Vehicle Donation Receipt

What is Vehicle donation receipt?

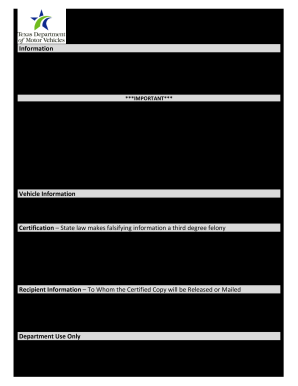

A vehicle donation receipt is a document provided to the donor by a charitable organization when they donate a vehicle. It serves as proof of the donation for the donor's tax purposes.

What are the types of Vehicle donation receipt?

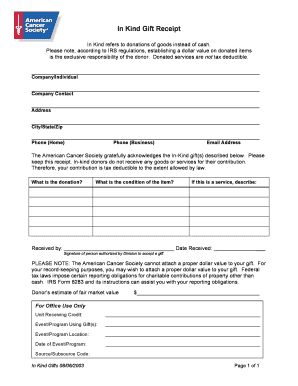

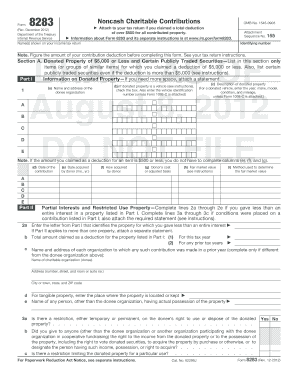

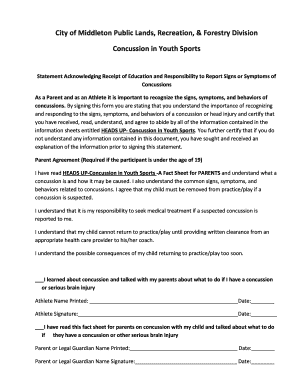

There are two main types of vehicle donation receipts: written acknowledgment and IRS Form 1098-C. Written acknowledgment is provided for donations under $250, while IRS Form 1098-C is required for donations over $500.

Written acknowledgment

IRS Form 1098-C

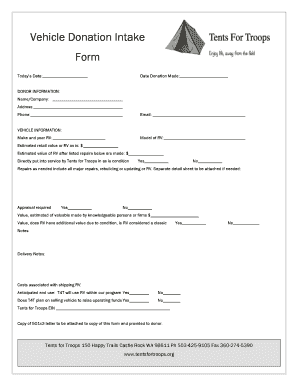

How to complete Vehicle donation receipt

Completing a vehicle donation receipt is a straightforward process. Here are the steps to follow:

01

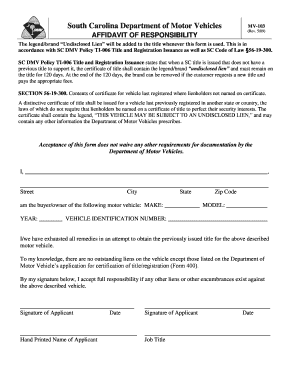

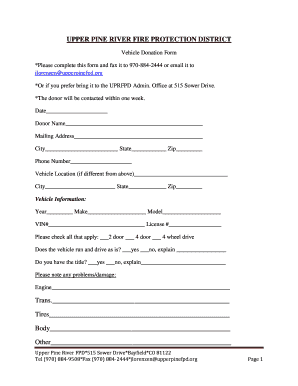

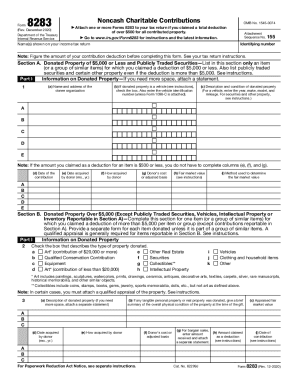

Contact the charitable organization and request a vehicle donation receipt form.

02

Fill out the form with accurate details about your donation, including the vehicle description and estimated value.

03

Have the charitable organization sign and date the receipt.

04

Keep a copy of the completed receipt for your records.

05

Submit the original receipt along with your tax return for deduction purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Vehicle donation receipt

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Are donations 100% tax write off?

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income.

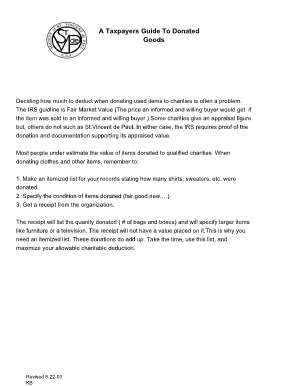

What should be included in a donation receipt?

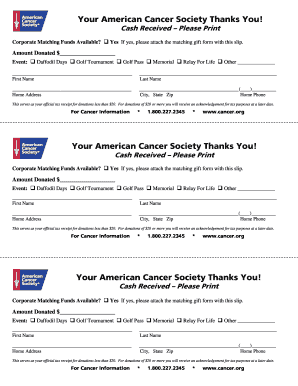

How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

Is donating a car worth the tax write off?

Usually, yes. Of course, the car's value won't be much, so donating a car that doesn't run isn't likely to qualify for a tax deduction. Still, many charities will accept old cars that no longer work, which they then sell to junkyards or auction off to people looking for parts or scrap.

How much of a tax break do you get for donating?

How much can you donate to charity for a tax deduction? Generally, itemizers can deduct 20% to 60% of their adjusted gross income for charitable donations. The exact percentage depends on the type of qualified contribution as well as the charity or organization.

How much of a tax write off for donating a car?

How much can I deduct? Once your vehicle is sold, the selling price determines the amount of your donation. If your vehicle sells for more than $500, you may deduct the full selling price. If your vehicle sells for $500 or less, you can deduct the “fair market value” of your vehicle, up to $500.

Is donating a car a good tax write off?

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status. Nonprofit How-to: Creating a Donation Receipt - Classy classy.org https://.classy.org › blog › creating-a-donation-receipt classy.org https://.classy.org › blog › creating-a-donation-receipt