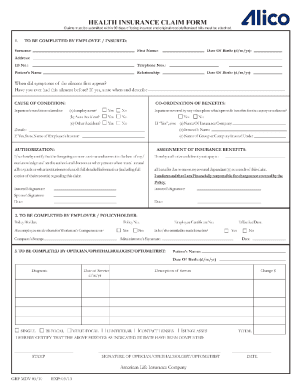

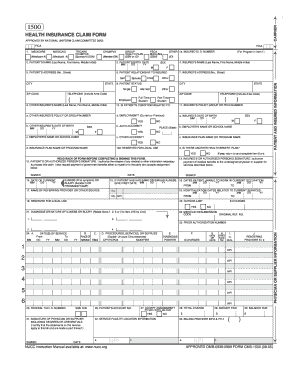

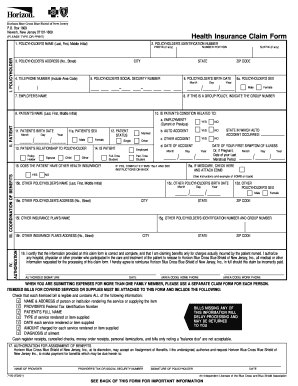

Health Insurance Claim Form

What is a Health Insurance Claim Form?

A Health Insurance Claim Form is a document used to request reimbursement for medical expenses incurred by policyholders. It contains important information such as patient details, treatment received, and costs incurred. Filing a claim form is crucial for insurance coverage and ensuring expenses are covered.

What are the types of Health Insurance Claim Form?

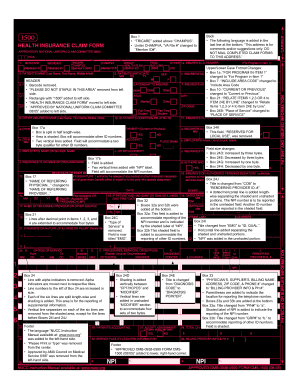

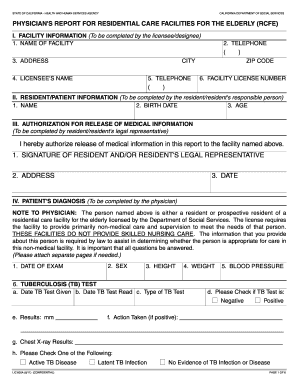

There are several types of Health Insurance Claim Forms, each serving a specific purpose. Some common types include:

How to complete Health Insurance Claim Form

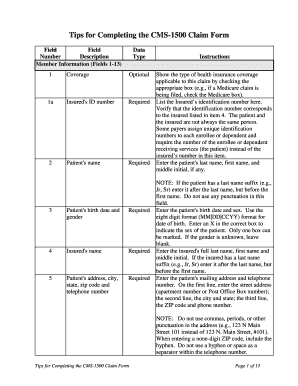

Completing a Health Insurance Claim Form may seem daunting, but it is essential for getting your medical expenses covered. Here are some steps to help you fill out the form accurately:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.