Credit Card Application Form Pdf - Page 2

What is Credit card application form pdf?

A Credit card application form pdf is a digital document used by financial institutions to collect information from individuals applying for a credit card. It is a convenient way for applicants to submit their details electronically and speed up the application process.

What are the types of Credit card application form pdf?

There are several types of Credit card application form pdf, including:

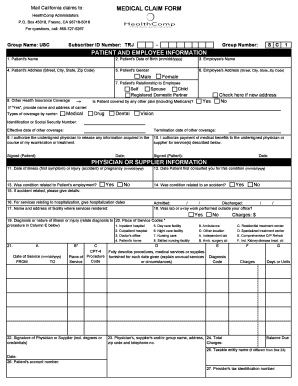

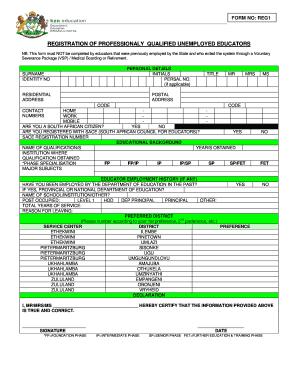

Basic personal information form

Employment and income verification form

Credit history questionnaire

How to complete Credit card application form pdf

To successfully complete a Credit card application form pdf, follow these steps:

01

Fill in your personal details accurately

02

Provide information about your employment and income

03

Answer questions regarding your credit history

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit card application form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How to fill out a credit card application form?

0:31 1:56 Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip Information in the next section. Provide your shipping and billing contact. Information.MoreInformation in the next section. Provide your shipping and billing contact. Information.

What is the credit card application form?

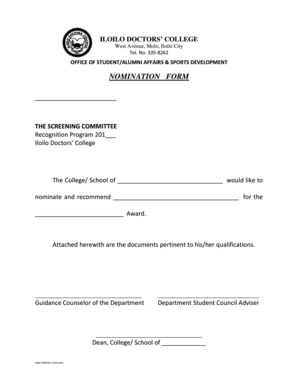

The credit card application is created to enable customers to apply for a credit card by providing basic personal and financial details. The applicant can also define preferences such as whether authorized users are to be added to the card and if balance transfers are to be defined.

How to create a credit card form?

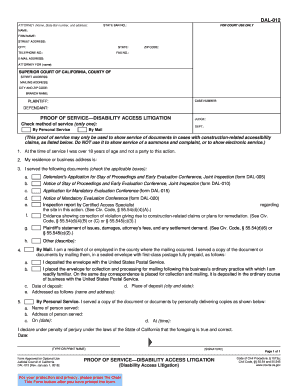

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

What is the importance of credit application form?

A credit application provides a path for mitigating risk, even though it does not eliminate it. Instead, it establishes rules between you (the seller) and your customer (the buyer), so both of you understand what's expected.

What do I need for a credit card application?

Most credit card applications require: Your full legal name. Your SSN and/or ITIN. Your street address. Your gross annual income. Your employment status. Your housing costs. Your phone number. Determine your credit health.

How to apply for a credit card from home?

How To Get Credit Card Easily in 3 Steps? Step 1: Choose your Credit Card. Each bank offers dozens of Credit Card options. Step 2: Apply for your card. Get all your documents ready – a bank will usually ask for identity, address and income proofs. Step 3: Activate your card.