Reg B Adverse Action Notice Model Form

What is Reg b adverse action notice model form?

The Reg B Adverse Action Notice Model form is a standardized document provided to applicants who have been denied credit or another type of financial accommodation based on information contained in their credit report.

What are the types of Reg b adverse action notice model form?

There are two main types of Reg B Adverse Action Notice Model forms: the Credit Score Notice and the Credit Report Notice.

Credit Score Notice

Credit Report Notice

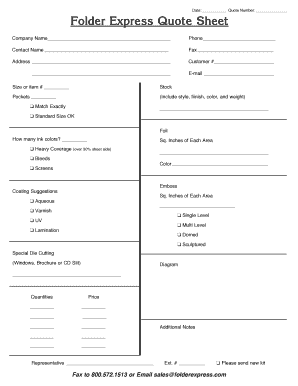

How to complete Reg b adverse action notice model form

Completing the Reg B Adverse Action Notice Model form is a straightforward process. Here are the steps to follow:

01

Enter the applicant's personal information in the designated fields

02

Specify the reason for the adverse action taken

03

Include contact information for the creditor or financial institution issuing the notice

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Reg b adverse action notice model form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

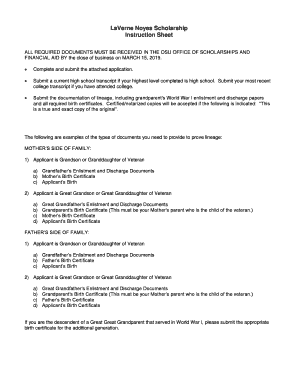

What is a Reg B statement of adverse action?

If adverse action is taken, as defined in the ECOA and Regulation B, the creditor must provide an adverse action notice (AAN) disclosing the reasons for taking adverse action, and, if a credit score was used, the key factors adversely affecting the score.

How do I fill out an adverse action notice?

The adverse action notice must: Give notice of the adverse action. Give the name, address, and telephone number of the credit reporting agency which provided the credit report (the telephone number must be toll free if the agency compiles and maintains consumer files on a nationwide basis).

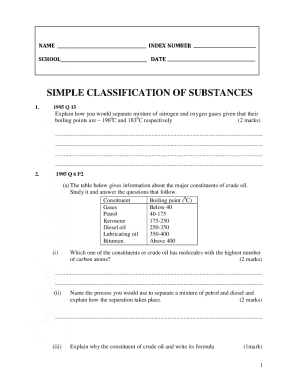

What is a Reg B form?

Regulation B covers the actions of a creditor before, during, and after a credit transaction. The CFPB protects the following credit applications and transactions for consumers: • Consumer credit. • Business credit. • Mortgage and open-end credit.

What are the requirements for adverse action under Reg B?

For businesses with gross annual revenues greater than $1 million, Regulation B requires only that a creditor provide notice within a reasonable time. A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application.

What are the requirements of Regulation B?

Regulation B prohibits creditors from requesting and collecting specific personal information about an applicant that has no bearing on the applicant's ability or willingness to repay the credit requested and could be used to discriminate against the applicant.

What is Regulation B disclosure requirements?

In January 2013, CFPB amended Regulation B to reflect the Dodd-Frank Act amendments requiring creditors to provide applicants with free copies of all appraisals and other written valuations developed in connection with all credit applications to be secured by a first lien on a dwelling.