Credit Score Disclosure Form Pdf

What is Credit score disclosure form pdf?

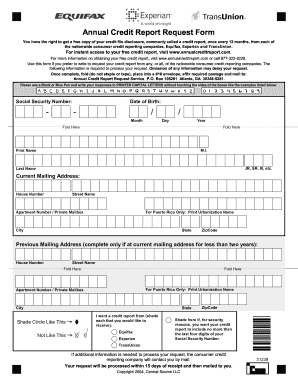

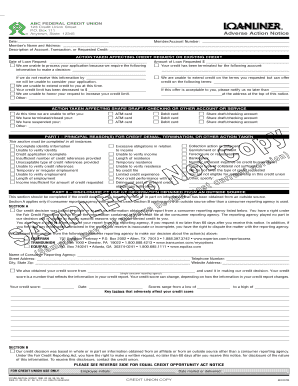

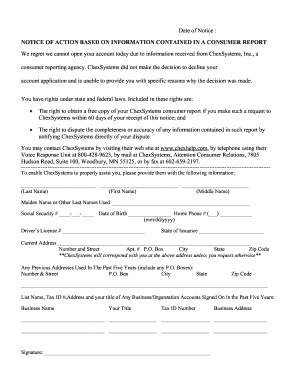

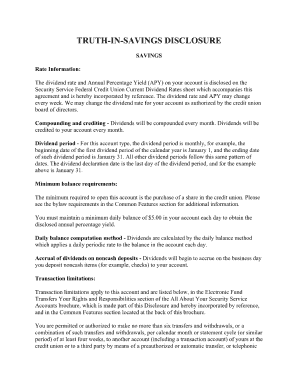

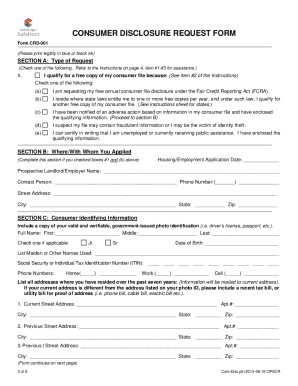

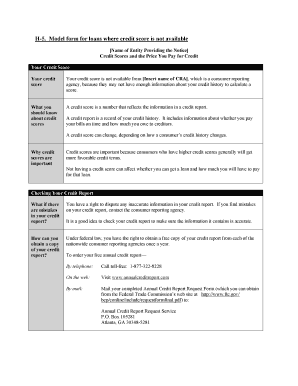

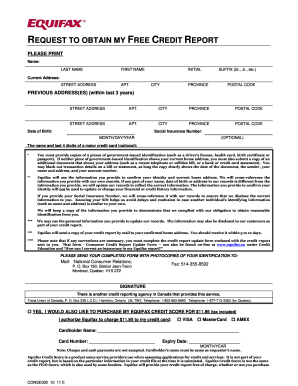

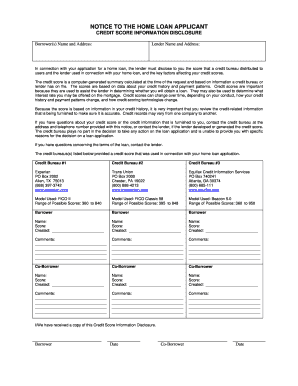

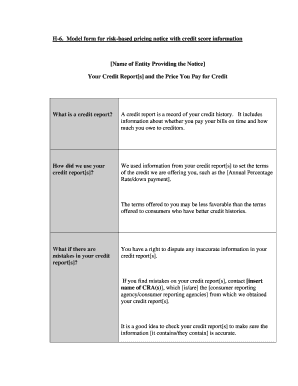

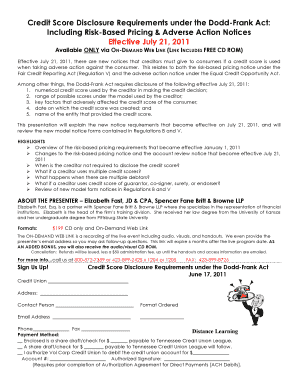

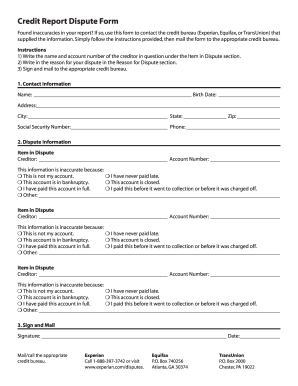

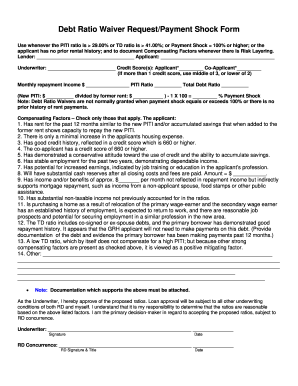

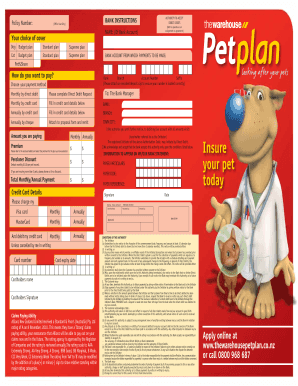

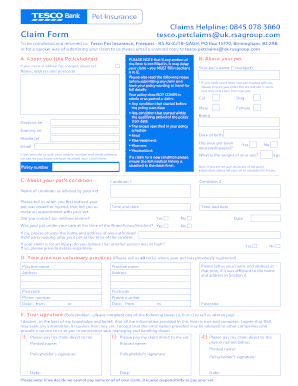

A Credit score disclosure form pdf is a document that provides individuals with information regarding their credit score. It includes details such as the individual's credit history, credit inquiries, and any negative factors impacting their credit score. This form is essential for individuals to understand their creditworthiness and take necessary steps to improve their credit score.

What are the types of Credit score disclosure form pdf?

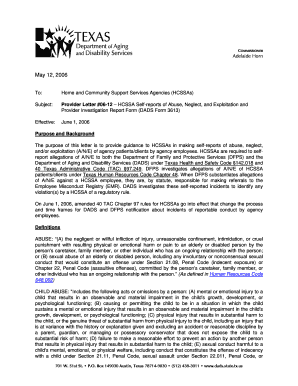

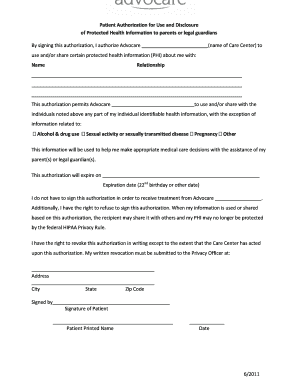

There are different types of Credit score disclosure forms pdf available, including:

How to complete Credit score disclosure form pdf

Completing a Credit score disclosure form pdf is easy and straightforward. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. pdfFiller is the only PDF editor users need to get their documents done efficiently and effectively.