Update Subsidize Certificate For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

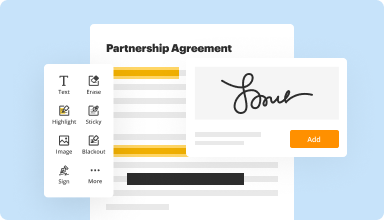

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

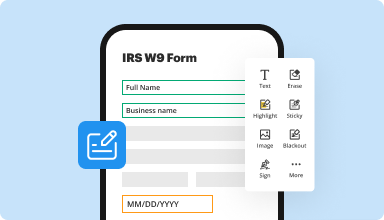

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

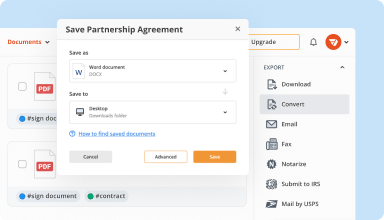

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

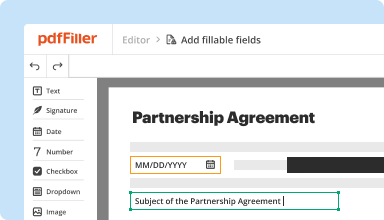

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

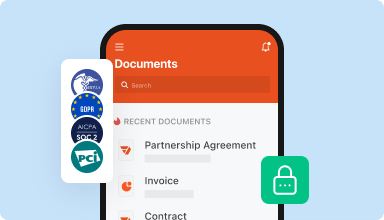

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Extremely convenient service and professional service. As a single-person business owner, using PDFiller allows me to expedite and streamline forms submission for quick payment.

2014-10-16

so far so good. Not the easiest to find document while logged in. I find I have to do a search on the document from a web browser to get to it. PFDfiller couldn't find the doc from within the app.

2015-09-22

I couldn't get my document to print and Anne in customer service looked at my document and resolved this issue in less than 3 minutes. Great customer service!

2016-11-04

So Easy to Use Anybody Could Do It

I have had a great experience with this program so far it has eliminated my need for some of the other programs I have tried which ultimately has saved a lot of money while also making my job a little easier.

PDFiller is so easy to use that you anybody can do it. It walks you through everything but you may not even need to do that its very clear and easy to navigate. This program also has saved me so much time and money on other options in which you would have to get more than one program to accomplish what just this one program does.

Once in a while I have to exit out of it because it freezes up, but I'm always able to go right back into it without having to wait.

2019-09-30

Everything works

Everything works, you do not require me to pay for continually using the service and my signatures and information are saved in the site. 100% would recommend to others.

2024-09-12

Quick download, easy fillable PDF forms online

very practical online fillable forms but using the snail mail from the IRS, i was able to obtain the same forms via mail a week later. I like its free trial but only needed the 2022 W2 form and not the entire services

2023-06-01

It gives me a lot of options to pdf editing

It gives me a lot of options to pdf works that I did not find somewhere else, and even when I cannot readily pay for the service, I was given a trial with no gimmicks attached

2023-01-09

It is a bit frustrating to learn how to send it to my computer to be accessed and modified as needed. Right now it serves me as a trial, but I wouldn't pay for this.

2021-02-24

I haven't even had a chance to try it…

I haven't even had a chance to try it out yet. I'm already paying for it -- let me use it for a while!!

2020-11-05

Update Subsidize Certificate Feature

The Update Subsidize Certificate feature provides a streamlined process for managing and renewing subsidy certificates. This tool is designed to simplify your experience, making it easier for you to maintain compliance and access funding opportunities.

Key Features

User-friendly interface for easy navigation

Automated reminders for certificate renewals

Secure storage for all documentation

Real-time updates on subsidy eligibility

Integration with existing financial systems

Potential Use Cases and Benefits

Nonprofits seeking to renew funding certificates efficiently

Businesses wanting to manage subsidy documents without hassle

Organizations needing to stay compliant with government regulations

Users looking to access timely financial aid for projects

Administrators wanting to simplify reporting processes

This feature addresses your needs for organization and compliance. By keeping all your subsidy documentation in one secure location and providing timely reminders, you can focus on your core activities without worrying about missing deadlines or paperwork. Experience peace of mind with the Update Subsidize Certificate feature.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is better subsidized or unsubsidized loans?

If you meet the financial need requirements to qualify for subsidized loans, you'll pay less overtime. That's because while your subsidized loan for undergraduate study will carry the same interest rate as an unsubsidized loan, interest won't accrue while you're still in college and during other periods of nonpayment.

What is the difference between subsidized and unsubsidized student loans?

Federal aid offers Direct subsidized and unsubsidized loans. The difference between these two loans is that subsidized loans are based on financial need and the interest does not accrue while the student is in college, as the interest is paid by the federal government.

Do you have to pay back unsubsidized loans?

Even though they're still offered by the federal government, Uncle Sam won't pay the interest on unsubsidized student loans. The government does not pay interest on Direct Unsubsidized Loans because these are general loans not based on financial need. Borrowers must repay their debt in full, interest and all.

What is the difference between subsidized and unsubsidized Stafford loans?

The key difference between subsidized and unsubsidized Stafford loans is the federal government pays (or subsidizes) interest on subsidized loans during select periods. With unsubsidized loans, there's no federal help with interest, but there are fewer limits on borrowing funds.

What is an unsubsidized federal student loan?

An unsubsidized loan is a federal loan for undergraduate college students who are still in school, and need for help to pay for tuition and related expenses. To qualify for an unsubsidized loan, or direct unsubsidized loan, you first need to visit and complete the Free Application for Federal Student Aid (FAFSA).

How does a subsidized loan work?

With subsidized loans, somebody pays your interest charges for you. Usually, when you borrow money, your lender charges interest on your loan balance, and you are required to pay those charges. For example, lenders may calculate interest costs every day or every month.

Should you accept unsubsidized loans?

If you need to accept loans to help cover the cost of college or career school, remember to borrow only what you need. You should accept the subsidized loan first because it has more benefits. If you have to accept an unsubsidized loan, remember that you're responsible for all the interest that accrues on that loan.

Are unsubsidized loans bad?

But that doesn't mean federal direct unsubsidized loans are a bad deal. They are still government student loans, and that means they come with low, fixed rates and some valuable borrower benefits. In fact, direct unsubsidized loans for undergraduates carry the same interest rate as subsidized loans.

#1 usability according to G2

Try the PDF solution that respects your time.