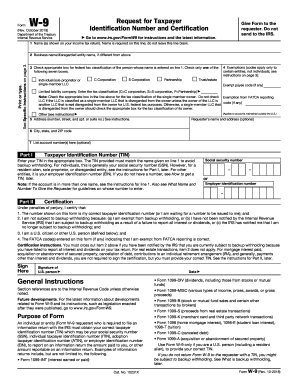

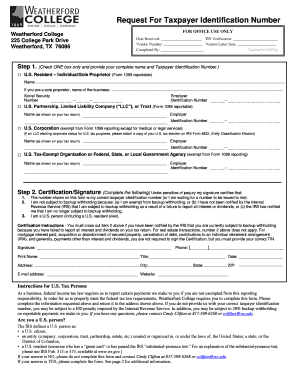

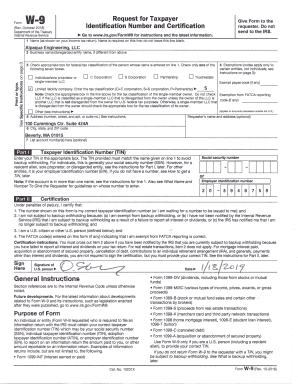

Request Letter For Tax Identification Number

What is Request letter for tax identification number?

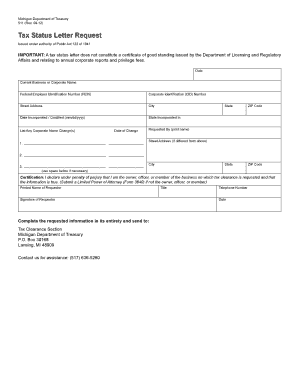

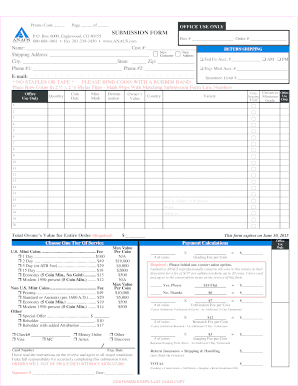

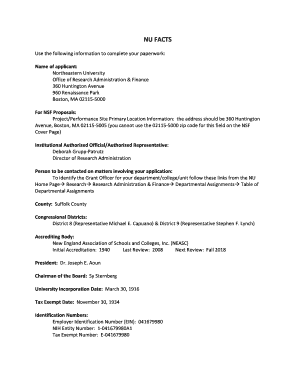

A request letter for tax identification number is a formal document used to request a TIN from the relevant tax authority. It is necessary for individuals or businesses who need to be assigned a unique identification number for tax purposes.

What are the types of Request letter for tax identification number?

There are two main types of request letters for tax identification numbers: individual request letters and business request letters.

Individual request letters: These are used by individuals who need a TIN for personal tax purposes.

Business request letters: These are used by businesses or organizations that require a TIN for tax reporting and compliance.

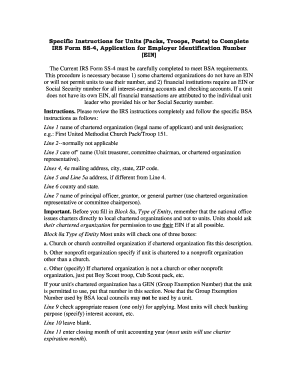

How to complete Request letter for tax identification number

To complete a request letter for tax identification number, follow these steps:

01

Gather all necessary personal or business information required for the application.

02

Address the letter to the appropriate tax authority or department.

03

Clearly state the purpose of the request and provide any relevant details.

04

Include contact information for follow-up communication if needed.

05

Sign and date the letter before sending it out.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Request letter for tax identification number

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is a tax ID the same as a SSN?

A tax identification number (TIN) is used for filing tax returns and exists in different forms. A Social Security number (SSN) is a type of tax ID number just like an Employer Identification Number (EIN) is, the difference being the former is for individuals and the latter for businesses.

How do I ask for a tax ID number?

You can use the IRS's Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number (ITIN). To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number.

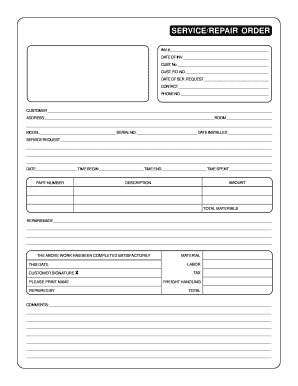

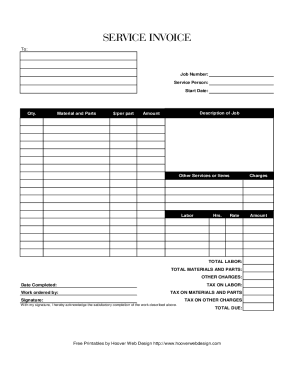

Why would a customer ask for a tax ID number?

When the EIN of your business is included on invoices submitted to clients and buyers, it allows clients who catalog contract payments by EINs to maintain a running tally of funds paid to individual businesses. This expedites the sending of income tax forms at the end of the tax year.

What is the fastest way to get a tax ID number?

You can get an EIN immediately by applying online.

What is a TIN letter?

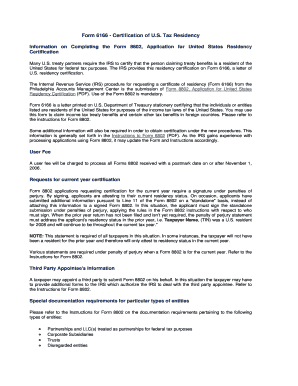

Taxpayer Identification Numbers (TIN).

How do I get an EIN letter from the IRS?

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are 7:00 a.m. - 7:00 p.m. local time, Monday through Friday.