Save Salary Notification For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

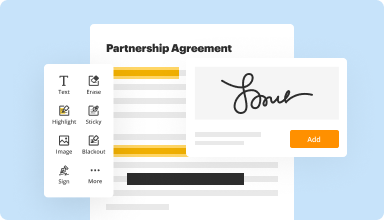

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

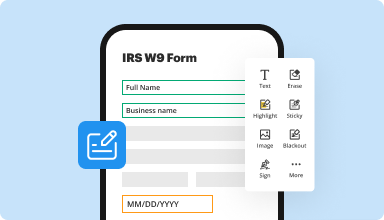

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

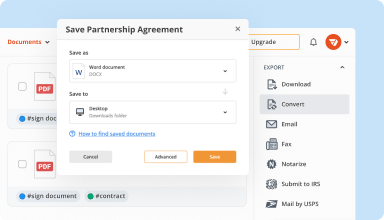

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

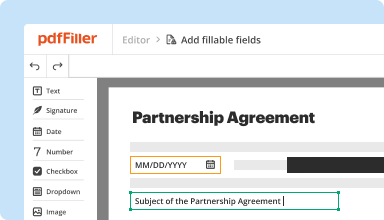

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

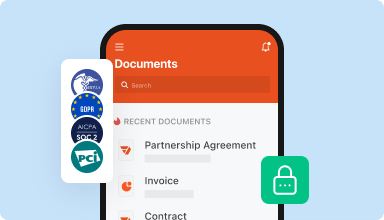

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Works OK so far. I'd like to be able to move/drag text so it is better aligned (After using it for a while I found I could make it work like I wanted it to).

It was nor intuitive; it required considerable fiddling with

2014-12-10

so far ease of use seams to be the direction this system is built on. I would love to see more controls to authorized users and an auto save feature from original templates after and before fill. over all I love how going paperless is very easy to use

2018-04-25

What do you like best?

I like the fact that you have send a document via text or email to have someone electronically sign it. I also like the fact that you can edit PDF documents! It used to be so hard to get anything done at my current job but now I can edit Bill of Laidings, Commerical invoices.... etc.

What do you dislike?

nothing! this software is truly amazing!

Recommendations to others considering the product:

Don't hesitate! You need this in your life! Its awesome for sending my drivers documents to Esign.

What problems are you solving with the product? What benefits have you realized?

over seas documents that were quite difficult to re-create or edit.

I like the fact that you have send a document via text or email to have someone electronically sign it. I also like the fact that you can edit PDF documents! It used to be so hard to get anything done at my current job but now I can edit Bill of Laidings, Commerical invoices.... etc.

What do you dislike?

nothing! this software is truly amazing!

Recommendations to others considering the product:

Don't hesitate! You need this in your life! Its awesome for sending my drivers documents to Esign.

What problems are you solving with the product? What benefits have you realized?

over seas documents that were quite difficult to re-create or edit.

2019-02-01

What do you like best?

I like the accessibility of the application. I can access from anywhere by just using my browser.

What do you dislike?

Sometimes the sizing is a bit tricky and I need to play around with the edits to make it work.

What problems are you solving with the product? What benefits have you realized?

I am able to take pdf documents, to which I have lost or never had the source file, and easily change them to what I need. Also, another great use is to fill-in forms in forms to which i only have hardcopy.

I like the accessibility of the application. I can access from anywhere by just using my browser.

What do you dislike?

Sometimes the sizing is a bit tricky and I need to play around with the edits to make it work.

What problems are you solving with the product? What benefits have you realized?

I am able to take pdf documents, to which I have lost or never had the source file, and easily change them to what I need. Also, another great use is to fill-in forms in forms to which i only have hardcopy.

2020-02-03

PdfFiller is the best site money can buy!

I will say my experience with PdfFiller has exceeded my expectations. With PdfFiller it's easy to have access to so many great features! I would recommend to friends and family and anyone with any experience to try them out!

2024-06-10

PdfFiller has been an extremely convenient tool and service for me and my business. I basically have admin on demand without all the extra machinery of fax, printers, Scanners, etc. I can do it all from my device. I am happy to have found this service.

2024-04-05

I lost a very important document and…

I lost a very important document and thank you God for Dee OMG not only found the document but helped me save and print Dee was sent by God to help me today and your company should fill proud you have Dee as an employee. Pam Sweeton

2020-12-28

The NC OTP was a perfect match and was all that we needed to get the buyer and seller on the same page. Although it wasn't used by the attorneys it could have easily been used since it was identical to the one they used.

2020-09-15

The product is very good and it works very nice and...

The product is very good and it works very nice and it's very easy to comprehend how to use it, but the way you have the purchase setup I feel is very misleading I signed up for the month the month payment and you took a full year out of my account I did not like that that is why I would never recommend your product to anyone want to use because you can really mess up a person and you could be taking money that they could not have to be taken at the time. You need the fix your payment process area or you will lose other customers like myself because I did report it to the Better Business Bureau cuz I did not appreciate that.

2020-04-27

Save Salary Notification Feature

The Save Salary Notification feature helps you manage your finances more effectively. You receive alerts when your salary is deposited, so you stay informed and can plan your spending.

Key Features

Instant notifications for salary deposits

Customizable alert settings

User-friendly interface for easy navigation

Integration with financial planning tools

Secure and reliable notification system

Potential Use Cases and Benefits

Track your salary deposits and budgeting effortlessly

Plan your monthly expenses with confidence

Avoid overdraft fees by knowing exactly when your funds are available

Stay informed about your financial status in real-time

Enhance your savings strategy by aligning notifications with your financial goals

The Save Salary Notification feature solves your problem of uncertainty in financial management. By delivering timely alerts, it enables you to take immediate action on your finances. This way, you can plan, save, and spend wisely without unnecessary stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I save on 40k salary?

If you're 25, have no savings, and make $40,000 a year, you should be socking between $4,000 and $6,000 away annually. If you're 35 and make $50,000, you should be saving between $10,500 and $17,500 a year. Don't get discouraged. No matter how much your paycheck is, if you want to save money, you can.

How much should you save on 40k salary?

If you're 25, have no savings, and make $40,000 a year, you should be socking between $4,000 and $6,000 away annually. If you're 35 and make $50,000, you should be saving between $10,500 and $17,500 a year. Don't get discouraged. No matter how much your paycheck is, if you want to save money, you can.

How much should I save if I make 100k?

To put it into context, Gonzalez says, “Ideally, you should start by saving about a quarter of your gross income, and increase with age. With a $100K salary, you should [start by] saving about $2,000 a month.”

How much should you save per paycheck?

Many sources recommend saving 20 percent of your income every month. According to the popular 50/30/20 rule, you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and at least 20 percent for savings.

Is $40000 a lot of money?

$40K Per Year (Hourly, Weekly, Monthly) Before you accept a job that pays $40,000 per year, it is a good idea to break down your income. Please note, this is gross income, which doesn't account for taxes. $40,000 per year equals: $3,333.33 per month.

Is 40k a good starting salary?

$40k is a good salary for a single individual. Consider if you and a partner were living together and both making that salary, you'd be making 36% more than the U.S. average household income.

How do you manage 40k salary?

Check your earnings in hand. Make it habit to first save and then spend. Set a monthly budget. Set aside a fixed amount each month. Decide your priorities. Self Control -Avoid impulsive buying. Reduce your bills. Invest wisely.

How do I manage 40000 salary?

Check your earnings in hand. Make it habit to first save and then spend. Set a monthly budget. Set aside a fixed amount each month. Decide your priorities. Self Control -Avoid impulsive buying. Reduce your bills. Invest wisely.

#1 usability according to G2

Try the PDF solution that respects your time.