Form C Download - Page 2

What is Form C Download?

Form C download is a process that allows users to access and save a specific form from a website or online platform. This form typically serves a specific purpose, such as gathering information or requesting certain details from the user.

What are the types of Form C Download?

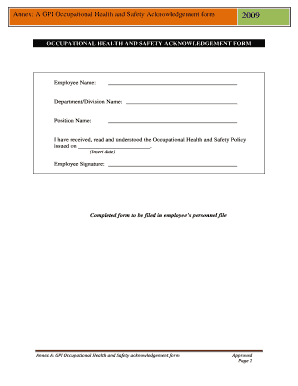

There are different types of Form C downloads available depending on the organization or entity providing the form. Some common types include:

Personal information form download

Tax declaration form download

Employment application form download

Consent form download

How to complete Form C Download

Completing a Form C download is a simple process that can be done in a few easy steps. Here's how:

01

Find the Form C download link on the website or platform.

02

Click on the link to access the form.

03

Fill out the required fields on the form.

04

Save the completed form to your device for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form c download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a Form C filing?

Form C is an offering statement that must be filed by any company conducting a Regulation Crowdfunding offering. Form Cs are submitted through the Securities and Exchange Commission's EDGAR online filing system.

What is a Form C in a business?

Form C is used for the offering statement as well as any related amendments (Form C/A) or progress reports (Form C-U) to that offering statement. Materials disclosed in the form help investors make an educated decision before putting their money into the company.

How do I file a 1040 C?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

What is the purpose of Form C?

'C' form helps to provide the buyer and sellers of goods and services concession on inter- state trade while filing the tax returns. A certificate, or C from, is required to conduct business between other states. It is given by the seller of the goods to the purchaser of the commodities in order to lower the tax rate.

What are the requirements for Form C-AR?

The Form C-AR is the annual report you are required to file with the SEC if you've successfully closed a crowdfunding round. Form C-AR will require disclosure substantially similar to the disclosure provided in the Form C, except you do not need to discuss securities being sold.

What is the Form C annual report?

What is the Form C-AR? The Form C-AR is the annual report you are required to file with the SEC after selling securities in a regulation crowdfunding campaign. Disclosures similar to the disclosures provided in the Form C are required except you do not need to discuss the securities being sold.