Individual Taxpayer Identification Number - Page 2

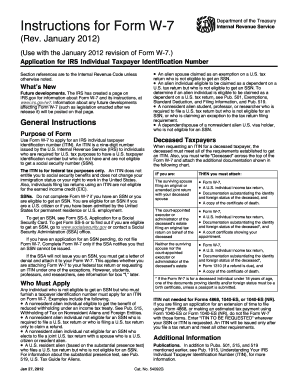

What is an Individual Taxpayer Identification Number?

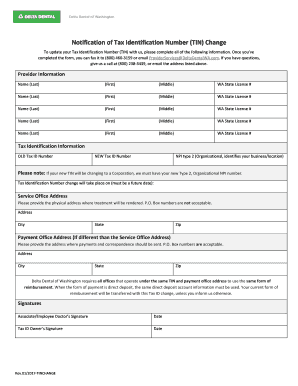

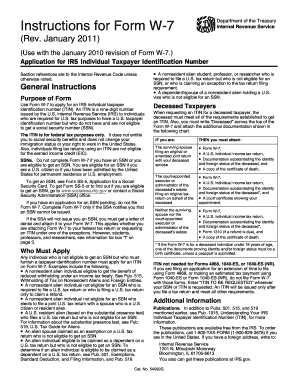

An Individual Taxpayer Identification Number, or ITIN, is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are required to pay federal taxes in the United States but do not qualify for a Social Security Number (SSN). It is a nine-digit number that is used for tax purposes only.

What are the types of Individual Taxpayer Identification Numbers?

There are two main types of Individual Taxpayer Identification Numbers. The first type is the regular ITIN, which is issued to individuals who are not eligible for an SSN but need to file their taxes. The second type is the ITIN for dependents, which is issued to individuals who have dependents that they need to claim on their tax returns.

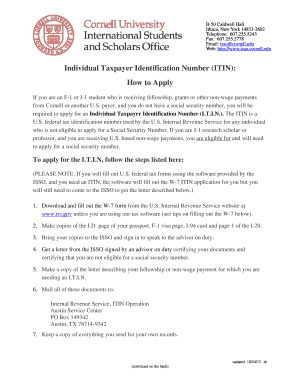

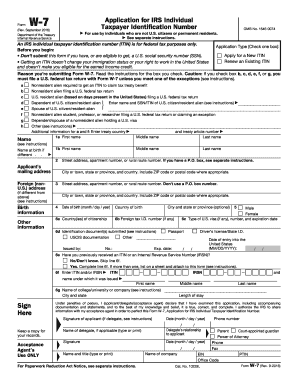

How to complete an Individual Taxpayer Identification Number

To complete an Individual Taxpayer Identification Number application, you will need to fill out Form W-7, Application for IRS Individual Taxpayer Identification Number. You will need to provide supporting documentation to prove your identity and foreign status. Once you have completed the form and gathered the necessary documents, you can submit your application to the IRS for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.