Risk-based Pricing Disclosure Pdf

What is Risk-based pricing disclosure pdf?

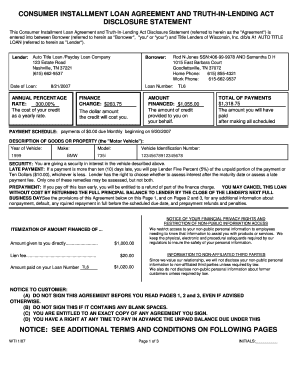

Risk-based pricing disclosure pdf is a document that provides information about how lenders determine interest rates based on an individual's creditworthiness and other relevant factors. This disclosure is designed to help consumers understand the factors that may impact the interest rates they are offered.

What are the types of Risk-based pricing disclosure pdf?

There are several types of Risk-based pricing disclosure pdf documents that lenders may use. Some common types include:

How to complete Risk-based pricing disclosure pdf

Completing a Risk-based pricing disclosure pdf is a straightforward process that can help you better understand the terms of your loan. Here are some steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.