Help To Buy And Right To Buy

What is Help to buy and right to buy?

Help to buy and right to buy are government schemes designed to help individuals in the UK get on the property ladder. They provide financial assistance or discounts to make buying a home more affordable.

What are the types of Help to buy and right to buy?

There are several types of Help to buy and right to buy schemes available, including:

Help to Buy ISA

Shared Ownership

Right to Buy

Equity Loan Scheme

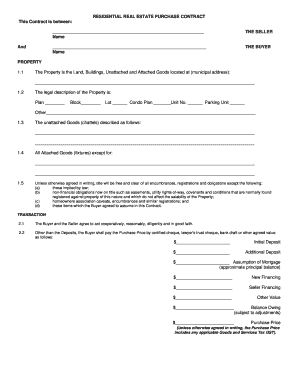

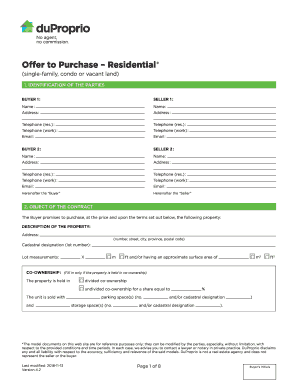

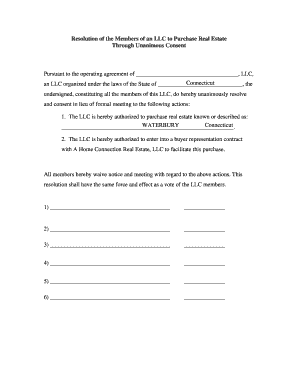

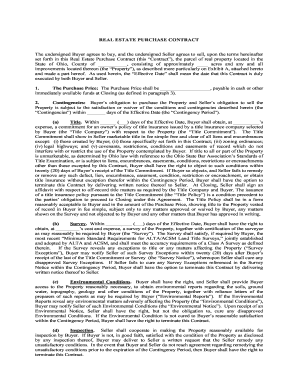

How to complete Help to buy and right to buy

Completing the Help to buy and right to buy process is simple with the following steps:

01

Research and choose the right scheme for you

02

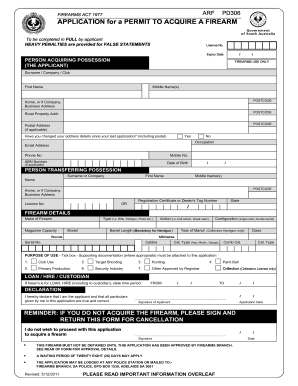

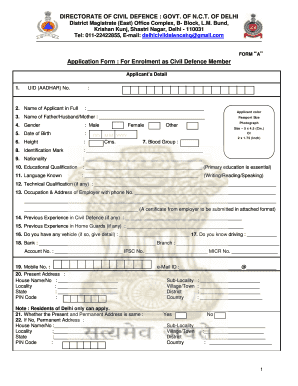

Check your eligibility and gather necessary documents

03

Submit your application

04

Consult with a financial advisor if needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Help to buy and right to buy

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is 5% enough for a house deposit?

Usually, 20% of the full value of the house is a good amount to aim for as a deposit. You can still get a loan if you have a smaller deposit, but you may need to take out Lenders Mortgage Insurance (LMI) which adds an additional cost to your loan. It'll also take longer to pay off.

How much deposit do I need for a 100 000 House?

How much deposit do you need to get a mortgage? 5% of a property's value is the minimum deposit you could have but very few lenders will be open to such a low amount. The bigger deposit, the better rates and mortgage deals you'll be able to find as more lenders will be willing to consider your application.

How much deposit do I need for a house?

Before looking at properties, you need to save for a deposit. Generally, you need to try to save at least 5% of the cost of the home you'd like to buy.

How much of a deposit do I need for a 250k house?

Generally, lenders are comfortable with 80-85 per cent mortgages or below, so if you have enough deposit to cover 15-20 per cent of your property's price, you should be able to borrow up to 4.5 times your income.

How much is a downpayment on a 200k house?

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If you're buying a home for $200,000, in this case, you'll need $10,000 to secure a home loan.