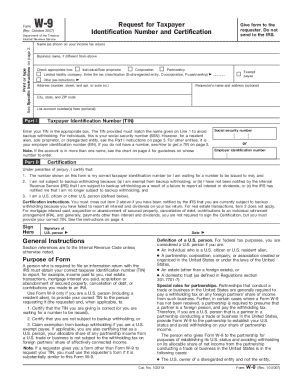

W-9 Request Letter To Vendors

What is W-9 request letter to vendors?

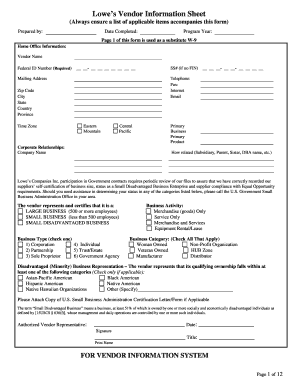

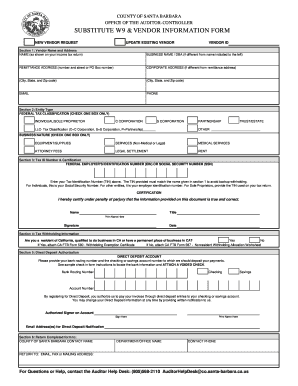

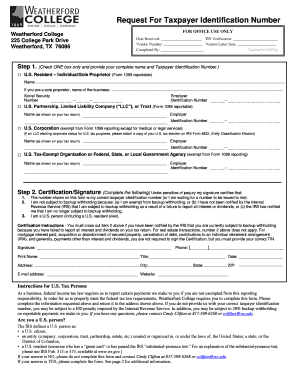

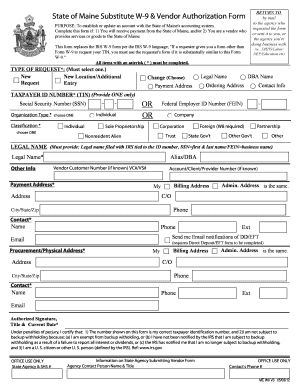

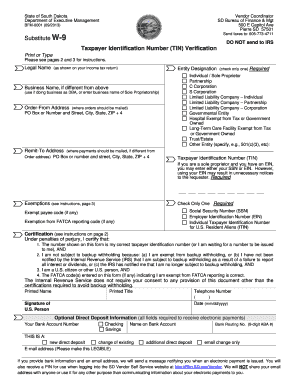

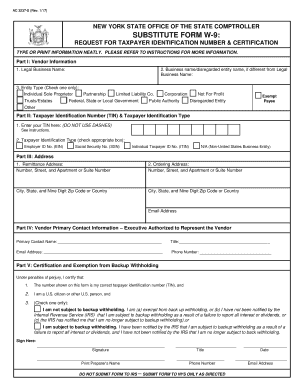

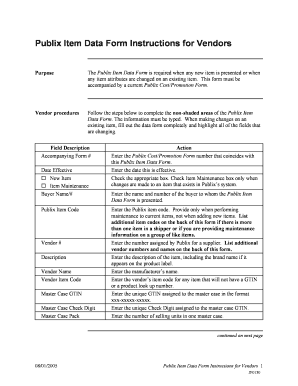

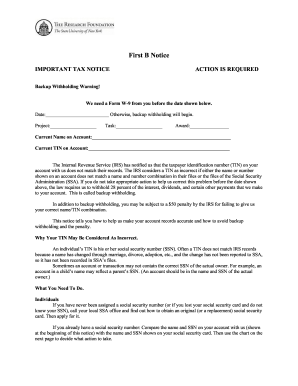

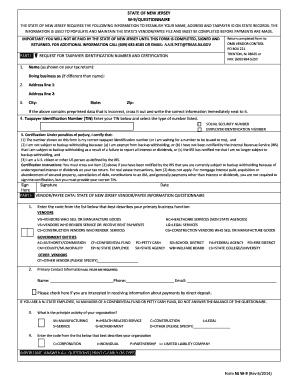

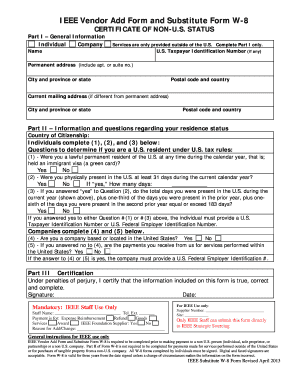

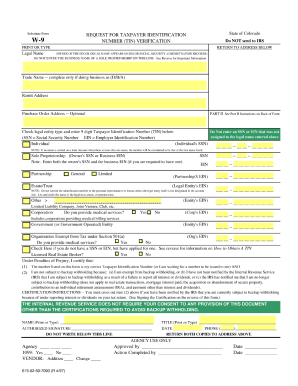

A W-9 request letter to vendors is a formal request sent by businesses to vendors requesting them to provide their taxpayer identification number (TIN) for tax reporting purposes. This is necessary for businesses to accurately report payments made to vendors to the IRS.

What are the types of W-9 request letter to vendors?

There are mainly two types of W-9 request letters that businesses send to vendors:

Initial Request: This is the first request sent to a vendor asking them to provide their W-9 information.

Follow-Up Request: If the vendor fails to respond to the initial request, a follow-up request is sent to remind them to submit the required information.

How to complete W-9 request letter to vendors

To complete a W-9 request letter to vendors, follow these steps:

01

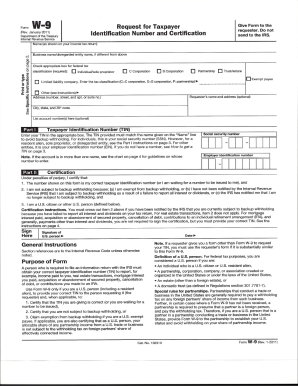

Download a W-9 form from the IRS website.

02

Fill out the business information section on the form.

03

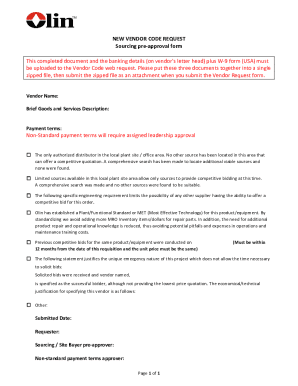

Include a cover letter explaining the purpose of the request and how to submit the completed W-9 form.

04

Send the W-9 request letter along with the W-9 form to the vendor via email or mail.

05

Follow up with the vendor if they fail to respond within a reasonable time frame.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out W-9 request letter to vendors

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a sample letter to request a W9 from a vendor?

