Split Contact Contract For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

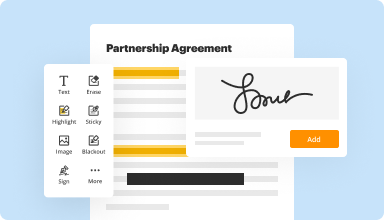

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

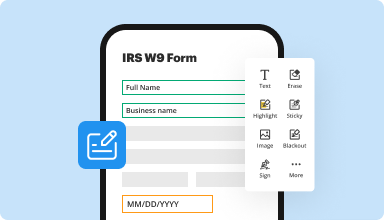

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

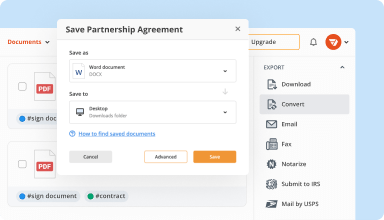

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

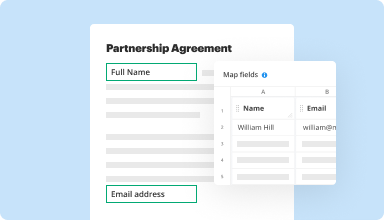

Collect data and approvals

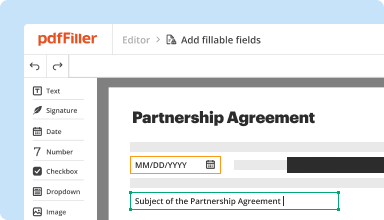

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

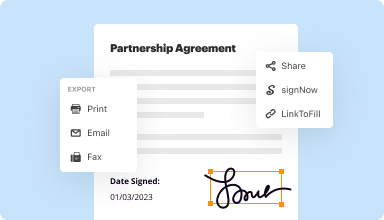

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

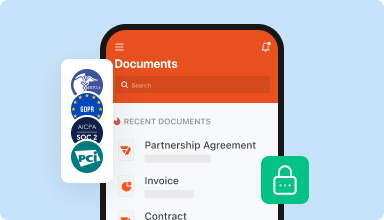

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I was very upset that I wasn't told I'd have to pay until after I'd edited a very long file, but customer service gave me 30 days free when I brought this to their attention.

2014-05-18

You are wonderful to help this disabled man. God Bless

As soon as I can afford this service I will be subscribing. You treated me with great kindness. I have told several people of your great service and referred them to your web-site to subscribe. Sincerely, Don Black

2014-06-21

I use PDFFiller for our trucking company Bills of Lading and Log Sheets. I absolutely love it! My paperwork looks so much more professional and the more I use it the more I like it.

2015-08-17

Some of the fill ins didn't exactly fill in right, but this was my first time using PDF Filler, so maybe it is just part of the learning curve for me. Thanks.

2017-11-01

Overall, the application is useful. The only issues that I have been experiencing is some of the edits I make either reappear, or are placed on top of the existing text.

2019-05-26

This software is absolutely amazing and easy to use. I would highly recommend this product to anyone who works with PDF forms on a daily basis, as it simplifies the process of typing on a PDF document.

2019-09-17

What do you like best?

In-line text, change font size, save options to name a few. Being able to quickly fill out insurance applications and having the text line up is amazing. I have been looking for this feature for awhile. PDFfiller is quick, easy, and has boosted my efficiency greatly.

What do you dislike?

The page fails when resizing text, and then you need to reload it. That is really my only issue other than when saving a PDF to my local machine, I don't need the indicator to pop up and tell me where to look.

Recommendations to others considering the product:

Sign up! You won't regret it. PDFfiller is easy to use, extremely helpful, and increases productivity dramatically. Great product.

What problems are you solving with the product? What benefits have you realized?

Easily fill out lengthy forms via pdf vs having to print them out and fill out by hand. We have been able to complete applications and fill pdfs faster and get them to where they need to go much faster.

