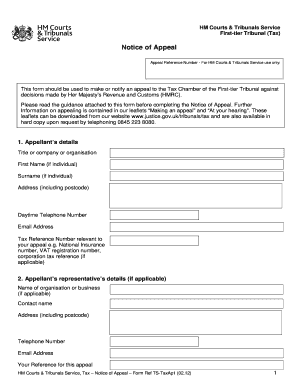

First Tier Tax Tribunal Phone Number - Page 2

What is First tier tax tribunal phone number?

The First-tier Tax Tribunal phone number is a direct line of contact provided by the UK government for individuals to address their tax-related issues and disputes. It serves as a crucial point of communication between taxpayers and the tribunal to seek resolution and clarify tax matters.

What are the types of First tier tax tribunal phone number?

There are primarily two types of First-tier Tax Tribunal phone numbers: general inquiry lines and dedicated support lines for specific tax issues. General inquiry lines cater to a wide range of tax queries, while dedicated lines focus on specialized areas like income tax, VAT, or corporation tax.

How to complete First tier tax tribunal phone number

Completing the First-tier Tax Tribunal phone number process is simple and efficient. To reach the tribunal, follow these steps:

By utilizing the First-tier Tax Tribunal phone number and following the steps outlined above, you can effectively address your tax issues and ensure clarity and resolution. Additionally, pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools to streamline document management.