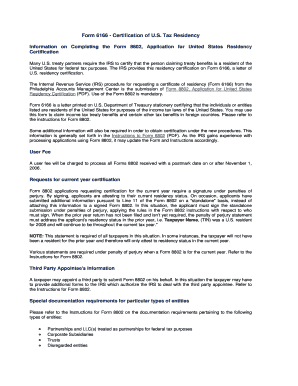

Dear Vendor, Enclosed is Form W-9, Request for Taxpayer Identification Number and Certification. IRS regulations require that we issue 1099 forms to certain companies and individuals. In order to accurately prepare these forms, the IRS requires that we obtain and maintain form W-9 for all of our vendors.

What is an example of a letter requesting W9?

Dear (name of company or individual): Enclosed please find IRS Form W-9, “Request for Taxpayer Identification Number and Certification”. We are required by the Internal Revenue Service to obtain this information from you to determine if we have to issue you a 1099 at the calendar year end.

How do I ask a vendor for a W9?

Be transparent when asking for a completed W-9. Explain that you suspect a business relationship with the vendor might result in a required Form 1099 filing, at which point you'll need the information on the W-9. Mention your secure document management system that allows only key employees access to personnel files.

Should I request a W9 from all vendors?

A W9 from vendors is not required when payments will be less than $600 in a calendar year, but it is a good idea to request a W9 from all vendors. Also a W9 is not required when payments are not associated with conducting a trade or business.

When should I ask my vendor for W9?

When do I need to request a Form W-9? As a small business owner, it is important to collect a W-9 for any person or entity you pay more than $600 in a tax year. You will use the information provided to you on the W-9 to complete Form 1099-NEC, Nonemployee Compensation, or Form 1099-MISC, Miscellaneous Income.

What do I do if my vendor won't provide a W9?

If the independent contractor doesn't provide you with Form W-9 you must withhold tax from payments to that person. This is referred to backup withholding and should be withheld at the rate of 24% and then submitted to the IRS. Form 945 will also need to be filed to report the withheld tax.