Validate E-Sign Tax Sharing Agreement with pdfFiller

How to Validate E-Sign Tax Sharing Agreement

To validate an E-Sign Tax Sharing Agreement using pdfFiller, upload your PDF document, utilize the e-signature tool to apply digital signatures, and save the validated document for future reference. This process ensures that all parties have signed the agreement electronically.

What is an E-Sign Tax Sharing Agreement?

An E-Sign Tax Sharing Agreement is a legally binding document that outlines how parties involved will share tax obligations and benefits. By leveraging electronic signatures (e-signatures), the agreement can be signed digitally, simplifying the process and enhancing efficiency.

Why validating an E-Sign Tax Sharing Agreement is critical for modern document workflows

Validating an E-Sign Tax Sharing Agreement is essential for ensuring legal compliance and maintaining clear communication among parties. In today’s fast-paced business environment, organizations rely on efficient documentation to stay competitive.

-

Streamlines the signing process, reducing turnaround time.

-

Enhances security through encrypted signatures.

-

Ensures legal compliance with e-signature laws.

-

Facilitates easy tracking of signatories and document versions.

Use-cases and industries that frequently validate E-Sign Tax Sharing Agreements

Various industries utilize E-Sign Tax Sharing Agreements, making the validation of these documents critical for their operational efficiency. These include finance, real estate, and accounting, where tax obligations and benefits often necessitate formal agreements.

-

Financial institutions managing client assets.

-

Real estate firms negotiating property taxes.

-

Accounting firms ensuring compliance for clients.

-

Businesses with shared revenue or profit-sharing models.

Step-by-step: how to validate an E-Sign Tax Sharing Agreement in pdfFiller

Following these steps will help you validate an E-Sign Tax Sharing Agreement effectively within pdfFiller.

-

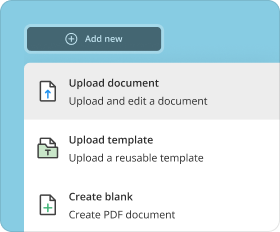

Log in to your pdfFiller account or sign up for a new account.

-

Upload your Tax Sharing Agreement PDF document.

-

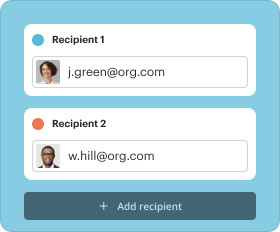

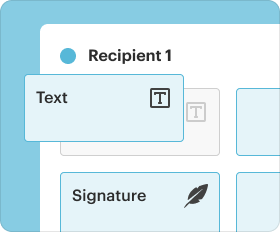

Select the e-signature option to initiate the signing process.

-

Add your signature and any other required fields.

