Donation Register Template

What is Donation register template?

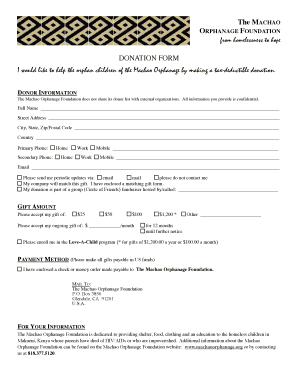

A Donation register template is a document used to keep track of donations received by an organization. It helps maintain a record of donors, donation amounts, and dates of donations.

What are the types of Donation register template?

There are several types of Donation register templates available, including:

Basic Donation register template

Detailed Donation register template

Yearly Donation register template

Event-specific Donation register template

How to complete Donation register template

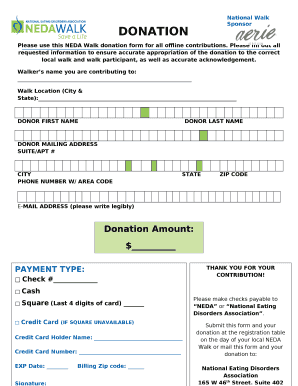

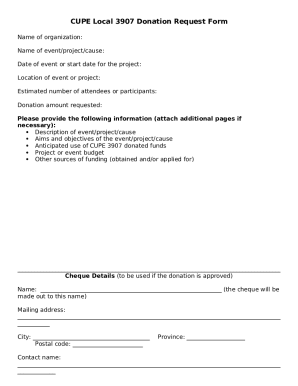

To complete a Donation register template, follow these simple steps:

01

Fill in the donor's name, contact information, and donation amount.

02

Record the date of the donation and any specific instructions from the donor.

03

Ensure all information is accurately entered and organized in the template.

04

Save and store the completed template for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Donation register template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

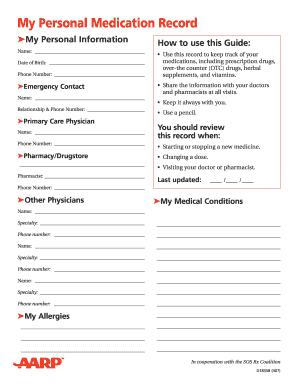

How do you record donations for a non profit?

How To Document Cash Donations. Your nonprofit treasurer should record cash donations in your statement of activities, which is a component of your complete financial statement that provides a net change in assets over the course of the year. In other words, it is a picture of how "profitable" your nonprofit agency is.

How to set up a bank account for donations for an individual?

Speak to a bank representative about opening an account to accept donations for charity. The representative will go over the options available, such as the different ways people can donate money to the account. The representative presents an application for you to complete after going over the options with you.

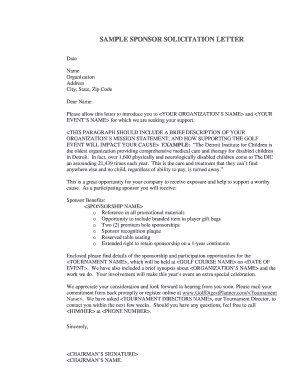

What do you say when asking for donations examples?

Dear [Donor Name], Today, I'm writing to ask you to support [cause]. By donating just [amount], you can [specific impact]. To donate, [specific action]. Thank you for joining [cause's] efforts during this [adjective] time—It's supporters like you that help us change the world every day.

How do you write off donations to a non profit?

To claim a deduction for charitable donations on your taxes, you must have received nothing in return for your gift, and you must itemize on your tax return by filing Schedule A of IRS Form 1040.

What is the journal entry for donated assets non profit?

Non-For-Profit Accounting: Journal Entries If the asset passes as such and is substantial, then debit "Expense" and credit "Unrestricted Contributions." If someone donates a substantial amount but the asset is not passed to another person, then record the donation by debiting "Assets" and crediting "Contributions."

What is the journal entry for a donation?

When you make a donation of your own products or inventory, keep in mind that you are giving away a product, not selling it. To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods.