Help To Buy Application Form

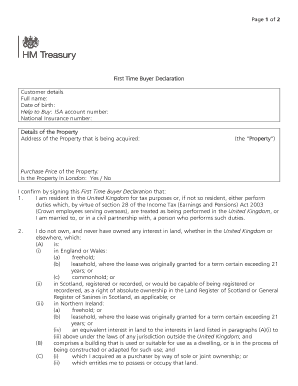

What is Help to buy application form?

The Help to Buy application form is a document that individuals utilize to apply for the government-backed scheme designed to help people purchase a home with as little as a 5% deposit.

What are the types of Help to buy application form?

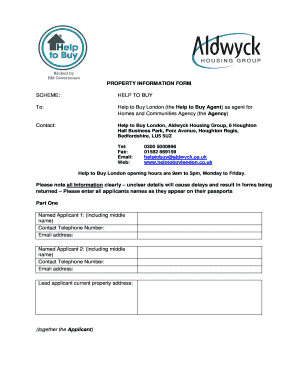

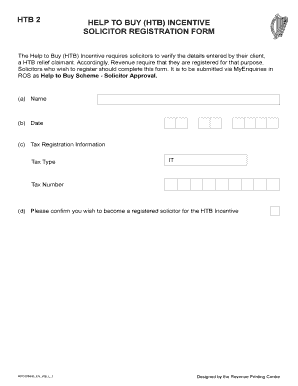

There are primarily two types of Help to Buy application forms: the Help to Buy ISA application form and the Help to Buy equity loan application form.

Help to Buy ISA application form

Help to Buy equity loan application form

How to complete Help to buy application form

To successfully complete the Help to Buy application form, follow these steps:

01

Gather all necessary documents such as proof of identity and income

02

Fill out the form accurately and truthfully

03

Submit the completed form online or by mail to the designated address

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Help to buy application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the help to buy scheme Scotland?

The Help to Buy (Scotland) Affordable New Build Scheme allows you to repay all or part of the equity stake held by the Scottish Government, often referred to as “tranching up”. than when originally purchased. You may increase your share up to 100% if you choose to do so.

Can I use the equity in my house as a deposit?

Yes, if you have enough equity in your current home, you can use the money from a home equity loan to make a down payment on another home—or even buy another home outright without a mortgage.

Can I use the equity in my house as a deposit UK?

In short, yes you can. In fact, this is by far the most common way people make use of the equity they have built up in their homes. By using the equity as a deposit, you'll lower the amount you'll need to borrow for your new mortgage, thus lowering your loan to value (LTV).

How do I withdraw money from my home equity?

Overview of options for cashing out your home equity The most common options for tapping equity in your home are a home equity loan, HELOC or cash-out refinance. A home equity loan is an installment loan based on your home's equity. A home equity line of credit (HELOC) is a credit line based on your home equity.

How do I contact help to buy Wales?

Tel: 08000 937 937 General enquiries: enquiries@helptobuywales.co.uk Website: . gov. wales/helptobuy This form is available in other formats and in Welsh on request. Please contact us to discuss your needs.

How can I release money from my house UK?

Equity release works by borrowing cash against the value of your home. There are two ways to do this – a lifetime mortgage and a home reversion plan. Lifetime mortgages allow you to release some of your home value to a limit, while still being the homeowner. This cash is tax-free and able to be used as you please.