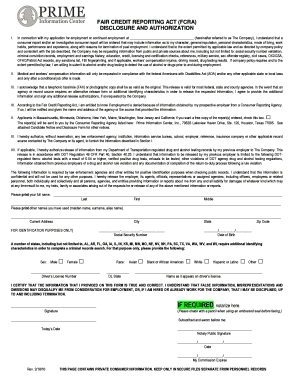

Fcra Form Download

What is Fcra form download?

Fcra form download is a document that individuals can access to obtain information or make requests related to their credit reports. It allows users to have a copy of their credit report and dispute any inaccuracies they may find.

What are the types of Fcra form download?

There are several types of Fcra form downloads available to users depending on their specific needs. Some common types include:

Fcra form for requesting a free credit report

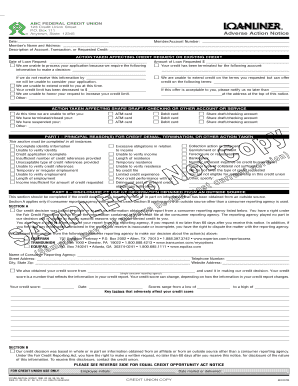

Fcra form for disputing errors on a credit report

Fcra form for requesting fraud alerts or security freezes

How to complete Fcra form download

Completing an Fcra form download is a simple process that can be done in a few easy steps. Here is a guide to help you complete the form:

01

Download the Fcra form from a trusted source or website

02

Fill in your personal information accurately

03

Check the specific purpose of your request and provide any additional required information

04

Review the form for accuracy and completeness before submitting

05

Submit the completed form through the appropriate channels

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fcra form download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

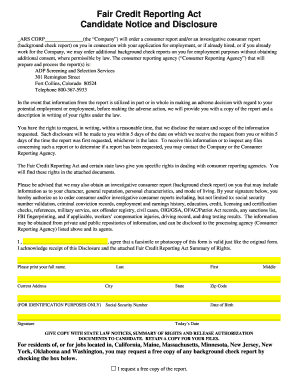

What are FCRA forms?

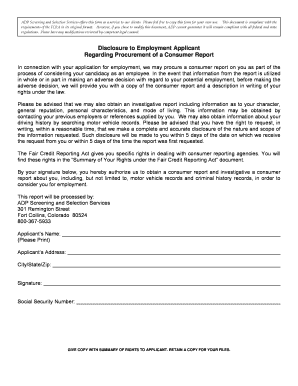

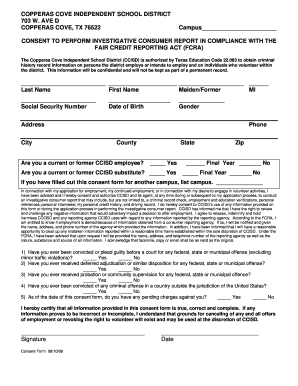

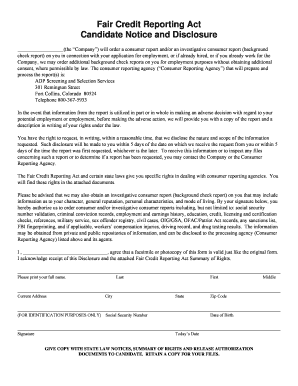

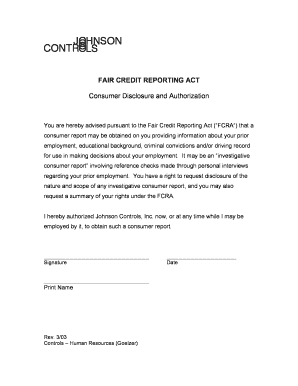

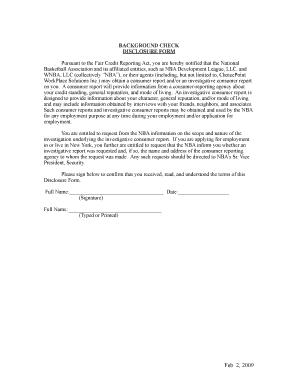

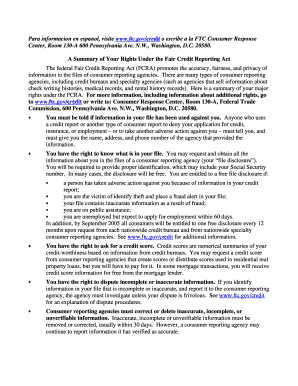

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

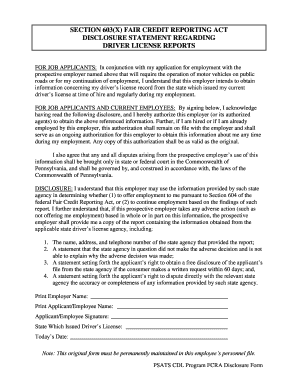

What is covered under the FCRA?

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Is FCRA free?

Consumers are entitled to one free credit report every 12 months from each of the three nationwide credit bureaus.

What is the FCRA requirements?

The FCRA requires a lender, insurance company, creditor and anyone else seeking your credit report to have a legally permissible purpose to do so. As credit ages, negative credit information will begin to “fall off” your credit report.

What is a FCRA letter?

Fill Now Click to fill, edit and sign this form now! Updated on June 8th, 2023. An adverse action letter explains to an applying individual that they have been denied access to financial-related benefits or employment.