Share Quantity Notice For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

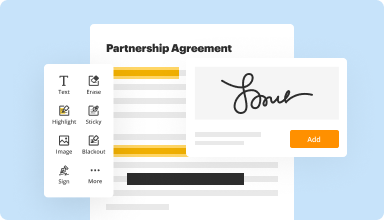

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

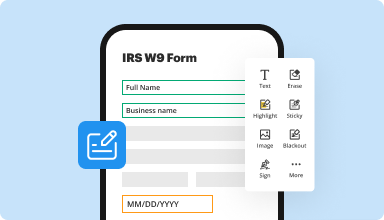

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

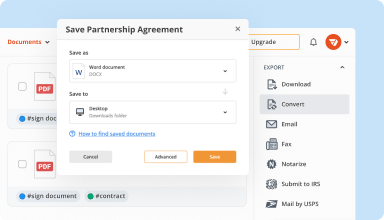

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

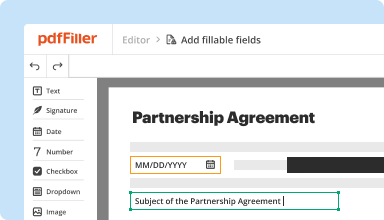

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

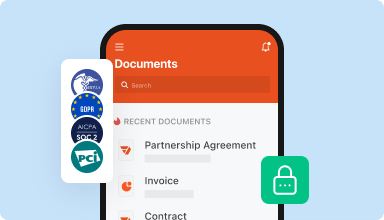

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

A little overwhelming at first. Trying to send to a client to fill out a form but it seems a little difficult. A webinar would be nice. I am going through the FAQ with some success.

2017-01-09

I have had limited use since I became a subscriber. I have difficulty printing the PDF file

I was working on and asked your online help desk what I could do to remedy that but

without success.

2019-02-19

Great for starting my transportation business. PDF filler help me to search and make documents that I needed for inspections, inventories, vehicle maintenance and more..

2019-06-04

Easy PDF completion app

Overall from what I've used, this has been a really great way to complete and sign documents.

I liked that you can basically fill out forms but digitally. Everything is digital these days and instead of having to download and do a bunch of cumbersome steps to complete a document, you can do it straight from the app. It's much easier and cleaner.

I wish you could edit things and make changes. If you need something changed you'd have to contact the other party and have it changed then resent. But even so it's not that big a deal and it's still a great software.

2020-03-16

I went into your chat hoping to get…

I went into your chat hoping to get answers to my inquiries regarding my account and why I couldn't locate what it kept telling me that I should be seeing. Kara was the second chat agent I messaged in this desire to find out what I was doing wrong... which is fine. The first agent was like an operator I assume... finding out what I needed exactly and then transferring me to the right team. Which happened really QUICKLY!! I am NOT used to any online chats actually being able to do anything as fast as this happened today! Much less get an agent that could actually help me... TODAY was the first in a very LOOOONG time! Kara was GREAT!!! She needs a raise and maybe a promotion. Thanks again, Kara!!! KUDOS to Kara!!!

The one entity that I HAD dedicated my loyalty to (Best Buy) for over a decade... is now in my rearview mirror!!!! They are atrocious at helping anyone with anything online!!! The store employees have to go through the same phone number we do, so they're worthless! And corporate Best Buy... smh... I won't get ugly here, but just state that they were the final straw that broke the camel's back!! I will NEVER give them any more of my time or money!!!

PDF Filler though... has been a nice change!!! Thanks again!!!

2023-11-05

The UI were strange at times(As I sometimes had to look for something specific) , but overall my experience were really good as I am able to achieve my goal everytime with ease. I were using the edit pdf feature and again a bit of trouble trying to establish what I was looking for, but once I found it, it was quite an ease.

2023-02-20

Finally! A way for me to fill things out properly without printing!

I am very happy so far with this experience because not only does it allow me to fill out pdf's online and not waste paper and look unprofessional, it allows me to CREATE a pdf in the exact manner that I want it to look. I will use it for some of my professional documents on a regular basis!

2022-06-13

Super easy to learn and use. Would love to learn how to create templates for budget, expenses etc. I used pdfFiller to change bank statements from pdf to csv . Thank you

2021-08-15

where has this been all my life

where has this been all my life. i'm 20 minutes into download, clicked buy, installed laptop & cell. already created two forms & makes my time with older versions of fillable PDF generator programs seem like a million years ago.

2020-09-22

Share Quantity Notice Feature

The Share Quantity Notice feature simplifies tracking and managing your inventory. With this tool, you can stay informed about your stock levels and ensure you never run low on essential items. This feature empowers you to take control of your inventory processes effectively.

Key Features

Real-time updates on stock levels

Customizable alerts for low inventory

User-friendly dashboard for quick insights

Integration with existing systems

Support for multiple product categories

Potential Use Cases and Benefits

Retailers can maintain optimal stock levels for key products

E-commerce businesses can enhance customer satisfaction by preventing stockouts

Manufacturers can streamline production planning with accurate inventory data

Restaurants can avoid shortages of ingredients, ensuring smooth operations

Small business owners can save time and reduce stress when managing inventory

This feature addresses common inventory challenges. By keeping you informed about stock levels, it helps prevent surprises like running out of popular products. With timely alerts, you can order new supplies before your stock runs low. In turn, this leads to better customer experiences and increased sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate number of shares?

If you know the market cap of a company, and you know its share price, then figuring out the number of outstanding shares is easy. Just take the market capitalization figure and divide it by the share price. The result is the number of shares on which the market capitalization number was based.

How do you calculate the number of ordinary shares?

Issue price of the share in the face of the value of the share at which it is available to the public. The number of outstanding shares is the number of shares available to raise the required amount of capital.

How do you calculate number of equity shares?

It is calculated by multiplying a company's share price by its number of shares outstanding. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements.

How do you calculate equity per share?

Equity Value = Total Shares Outstanding * Current Share Price. Equity Value = Enterprise Value Debt. Enterprise Value = Market Capitalization + Debt + Minority Shareholdings + Preference Shares Cash & Cash Equivalents.

How do you find the number of shares issued?

If you know the number of treasury stock, or shares reclaimed by the company but not retired, and the number of shares outstanding, you can calculate shares issued: shares issued = shares outstanding + treasury stock.

What does the number of shares mean?

The number of shares of common stock outstanding is a metric that tells us how many shares of a company are currently owned by investors. This can often be found in a company's financial statements, but is not always readily available -- rather, you may see terms like “issued shares” and “treasury shares” instead.

How many shares does a company have?

Typically a startup company has 10,000,000 authorized shares of Common Stock, but as the company grows, it may increase the total number of shares as it issues shares to investors and employees. The number also changes often, which makes it hard to get an exact count. Shares, stocks, and equity are all the same thing.

Why might the number of shares issued be more than the number of shares outstanding?

Issued stock represents the amount of shares the company has sold. The number of shares issued could be more than the number of shares outstanding if the company has treasury shares. Furthermore, to make shares seem more affordable to small investors even though the value of the company has not changed.

Video Review on How to Share Quantity Notice

#1 usability according to G2

Try the PDF solution that respects your time.