In-line text, change font size, save options to name a few. Being able to quickly fill out insurance applications and having the text line up is amazing. I have been looking for this feature for awhile. PDFfiller is quick, easy, and has boosted my efficiency greatly.

What do you dislike?

The page fails when resizing text, and then you need to reload it. That is really my only issue other than when saving a PDF to my local machine, I don't need the indicator to pop up and tell me where to look.

Recommendations to others considering the product:

Sign up! You won't regret it. PDFfiller is easy to use, extremely helpful, and increases productivity dramatically. Great product.

What problems are you solving with the product? What benefits have you realized?

Easily fill out lengthy forms via pdf vs having to print them out and fill out by hand. We have been able to complete applications and fill pdfs faster and get them to where they need to go much faster.

2019-05-28

I love the app because it's very…

I love the app because it's very convenient. However, I found typing into the right spaces to be challenging, especially when I tried to align to them into the correct places.

2022-04-15

They were super helpful to me when I…

They were super helpful to me when I accidentally subscribed. They voided the transaction and were understanding. I really appreciate this because there are too many other automatic subscriptions that would not have been as forgiving.

2020-05-04

Split Contact Contract Feature

The Split Contact Contract feature enables seamless management of contracts for multiple parties. This tool simplifies how you handle contracts and ensures everyone is on the same page. By splitting contracts, you maintain clarity and organization in your agreements.

Key Features

Easily split contracts between multiple contacts

Clear visibility of each party's responsibilities

Streamlined communication options for all parties

Customizable templates for different scenarios

Secure storage for all contract documents

Potential Use Cases and Benefits

Ideal for partnerships involving several stakeholders

Helpful in project management scenarios with multiple contractors

Simplifies agreements for joint ventures or collaborations

Improves accountability among parties involved in a contract

Enhances transparency and trust in business relationships

By using the Split Contact Contract feature, you can solve common contract management issues. It removes the confusion that often arises when multiple parties are involved. With clear roles defined and streamlined communication, you can focus on what truly matters: achieving your goals. This feature helps you save time and reduce the risk of misunderstandings, ensuring that every party is informed and engaged.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What happens to options during a split?

While a stock split adjusts the price of an option's underlying security, the contract is adjusted so that any changes in price due to the split do not affect the value of the option.

What happens to options during reverse split?

A reverse split results in the reduction of outstanding shares and an increase in the price of the underlying security. The holder of an option contract will have the same number of contracts with an increase in strike price based on the reverse split value.

Will CHK reverse split?

Chesapeake Energy Sets Date For Reverse Stock Split, Stock Down 80% YTD. Oil and natural gas stock Chesapeake Energy (CHK) has announced that the company's expected reverse stock split is set to occur on April 13, subject to shareholder approval.

What happens to options after merger?

All-Stock Offer With an all-stock merger, the number of shares covered by a call option is changed to adjust for the value of the buyout. The options on the bought-out company will change to options on the buyer stock at the same strike price, but for a different number of shares.

What happens when your stock splits?

A stock split happens when a company decides to exchange more shares at a lower price for stockholders' existing shares. Because the new price of the shares correlates to the new number of shares, the value of the shareholders' stock doesn't change and neither does the company's market capitalization.

Is a stock split good or bad?

When you had to split something as a kid, that generally didn't feel like a perk. But when you're an investor, splitting can be a good thing. Stock splits are a way a company's board of directors can increase the number of shares outstanding while lowering the share price.

Do you make money when a stock splits?

A stock split doesn't add any value to a stock. Instead, it takes one share of a stock and splits it into two shares, reducing its value by half. Investors who own a stock that splits may not make a lot of money immediately, but they shouldn't sell the stock since the split is likely a positive sign.

Is Gush stock going to split?

GUSH's 5th split took place on November 22, 2019. This was a 1 for 10 reverse splits, meaning for each 10 shares of GUSH owned pre-split, the shareholder now owned 1 share. For example, a 100 share position pre-split, became a 10 share position following the split. GUSH's 6th split took place on March 24, 2020.

#1 usability according to G2

Try the PDF solution that respects your time.