-

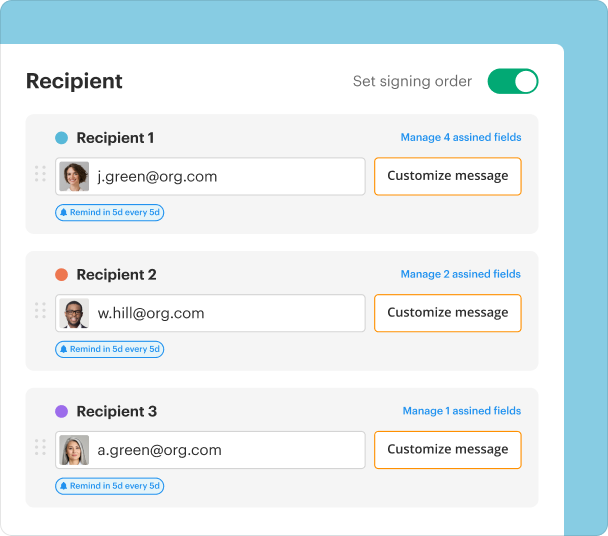

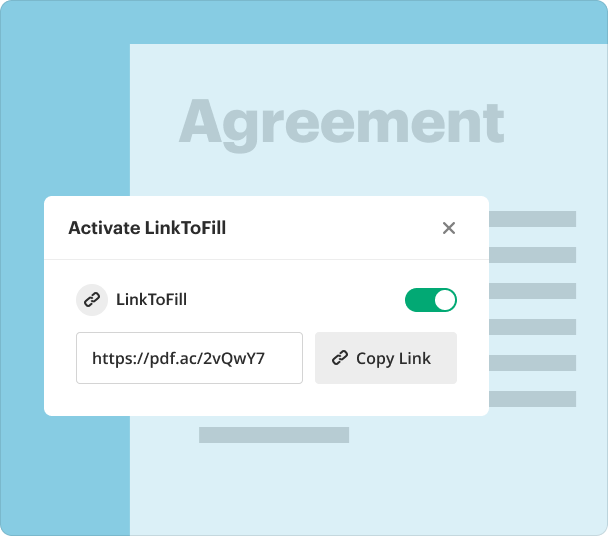

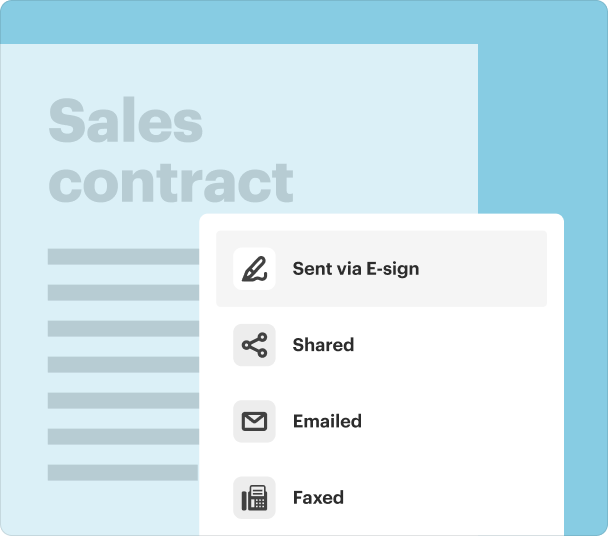

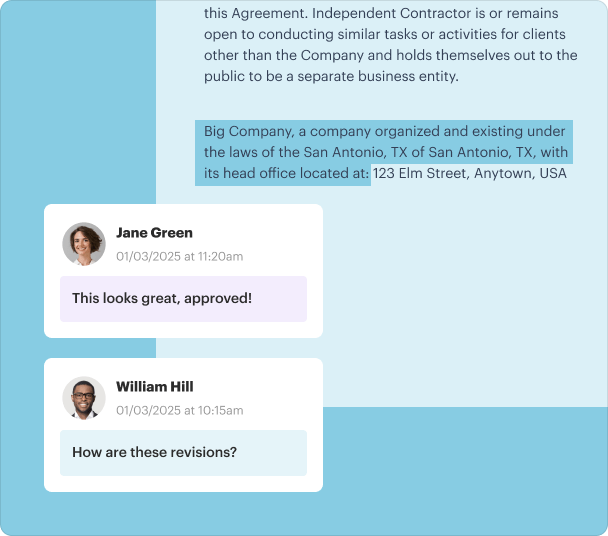

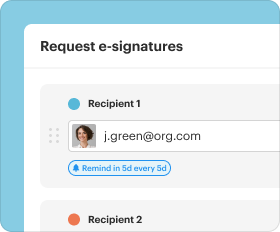

Send the document to other parties for their signatures.

-

Once all signatures are collected, download the validated document.

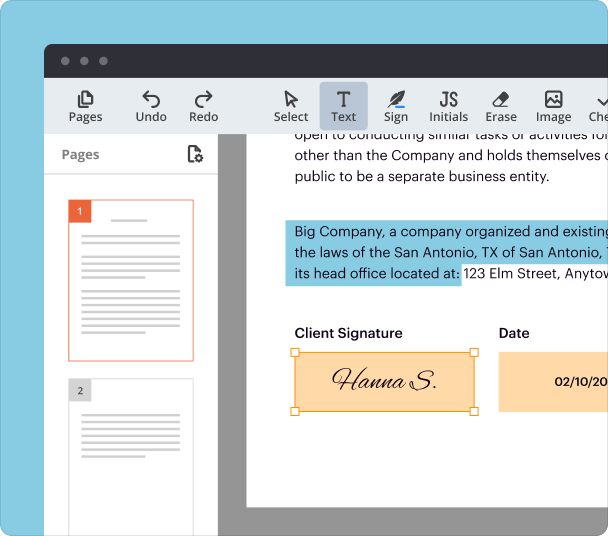

Options for customizing signatures, initials, and stamps when you validate an E-Sign Tax Sharing Agreement

pdfFiller allows users to customize their signatures, initials, and stamps, adding a personal touch to your validated E-Sign Tax Sharing Agreement. This enhances the authenticity and professionalism of your document.

-

Create a custom e-signature that reflects your name or brand.

-

Add initials for acknowledgment on multiple pages.

-

Incorporate a company stamp to signify approval.

Managing and storing documents after you validate an E-Sign Tax Sharing Agreement

Once you validate an E-Sign Tax Sharing Agreement, managing and storing your documents securely is vital. pdfFiller provides a robust storage system for easy retrieval and organization.

-

Organize documents into folders for easy access.

-

Utilize advanced search features to find documents quickly.

-

Set permission levels for document access.

-

Regularly back up documents to prevent data loss.

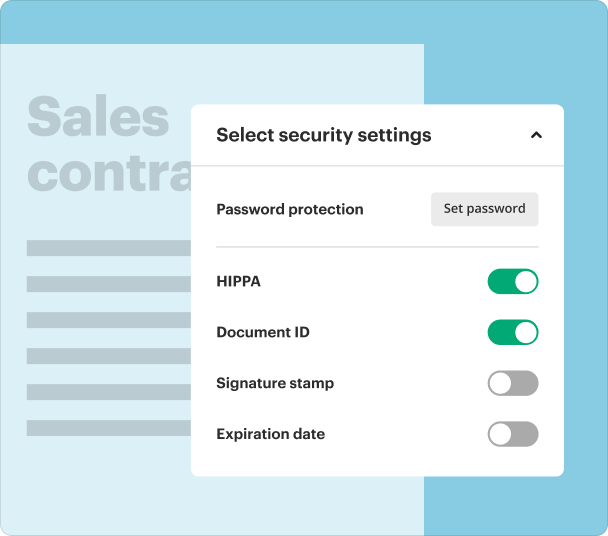

Security, compliance, and legal aspects when validating an E-Sign Tax Sharing Agreement

Understanding the security and compliance measures surrounding E-Sign Tax Sharing Agreements is crucial. pdfFiller ensures that all documents are encrypted, audited, and comply with local e-signature laws, such as the ESIGN Act in the United States.

-

Encryption protects sensitive information.

-

Audit trails provide proof of signing history.

-

Compliance with international e-signature laws.

-

User authentication to verify identities.

Alternatives to pdfFiller for E-Sign workflows

While pdfFiller is a powerful tool for validating E-Sign Tax Sharing Agreements, there are alternative solutions worth considering, each with its strengths and weaknesses.

-

DocuSign: A widely used e-signature platform with robust compliance features.

-

Adobe Sign: Integrated well with Adobe products, providing great user experience.

-

HelloSign: User-friendly, suitable for small businesses seeking e-sign solutions.

Conclusion

Validating an E-Sign Tax Sharing Agreement with pdfFiller streamlines the signing process, enhances security, and ensures legal compliance. By following the outlined steps and utilizing the available features, users can effectively manage their documents in today’s digital landscape.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms