Sign Individually with pdfFiller

How to Sign Individually using pdfFiller

To sign individually using pdfFiller, upload your PDF document, choose the 'eSign' option, and follow prompts to create your signature. Download or send the signed document directly to the required recipient.

-

Visit pdfFiller and log into your account.

-

Upload the document you wish to sign.

-

Select the eSign option from the toolbar.

-

Create or insert your signature.

-

Save or send the signed document.

What does it mean to sign individually?

Signing individually refers to the process of adding a personal e-signature to a document, confirming agreement or acknowledgment. This process eliminates the need for physical signatures, streamlining workflows in digital document handling.

Why signing individually is critical for modern document workflows?

Signing individually enhances efficiency, reduces mailing costs, and accelerates decision-making since documents can be signed and returned instantly. It directly addresses the needs of businesses and individuals for speed and effectiveness in contract management.

Use-cases and industries that frequently sign individually

Various industries utilize individual signing, including real estate, law, finance, and healthcare. Whether it's signing contracts, agreements, or consent forms, the need for expedited processing is universal.

-

Real Estate: Signing purchase agreements and lease contracts.

-

Legal: Signing affidavits and contracts.

-

Finance: Signing loan agreements and contracts.

-

Healthcare: Signing patient consent forms.

Step-by-step: how to sign individually in pdfFiller

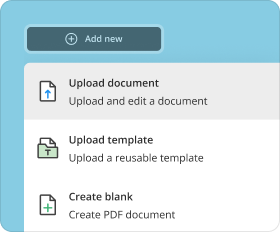

Using pdfFiller to sign individually is straightforward. Here's how to navigate the application efficiently:

-

Log into pdfFiller and access the dashboard.

-

Click on 'Upload' to select your document.

-

Open the document and locate the 'eSign' function.

-

Use the signature creation tool to sign your document.

-

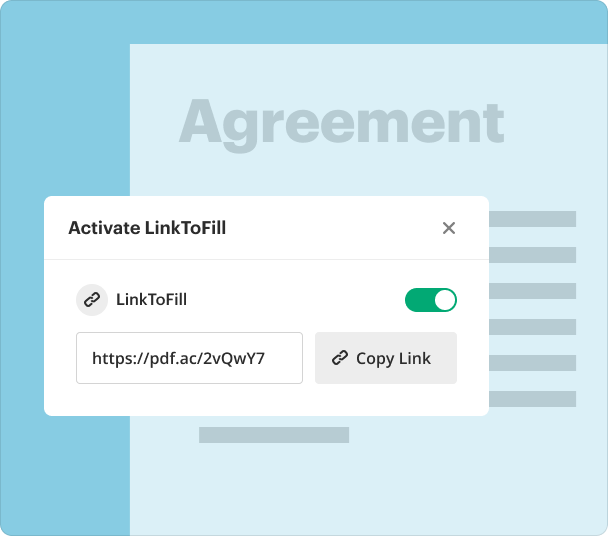

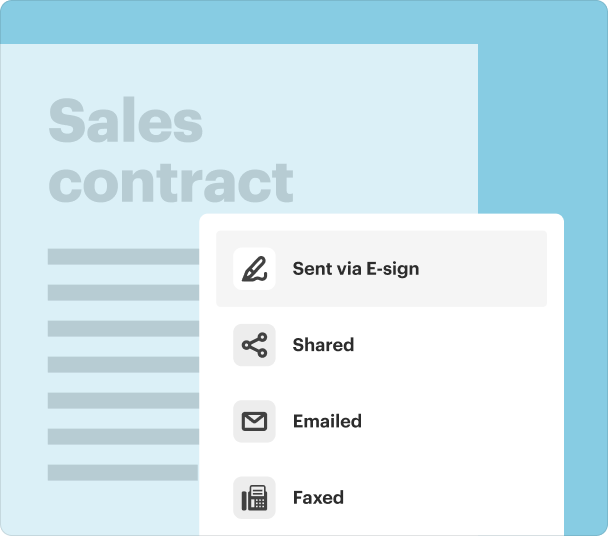

Finalize your document and choose to save or share it.

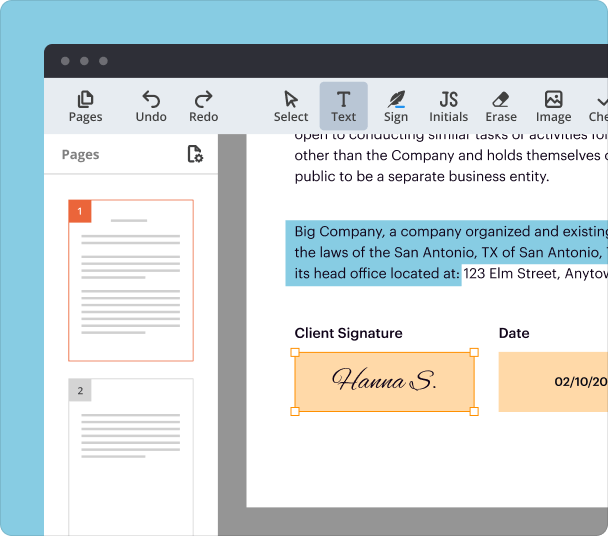

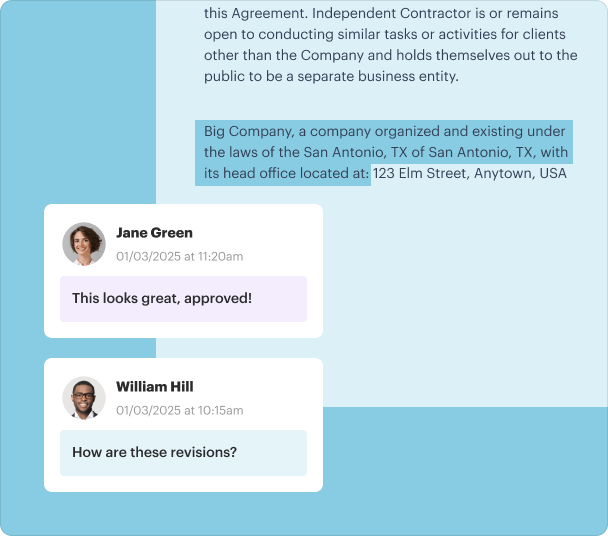

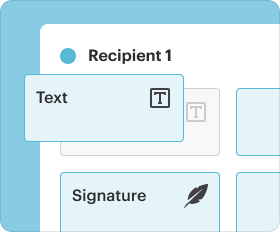

Options for customizing signatures, initials, and stamps when you sign individually

pdfFiller provides flexibility in personalizing signatures and initials. Users can draw, type, or upload their signature images, along with custom stamps that can enhance documents.

Managing and storing documents after you sign individually

After signing, pdfFiller allows for organized storage of signed documents directly in the cloud. This ensures all signed files are accessible, easily searchable, and secure.

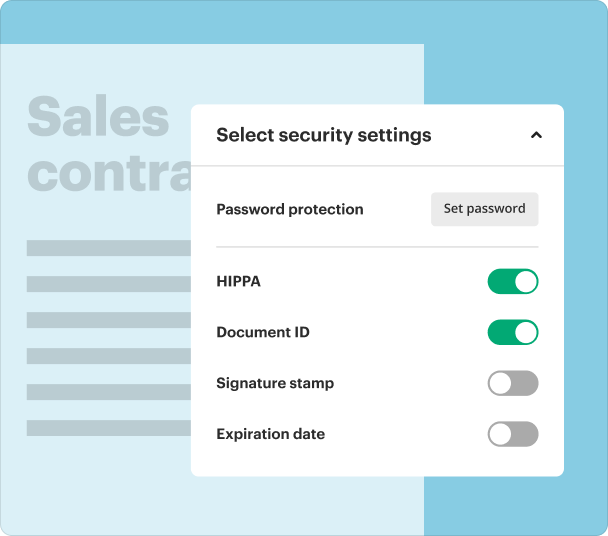

Security, compliance, and legal aspects when you sign individually

Using pdfFiller for signing individually maintains high security, employing encryption protocols. Compliance with e-signature laws, such as ESIGN Act and UETA, ensures legally binding signatures.

Alternatives to pdfFiller for signing individually

While pdfFiller is feature-rich, it's beneficial to consider alternatives like DocuSign, Adobe Sign, and HelloSign. Each platform offers distinct functionalities ranging from user interface design to integration capabilities.

-

DocuSign: Robust compliance, market leader.

-

Adobe Sign: Strong integration with Adobe Suite.

-

HelloSign: Focused on user experience, simplicity.

Conclusion

Signing individually with pdfFiller streamlines the process of document approval and enhances productivity. By leveraging its comprehensive tools for e-signature, users can efficiently manage their documents with ease.

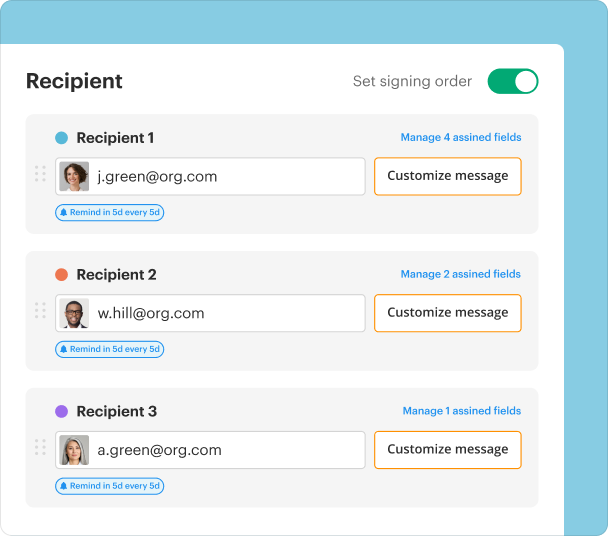

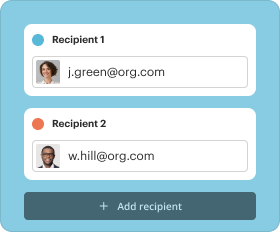

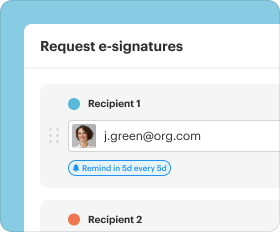

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms