How to Write E-Signature Tax Sharing Agreement with pdfFiller

What does it mean to write an e-signature tax sharing agreement?

Writing an e-signature tax sharing agreement involves creating a document that outlines how taxes are shared among parties using electronic signatures. This is crucial for ensuring legal compliance and facilitating smooth transactions between individuals and organizations. By leveraging digital signatures, all parties can sign documents digitally, eliminating the need for physical signatures and streamlining the approval process.

Why writing an e-signature tax sharing agreement is critical for modern document workflows

In today's digital landscape, efficiency is key. An e-signature tax sharing agreement allows parties to expedite their tax documentation processes while maintaining accuracy and security. The use of electronic signatures not only saves time but also supports remote transactions, crucial for cross-border dealings that have become common in modern business.

Use-cases and industries that frequently write e-signature tax sharing agreements

Various industries utilize e-signature tax sharing agreements, including finance, real estate, and consultancy. They are essential for partnerships and collaborations where tax responsibilities are divided among parties. Here are some common use cases involving these agreements:

-

Partnerships: When two or more entities collaborate, they often share profits and losses, necessitating an agreement.

-

Consultancy services: Consultants providing tax-related advice may need tax sharing clauses in their contracts.

-

Joint ventures: Multiple companies working together on a project can benefit from defining tax obligations.

Step-by-step: how to write an e-signature tax sharing agreement in pdfFiller

Using pdfFiller to create and sign a tax sharing agreement is a straightforward process. Follow these steps to ensure you set up everything correctly:

-

Log into your pdfFiller account and select 'Create New Document'.

-

Choose a template or start from scratch by setting up the essential structure of your agreement.

-

Add relevant details: parties involved, tax obligations, and sharing percentages.

-

Include clauses for dispute resolution, ensuring all parties agree on the terms.

-

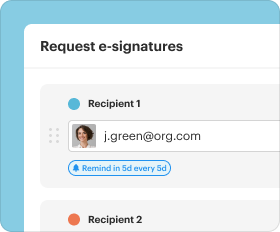

Use pdfFiller’s e-signature feature to sign the document electronically.

-

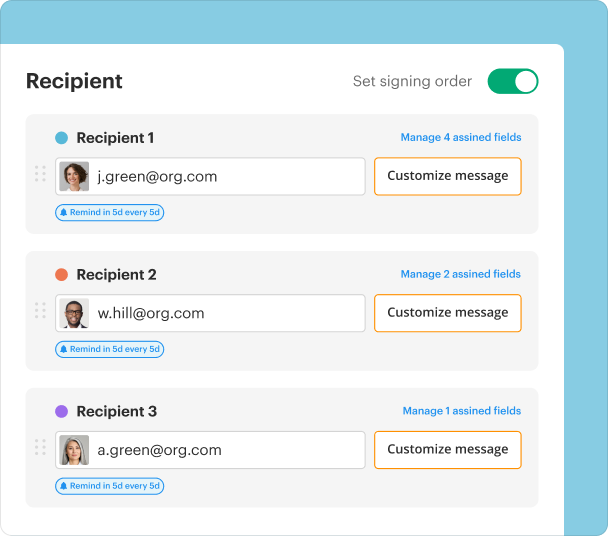

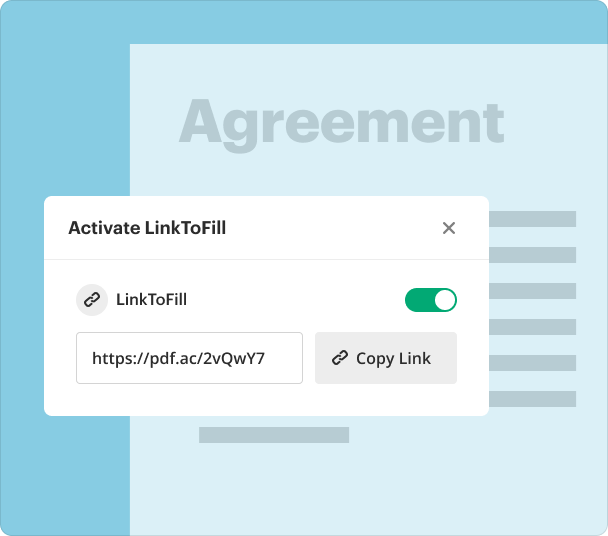

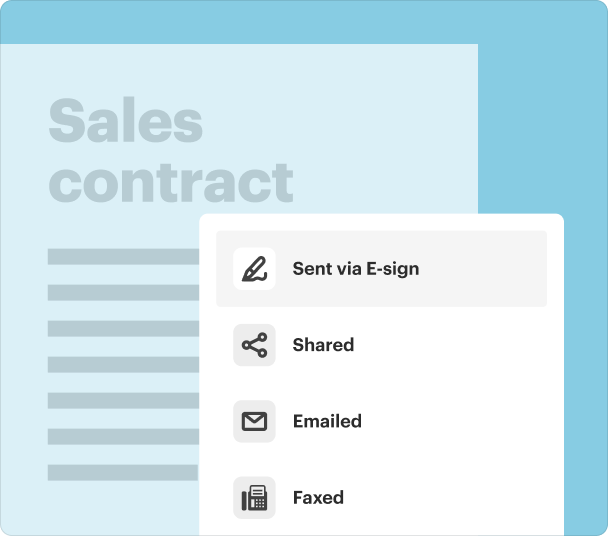

Share the document with other signatories, encouraging them to e-sign.

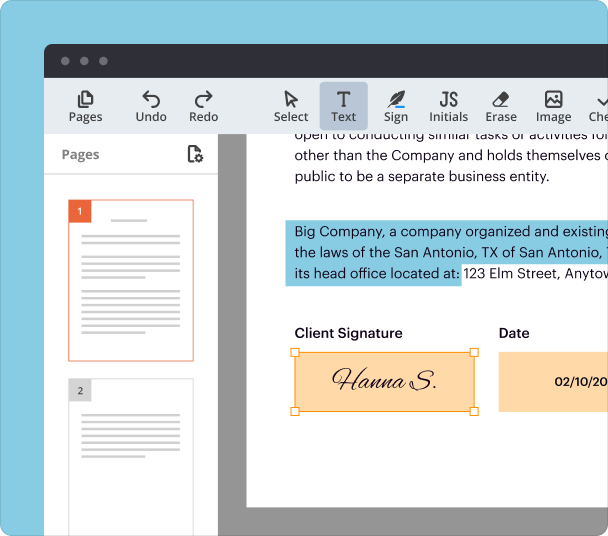

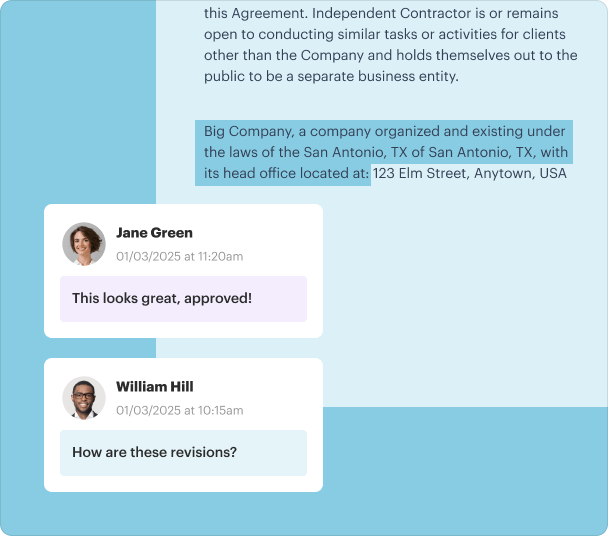

Options for customizing signatures, initials, and stamps when you write an e-signature tax sharing agreement

pdfFiller allows you to fully customize your signatures and initials within the document. Custom signatures can enhance the personalization of your agreement. You can also add stamps to validate documents easily.

-

Draw or upload a unique signature image for personalization.

-

Add initials to specific sections, improving clarity on responsibilities.

-

Utilize date stamps to confirm when the agreement was signed.

Managing and storing documents after you write an e-signature tax sharing agreement

Once your e-signature tax sharing agreement is finalized, pdfFiller provides robust options for managing and storing your documents securely. This can be critical in ensuring your agreements are easily accessible when needed.

-

Organize documents using folders within pdfFiller for easy access.

-

Utilize the search feature to quickly find any stored agreement.

-

Set permission levels for sharing, ensuring only authorized individuals have access.

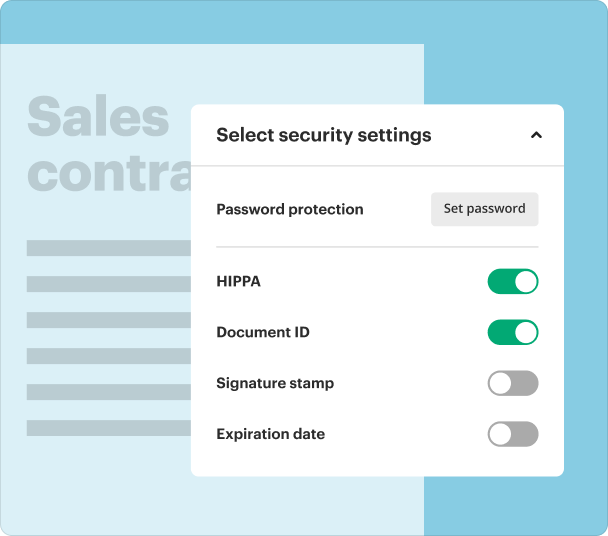

Security, compliance, and legal aspects when you write an e-signature tax sharing agreement

Security is paramount when dealing with sensitive financial documents. pdfFiller is designed to comply with industry standards for electronic signatures and data protection, ensuring that your agreements are legally binding and secure.

-

pdfFiller uses secure encryption to protect documents and signatures.

-

Compliance with eIDAS and ESIGN Act ensures that your digital agreements are valid.

-

Audit trails in pdfFiller provide records of edits and signatures for legal reference.

Alternatives to pdfFiller for writing e-signature tax sharing agreements

While pdfFiller offers a comprehensive solution, there are alternatives available on the market. Consider the following options, each with its own pros and cons:

-

DocuSign: Highly reputable for e-signatures but may lack some editing features.

-

Adobe Sign: Great integration features, yet potentially high costs for small businesses.

-

HelloSign: User-friendly with basic features, but limited options for document storage.

Conclusion

Writing an e-signature tax sharing agreement is an essential function in the modern digital landscape. Utilizing pdfFiller enables individuals and teams to create secure, compliant agreements effectively. By streamlining the process through electronic signatures and robust document management features, users can save time, reduce errors, and enhance collaboration.

How to send a document for signature?

Who needs this?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms