W-9 Form Download - Page 2

What is W-9 form download?

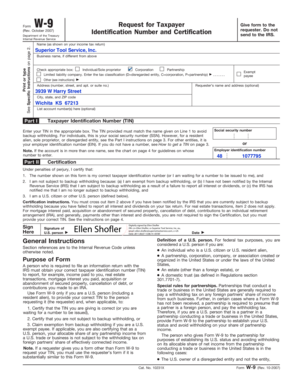

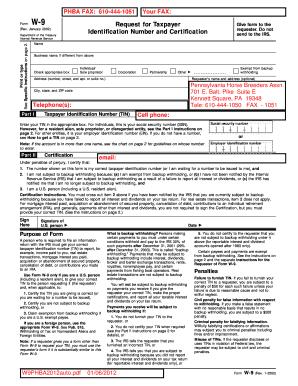

The W-9 form is a document used by businesses to gather information from individuals providing services as independent contractors or freelancers. It is used to collect the taxpayer identification number (TIN) of the individual or entity to whom the payment is being made.

What are the types of W-9 form download?

There are two main types of W-9 form downloads:

Blank W-9 form: This is a blank template of the W-9 form that can be filled out manually by hand.

Fillable W-9 form: This is an electronic version of the W-9 form that can be filled out digitally on a computer or mobile device.

How to complete W-9 form download

To complete a W-9 form download, follow these steps:

01

Download the W-9 form from a trusted source such as the IRS website.

02

Fill out the personal information section including name, address, and TIN.

03

Sign and date the form to certify the accuracy of the information provided.

Remember, pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. pdfFiller is the only PDF editor you need to get your documents done.

Video Tutorial How to Fill Out W-9 form download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the latest version of the W9?

The IRS's most updated revision of the W9 form was in October 2018. This form is the current version that is used for all succeeding tax years.

Can I download a W 9 form?

The W-9 can be downloaded from the IRS website, and the business must then provide a completed W-9 to every employer it works for to verify its EIN for reporting purposes.

How do I get a W9 form online?

Most employers will provide you with a blank W-9 as a part of standard onboarding. Visit the IRS website to download a free W-9 Form from IRS website if you haven't received your form.

Is W9 form mandatory?

When is a W9 Not Required? A W9 from vendors is not required when payments will be less than $600 in a calendar year, but it is a good idea to request a W9 from all vendors. Also a W9 is not required when payments are not associated with conducting a trade or business.

Is there an electronic W9 form?

It can be called a “request for taxpayer identification number and certification” but “W-9” is more typically used. W-9s can be e-signed and sent back to you digitally, saving time for contract workers and companies alike.

How do I fill out a W 9 for an individual?

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. Choose your federal tax classification. Choose your exemptions. Enter your street address. Enter the rest of your address. Enter your requester's information.