Spread Out Formula Diploma For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

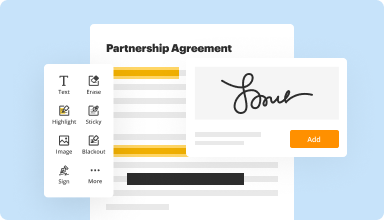

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

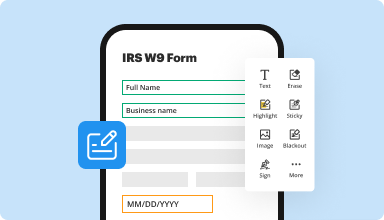

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

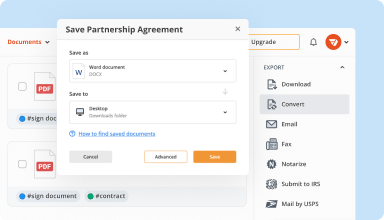

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

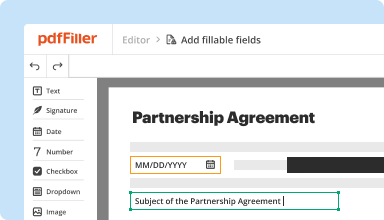

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

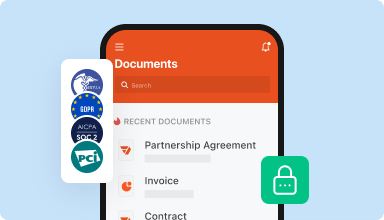

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I thought I was purchasing a one-month subscription (I didn't select the correct button prior to the check-out process and was not advised of the amount before I hit Submit). Would REALLY like a refund of the yearly subscription - am very happy to pay the19.99 for one month. Please...

2015-09-07

Minimal experience. Does take the time out of huge forms to fill out - even for my kids' school. $20 a month is a lot for the convenience. I will likely cancel after my 1 month.

2017-09-22

I love this app just wish when using the Text Feature, when filling in a form with white space, that you could move the text box if it is not aligned .

2018-10-09

By far the absolutely best PDF app you can by today! It is very user friendly and economical! Download the trial version to check it out... I bet before the trial timeframe is up, you will be buying the complete version!

2019-03-05

What do you like best?

I use Quickbooks and have to send out 1099NT which is not a capability in Quickbooks. 1099 forms must be scannable and I can purchase the printed forms and fill it out on PDFfiller. I can then print on the scannable forms and they are perfectly aligned. Saves time and money. Also, I like the fact that I can create a template so I don't have to re-type the same company information, tax numbers, etc. The product is easy to use.

What do you dislike?

I don't really dislike anything about PDFfiller. Other than maybe the fact that I probably don't use it enough to offset the cost.

Recommendations to others considering the product:

Easy to use - I intended to use for a month and then cancel, but I ended up keeping it.

What problems are you solving with the product? What benefits have you realized?

I mostly use for 1099NT's as mentioned above. I really need to explore!

I use Quickbooks and have to send out 1099NT which is not a capability in Quickbooks. 1099 forms must be scannable and I can purchase the printed forms and fill it out on PDFfiller. I can then print on the scannable forms and they are perfectly aligned. Saves time and money. Also, I like the fact that I can create a template so I don't have to re-type the same company information, tax numbers, etc. The product is easy to use.

What do you dislike?

I don't really dislike anything about PDFfiller. Other than maybe the fact that I probably don't use it enough to offset the cost.

Recommendations to others considering the product:

Easy to use - I intended to use for a month and then cancel, but I ended up keeping it.

What problems are you solving with the product? What benefits have you realized?

I mostly use for 1099NT's as mentioned above. I really need to explore!

2019-03-05

So convenient and easy!

I love it. I use a lot of State and local court forms that you cannot save from their websites. With PDFiller I can fill them in and save them for future use. It seems to do everything I need it for.

My favorite thing about this software is that it is so easy to fill in ANY document I may need.

Maybe there could be an easier way to print right from your document, without hitting save first. (maybe you already can I just don't know how to do it)

2019-01-29

Fill PDF easily

Filler software for life with the best features available to fill out pdf documents anywhere and anytime. The google docs addon save me a lot of time to fill out pdf's online and sending is easy after editing. Easy to use cloud based pdf editor which enhance productivity while I am working.

They don't have all language support. They should add more language support.

2018-09-24

What do you like best?

Very easy to use, very friendly, many options

What do you dislike?

That doesn't give you the option to save a file to a different folder in your computer

What problems are you solving with the product? What benefits have you realized?

Re-entering information or missing information, adding signatures

2021-02-16

I find pdfFiller to work amazing for me…

I find pdfFiller to work amazing for me through covid-19. It is the ultimate online experience and help for online to-do's :) Genuinely and honestly, everything in one place, quick and tidy and professional. Thank you

2020-04-17

Spread Out Formula Diploma Feature

The Spread Out Formula Diploma feature provides an organized approach to managing your learning process. It helps you structure your educational journey effectively, ensuring that you make the most of your time and resources.

Key Features

Step-by-step guidance through each module

Interactive learning materials

Progress tracking tools

Customizable study plans

Access to expert resources and support

Potential Use Cases and Benefits

Students can streamline their study routines

Educators can utilize structured lesson plans

Professionals can enhance their skills systematically

Individuals can pursue personal development goals with clarity

The Spread Out Formula Diploma feature addresses common challenges in learning, such as feeling overwhelmed and disorganized. By offering a clear framework and supportive resources, it empowers you to take charge of your education. You can progress at your own pace, stay motivated, and achieve your goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate spread?

To calculate the bid-ask spread percentage, simply take the bid-ask spread and divide it by the sale price. For instance, a $100 stock with a spread of a penny will have a spread percentage of $0.01 / $100 = 0.01%, while a $10 stock with a spread of a dime will have a spread percentage of $0.10 / $10 = 1%.

How do you calculate credit spread?

Credit Spread Formula The formula simply states that credit spread on a bond is simply the product of the issuer's probability of default times 1 minus possibility of recovery on the respective transaction.

What happens when credit spreads widen?

Translating Yield Spread Movements Because bond yields are always in motion, so too are spreads. The direction of the yield spread can increase, or widen, which means that the yield difference between two bonds or sectors is increasing. When spreads narrow, it means the yield difference is decreasing.

How do you calculate default spread?

Pre-tax cost of debt = Risk free rate + Default spread.

The default spread can be estimated from the rating or from a traded bond issued by the company or even a company CDS.

What is credit spread risk?

A credit spread is the risk premium add-on to the base interest rate used when pricing corporate debt issues. It reflects the credit rating or risk rating of the company, the maturity of the issue, current market spread rates, as well as other components such as security and liquidity.

How do you calculate forward spread?

A forward spread is the price difference between the spot price of a security and the forward price of the same security taken at a specified interval. The formula is the forward price minus the spot price. If the spot price is higher than the forward price, then the spread is the spot price minus the forward price.

What is a forward spread?

Forward spread is a trading term used to define the difference in the price of an asset between two time periods. The spread is calculated by taking away the current price of the asset from the future price. It is defined as a forward spread because it is always looking forward.

How is forward rate calculated?

To calculate the forward rate, multiply the spot rate by the ratio of interest rates and adjust for the time until expiration. So, the forward rate is equal to the spot rate x (1 + foreign interest rate) / (1 + domestic interest rate).

How do you use forward rates?

In the context of bonds, forward rates are calculated to determine future values. For example, an investor can purchase a one-year Treasury bill or buy a six-month bill and roll it into another six-month bill once it matures. The investor will be indifferent if both investments produce the same total return.

What is spread cost?

The spread is the transaction cost. Price takers buy at the ask price and sell at the bid price, but the market maker buys at the bid price and sells at the ask price. The bid represents demand and the ask represents supply for an asset.

#1 usability according to G2

Try the PDF solution that respects your time.