ease of securely transmitting documents while maintaining HIPAA compliance is the best problem solved. I recently discovered the ability to have documents faxed digitally through the services and it’s cut down on my physical paperwork.

2019-06-08

What do you like best?

The program is easy to use and super convenient. Your documents are always with you on the server PDFIller provides.

What do you dislike?

Getting in touch with a person in customer service is impossible and emails to cust. serv. have not been answered. I originally signed up as a single user; but then as my needs expanded at my office, I added and paid for three more users. For a while everything worked without issue, but then the other three users could not log-in and the different prompts in my dashboard were saying the subscriptions were active and to this day my office staff works through my sole account which can knock someone off in the middle of something.

What problems are you solving with the product? What benefits have you realized?

The fax benefit is awesome. I use the program with my insurance agency. It is way more user friendly than Adobe and you don't need a separate service to send a client a form to sign.

The program is easy to use and super convenient. Your documents are always with you on the server PDFIller provides.

What do you dislike?

Getting in touch with a person in customer service is impossible and emails to cust. serv. have not been answered. I originally signed up as a single user; but then as my needs expanded at my office, I added and paid for three more users. For a while everything worked without issue, but then the other three users could not log-in and the different prompts in my dashboard were saying the subscriptions were active and to this day my office staff works through my sole account which can knock someone off in the middle of something.

What problems are you solving with the product? What benefits have you realized?

The fax benefit is awesome. I use the program with my insurance agency. It is way more user friendly than Adobe and you don't need a separate service to send a client a form to sign.

2019-08-15

My subscription had expired

My subscription had expired. I was trying to reactivate my account with a discount offer that was offered to me before my account had expired. Unfortunately I couldn’t seem to figure this out. I was connected to Katrina using the live chat. She explained to me because my account had expired the offer was no longer available. She did however offer me 25% I accepted what was proposed to me. Yet again I was still having problems figuring out how to get this discount link Katrina had sent me. She eventually emailed the link to me because the computer and myself don’t see eye to eye and I can’t figure out how the thing works sometimes. Katrina was very patient and understanding. She helped me figure out my dilemma. Thank youMathieu

2021-06-02

PDFfiller was an easy and convenient service to use. I filled out my PDF no problem and saved my documents. The customer support team was extremely helpful and accommodating when I needed to change my plan. Highly recommend!

2020-06-10

Great website!!

So far I love this service! Only had some tech issues yesterday and they were addressed quick by your tech support. I love the layout, it's very easy to navigate, and the editing options on the top bar also make it super easy to check, sign, and type just about anywhere in the document. I love it!

2020-05-05

I am pleased with how easy it is to use…

I am pleased with how easy it is to use the app. The support given is great as any concerns I had were dealt with promptly and professionally.

2025-02-25

Save Age Form Feature: Simple Solutions for Everyday Needs

The Save Age Form feature is designed to streamline your data management process. This tool helps you capture vital information efficiently while offering a smooth user experience. By adopting this feature, you can enhance your workflow and keep your data organized.

Key Features

User-friendly interface that simplifies data entry

Automatic data saving to reduce the risk of loss

Flexible design to fit different forms and applications

Real-time validation to ensure accurate information capture

Potential Use Cases and Benefits

Ideal for businesses collecting customer information

Useful for event registrations and surveys

Enhances user experience on websites and applications

Saves time and minimizes errors during data collection

The Save Age Form feature addresses common challenges you face in data collection. By automating the saving process, it prevents data loss and saves you valuable time. This feature empowers you to focus on your core tasks, knowing your information is secure and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I save my age?

If your birthday passes during your application for insurance, and you become a year older, the carrier will let you lock in the price for the age you were when you initially applied by paying an increased premium. This is called Saving Age on your policy.

How much money should a 25-year-old have saved?

The quick answer to how much you should have saved by age 25 is roughly 0.5X your annual expenses. In other words, if you spend $50,000 a year, you should have at least $$15,00025,000 in savings with minimal debt. Your ultimate goal is to achieve a 20X expense coverage ratio in order to retire comfortably.

How much money does an average 24-year-old have?

The Average Salary 20-24 The median salary of 20- to 24-year-olds is $616 per week, which translates to $32,032 per year.

How much should a 28-year-old have saved?

If you are earning $50,000 by age 30, you should have $25,000 banked for retirement. By age 40, you should have twice your annual salary. By age 50, four times your salary. By age 60, six times, and by age 67, eight times. If you reach 67 years old and are earning $75,000 per year, you should have $600,000 saved.

How much money should a 20-year-old have saved?

That means that the typical 25-year-old might want to have somewhere around $10,000 in savings. Curious about where you stand? Averages for 20-somethings range widely: One median figure suggests young people have about $16,000 saved for retirement, according to a 2015 study by Transamerica.

How many savings should you have at 20?

Living expenses should be about 70% of your monthly income, debt payments (if you have any) should be about 20% of your monthly income and savings (for both long and short term goals) should take the remaining 10% of your monthly income.

How much should I have saved at my age?

According to a recent survey, 64% of Americans could potentially retire broke because they lag behind on saving. A general rule of thumb is to have one times your income saved by age 30. By age 35, you should have saved twice your income and by age 40, three times your income.

How much should a 22-year-old have saved?

If you start at 22, you will have a million dollars at 67 by saving just $35 per month. That's assuming a 10% return. If you start at 40, you'll need to save $608 per month. That's still pretty manageable, but that means more than 17 times as much money out- of-pocket each month to get to the same end result.

#1 usability according to G2

Try the PDF solution that respects your time.