Simple Loan Application Form Template

What is Simple loan application form template?

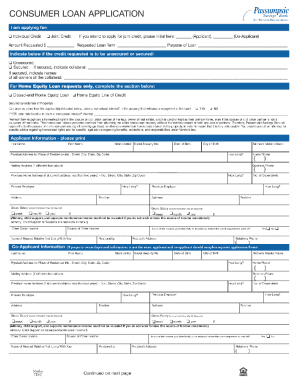

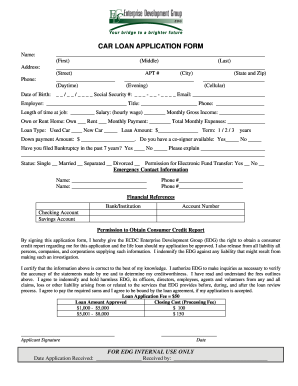

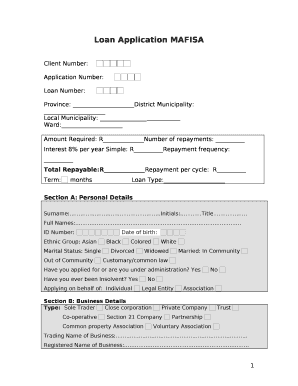

A Simple loan application form template is a ready-to-use document designed to collect essential information from individuals applying for loans. It simplifies the process by providing a structured layout that ensures all necessary details are captured accurately.

What are the types of Simple loan application form template?

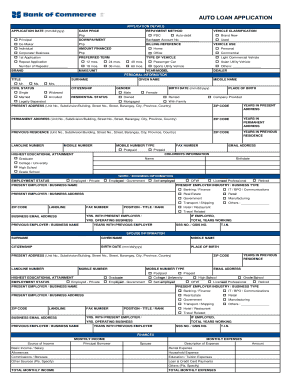

There are various types of Simple loan application form templates available to cater to specific loan types and purposes. Some common types include:

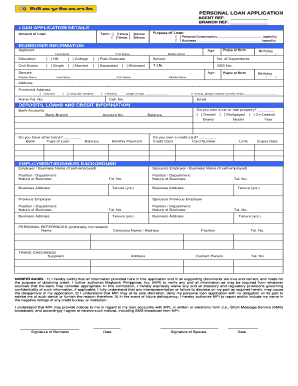

Personal loan application form template

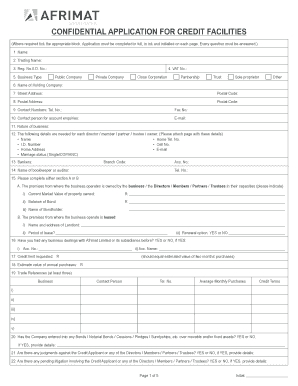

Business loan application form template

Mortgage loan application form template

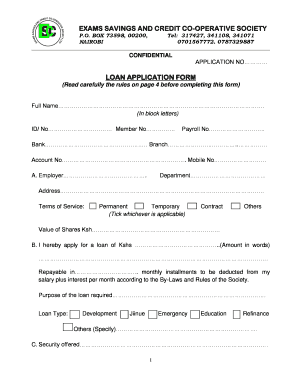

Student loan application form template

How to complete Simple loan application form template

Completing a Simple loan application form template is a straightforward process that can be done by following these steps:

01

Start by downloading the template from a reliable source

02

Fill in your personal information accurately

03

Provide details about the loan amount and purpose

04

Attach any required documents or proof of income

05

Review the completed form for accuracy before submitting

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What does it mean when your personal loan application is approved?

After your information is reviewed, you'll receive an approval letter stating your eligibility for the loan up to a specified amount. Conditional approval comes after initial approval and requires an underwriter to dig deeper into your income, credit and finances.

How do I write a simple loan application?

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. Mention the purpose of the loan. Assure the lender of repayment. Closing the business loan request letter.

What is a personal loan form?

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan. Whether you run a bank or work in another financial service, use our free Loan Application Form template to manage loans online!

How do I make a simple application form?

And there are a few best practices to make sure you reduce your application form abandonment rate. Be straight to the point. Don't waste applicants' time with unnecessary questions or wordy statements. Think about the information you need. Use personalization. Create an organized form structure. Use automation.

What is a loan application form?

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan.

What is a personal loan application form?

Loan application forms are used to gather the following types of information: Personal details and contact information. Employment status and history. Current income and outgoings (especially related to dependents, child support, alimony, etc.)