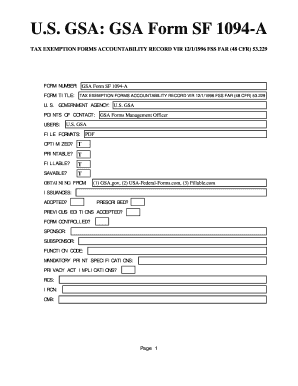

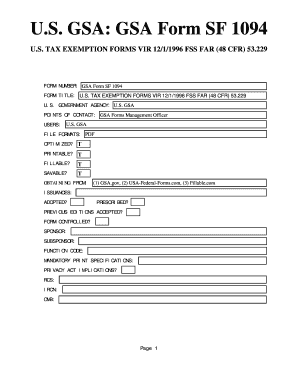

12 Cfr 229

What is 12 cfr 229?

12 CFR 229, also known as Regulation CC, is a federal regulation that governs the availability of funds deposited in checking accounts and the collection and return of checks. It establishes the maximum time a bank can hold funds before they are made available for withdrawal.

What are the types of 12 cfr 229?

There are two main types of 12 CFR 229: Regulation CC for Funds Availability and Regulation CC for Check Collection. These regulations outline the rules and procedures that financial institutions must follow when handling deposits and checks.

How to complete 12 cfr 229

To ensure compliance with 12 CFR 229, financial institutions should:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.